Edward Moore Kennedy works harder than most people think, and this morning he is working very hard at a simple but crucial task. He is trying to face the day. It is 9:30 A.M, September 26, and Kennedy is in Room 138 of the Dirksen Senate Office Building to introduce a bill to lure new and better teachers. This kind of thing is ice cream and cake for any practiced politician, a simple piece of business that will provoke few tough questions and at least a few approving editorials. But for Kennedy it seems a great challenge, and no fun at all. He hastens tonelessly through his prepared statement like a court stenographer reading back testimony to the judge. He passes off most of the perfunctory and easy questions to the other politicians and education-Establishment figures joining him, and he stares into space as the other men do the job. When he goes to the podium to introduce his fellow speakers, he walks with a nervous, cautious shuffle, like Steve McQueen after he’s been let out of solitary in Papillon. When he holds out the piece of white paper to read the introductions of men he’s known for decades, it flutters and shakes in the still air.

Up close, the face is a shock. The skin has gone from red roses to gin blossoms. The tracery of burst capillaries shines faintly through the scaly scarlet patches that cover the bloated, mottled cheeks. The nose that was once straight and narrow is now swollen and bulbous, with open pores and a bump of what looks like scar tissue near the tip. Deep corrugations crease the forehead and angle from the nostrils and the downturned corners of the mouth. The Chiclet teeth are the color of old piano keys. The eyes have yellowed too, and they are so bloodshot, it looks as if he’s been weeping.

Edward Kennedy was once the handsomest of the handsome Kennedy boys, with a proudly jutting chin, a Nelson Eddy jaw and Cupid’s-bow lips under a thatch of chestnut hair. When he is dieting and on the wagon, there is a glimpse of that still, which makes it all the harder to see him as he more often is. There is a great desire to remember him as we remember his brothers. The Dorian Grays of Hyannis Port, John and Robert, have perpetual youth and beauty and style, and their faces are mirrors of all that is better and classier and richer than us. Ted is the reality, the 57-year-old living picture of a man who has feasted on too much for too long with too little restraint, the visible proof that nothing exceeds like excess.

After the press conference, as reporters hustle around Kennedy for follow-up questions, it becomes clear that something is especially wrong today with his left eye, which he has been poking and rubbing. He has lost a contact lens. Motioning for room, he slowly searches the floor. A reporter spots the lens and scoops it up with a forefinger. Kennedy takes out a contacts case and screws it open so the reporter can drop in the lens. But there is a problem. The senator’s right hand is shaking so violently that he cannot hold the case steady. The reporter hovers his finger over the case, trying to coordinate the path of the lens with that of the case—but the case is all over the map, jiggling up, down, left, right. For a second, Kennedy gets it steady and the reporter swoops in—but there goes the hand again, and the case is off, jogging to the right and the left for another few agonizing seconds before Kennedy stills his hand and the reporter drops the lens home, safe. The senator slowly screws the top back on, to the evident relief of a young aide who stands at his elbow, clutching the boss’s bottle of Visine.

I grew up on Capitol Hill, the son of Kennedy Democrats and the child of an age shaped by Kennedy myths, and I remember playing on the Capitol grounds one fall day, watching the young Senator Kennedy stride importantly by. He seemed a great man: tall, broad-shouldered, with a big, deep chest that stuck out like the prow of a ship as he rushed forward. The man in front of me now seems, as the writer Henry Fairlie described him a few years ago, a “husk,” dried up and hollowed out.

But as I watch, a startling thing happens. With a heave of the chest, a deep-lunged breath, a squaring of the shoulders, Kennedy abruptly pulls himself together, becoming suddenly full of himself once more. As reporters press, he expounds on his bill with knowledge and enthusiasm. The Excellence in Teaching Act of 1989 would establish a new National Teaching Corps, like the old LBJ model Reagan killed in 1981, by giving scholarships to students who sign for four-or five-year teaching hitches. Kennedy has spent his political career pushing the religion of the Great Society and he remains devout, even if it often seems these days that he’s no longer preaching to masses of the converted but to two old ladies there for vespers and a guy looting the poor box.

“By God, this is exciting,” Kennedy says, talking fast and sure, jabbing his finger at a reporter. “What we can do with this bill, we can go into inner-city neighborhoods, we can go into places where there is very little hope, and we can say to the young people ‘Become a teacher! Here is an option for your life! Here is a mission for you!’ ”

In his autumn years, Senator Edward M. Kennedy is a man of parts. Sometimes, especially in the mornings, he seems as weak and fluttery as a butterfly. Sometimes, especially in the evenings, he seems a Senator Bedfellow figure, an aging Irish boyo clutching a bottle and diddling a blonde. But he is also a man who can rise above that caricature to stature: the leading voice of what is left of the Left in American politics, a lawmaker of great and probably increasing power, the self-appointed tribune of the disenfranchised, the patriarch of America’s most famous political family and the world’s most conspicuous Democrat. He is in obvious ways tragic. His three brothers and one of his sisters died violently, two by public murder. His cruel marriage ended in divorce, with his wife a recovering alcoholic. He suffers still from a back broken in a near-fatal airplane crash. His elder son lost a leg and almost his life to cancer.

The parts of his life collide with each other like bumper cars, the Teddy of the tabloids giving a boozy shove to the senior senator from the Commonwealth of Massachusetts, the sordid tragedies of his unprivate private life darkening the face of the public man.

The Kennedy brothers always perpetuated their own glorious images, but over the years the last brother has built an image—not glorious at all—of his very own. For his hard public drinking, his obsessive public womanizing and his frequent boorishness, he has become a late-century legend, Teddy the Terrible, the Kennedy Untrammeled. In Washington, it sometimes seems as if everyone knows someone who has slept with Kennedy, been invited to sleep with Kennedy, seen Kennedy drunk, been insulted by Kennedy. At Desirée, a private Georgetown club where well-heeled fat men mingle with society brats and party girls, Kennedy is known as a thrice-a-month habitué and remembered by at least one fellow customer for the time he made a scene with his overenthusiasm for a runway model during a club fashion show. In a downtown office, a former congressional page tells of her surprise meeting with Kennedy three years ago. She was 16 then. It was evening and she and her 16-year-old page, an attractive blonde, were walking down the Capitol steps on their way home from work when Kennedy’s limo pulled up and the senator opened the door. In the backseat stood a bottle of wine on ice. Leaning his graying head out the door, the senator popped the question: Would one of the girls care to join him for dinner? No? How about the other? The girls said no thanks and the senator zoomed off. Kennedy, the formal page said, made no overt sexual overtures and was “very careful to make it seem like nothing out of the ordinary.” It is possible that Kennedy did not know that the girls were underage or that they were pages and, as such, were under the protection of Congress, which serves in loco parentis. Nevertheless, the former page said she did find Kennedy’s invitation surprising. “He didn’t even know me,” she says. “I knew this kind of stuff happened, but I didn’t expect it to happen to me.”

A former mid-level Kennedy staffer, bitterly disillusioned, recalls with disgust one (now ex-) high-ranking aide as “a pimp…whose real position was to procure women for Kennedy.” The fellow did have a legitimate job, she says, but also openly bragged of his prowess at getting attractive and beddable dates for his boss. The former staffer also recalls attending a party at Kennedy’s McLean, Virginia, mansion and finding it “sleazy and weird” to see that senator had apparently established as his live-in girlfriend a young woman known to the staff as the T-Shirt Girl, a New Englander who had previously sold tees at a beach resort and who had reportedly met the senator through his son Teddy junior. A waiter at La Colline, a French restaurant near the senator’s office, remembers a drunken Kennedy and a fellow senator recently staging a late-night scene out of The Three Musketeers, grabbing long-stalked gladiolus from a vase in the front hall and fencing “just like D’Artagnan.” At the same restaurant in 1985, Kennedy and drinking buddy Senator Christopher Dodd of Connecticut did a “Mexican hat dance” on their own framed photographs. According to The Washingtonian magazine, which broke the story, “Kennedy spotted Dodd’s framed photo [on the wall] and shouted ‘Who’s this guy?’ Laughing, he grabbed the photo from the wall and threw it on the ground, breaking the glass in the frame. Dodd, not to be outdone, located Kennedy’s photo and returned the favor.” A new Kennedy photo adorns the wall today, inscribed with “Laissez les bons temps rouler—Let the good times roll.”

Lobbyist John Aycoth recalls a recent afternoon meeting he arranged between Kennedy and several of Aycoth’s potential clients, representatives of an African government. Aycoth says Kennedy “was incredibly rude” and “was drunk…stumbling and slurring his words and red in the face and smelling of alcohol.” One of the visiting dignitaries—a Kennedy devotee who had called on JFK at the White House—presented the senator with a necklace to give to his mother for her forthcoming ninety-ninth birthday. Kennedy’s appreciation? “When we were walking out, he just pitched it on the desk, right in front of them,” says Aycoth. “Didn’t open it. Didn’t say thanks. Nothing.” (After my talk with Aycoth, his associate, former Delaware Congressman Tom Evans, who was also at the meeting, called to say nervously that he had heard what Aycoth had said and that while the account of rude behavior is true, in his opinion Kennedy had been “perfectly sober.”)

Kennedy regularly finds himself in unseemly scenes. One East Coast playboy recalls an incident a few years ago in a popular Palm Beach bar when “a definitely drunk” Kennedy shoved him against the bar and spilled his beer as the senator rushed out the door with a blonde so young, the man at first mistook Kennedy for an angry father come to take home an underage daughter. Dropping in for a 2 A.M. drink in the Manhattan bar American Trash in January 1989, Kennedy reportedly got into a shouting match with an obnoxious (and possibly intoxicated) off-duty bouncer, which climaxed with the senator’s throwing his drink in the other fellow’s face. Unkind Boston Herald columnist Howie Carr writes of Kennedy as “Fat Boy” and says it isn’t really considered summer in Cape Cod until the senator drives on the sidewalk for the first time. Reporters wonder at his behavior. “He really will do anything at all,” says veteran Washington gossip columnist Diana McLelan, “I think he’s mad.” Says Bill Thomas, writer of the “Heard on the Hill” column for Roll Call, the well-regarded newspaper of Capitol Hill, “He’s off the reservation…out of control…He has no compunctions whatsoever.” Thomas likens Kennedy and Dodd to “two guys in a fraternity who have been loosed upon the world.”

Perhaps this seems unfair. From all available evidence, God created our elected officials to drink and screw around. Arrogance, too, is common. So is sexual recklessness (witness Gary Hart, Robert Bauman and Barney Frank); power dements as well as corrupts. But Kennedy’s behavior stands out. The two most infamous Terrible Teddy stories make the point. Both take place at Washington’s La Brasserie, where Kennedy is a favorite customer.

Brasserie I: In December 1985, just before he announced he would run for president in 1988, Kennedy allegedly manhandled a pretty young woman employed as a Brasserie waitress. The woman, Carla Gaviglio, declined to be quoted in this article, but says the following account, a similar version of which first appeared in Penthouse last year, is full and accurate:

It is after midnight and Kennedy and Dodd are just finishing up a long dinner in a private room on the first floor of the restaurant’s annex. They are drunk. Their dates, two very young blondes, leave the table to go to the bathroom. (The dates are drunk too. “They’d always get their girls very, very drunk,” says a former Brasserie waitress.) Betty Loh, who served the foursome, also leaves the room. Raymond Campet, the co-owner of La Brasserie, tells Gaviglio the senators want to see her.

As Gaviglio enters the room, the six-foot-two, 225-plus-pound Kennedy grabs the five-foot-three, 103-pound waitress and throws her on the table. She lands on her back, scattering crystal, plates and cutlery and the lit candles. Several glasses and a crystal candlestick are broken. Kennedy then picks her up from the table and throws her on Dodd, who is sprawled in a chair. With Gaviglio on Dodd’s lap, Kennedy jumps on top and begins rubbing his genital area against hers, supporting his weight on the arms of the chair. As he is doing this, Loh enters the room. She and Gaviglio both scream, drawing one or two dishwashers. Startled, Kennedy leaps up. He laughs. Bruised, shaken and angry over what she considered a sexual assault, Gaviglio runs from the room. Kennedy, Dodd and their dates leave shortly thereafter, following a friendly argument between the senators over the check.

Eyewitness Betty Loh told me that Kennedy had “three or four” cocktails in his first half hour at the restaurant and wine with dinner. When she walked into the room after Gaviglio had gone in, she says, “what I saw was Senator Kennedy on top of Carla, who was on top of Senator Dodd’s lap, and the tablecloth was sort of slid off the table ‘cause the table was knocked over—not completely, but just on Senator Dodd’s lap a little bit, and of course the glasses and the candlesticks were totally spilled and everything. And right when I walked in, Senator Kelly jumped off…and he leaped up, composed himself and got up. And Carla jumped up and ran out of the room.”

According to Loh, Kennedy “was sort of leaning” on Gaviglio, “not really straddling but sort of off-balance so it was like he might have accidentally fallen…He was partially on and off…pushing himself off her to get up.” Dodd, she adds, “said ‘It’s not my fault.’ ” Kennedy said something similar and added, jokingly, “Makes you wonder about the leaders of this country.”

Giving Kennedy the benefit of the doubt, it’s quite possible he did not intend an assault but meant to be funny, in a repulsive, boozehead way. Drunks are notoriously poor judges of distance, including the distance between fun and assault.

Brasserie II: On September 25, 1987, Kennedy and a young blonde woman—identified by several sources as a congressional lobbyist—allegedly got carried away at a wine-fueled lunch in a private room upstairs and succumbed to the temptations of the carpet, where they were surprised in a state of semi-undress and wholehearted passion by waitress Frauke Morgan. The room, located next to the restrooms, is secured only by a flimsy accordion door, which could not be fully closed. Morgan declined to be interviewed for this story or to comment on or refute the accounts of other sources.

However, waitress Virginia Hurt, who says Morgan described the scene to her shortly after witnessing it, recalls, “He was on the floor with his pants down on top of the woman, and he saw her and she just kind of backed away and closed the door. The girl didn’t see Frauke. So Frauke went downstairs and told the manager and [another waitress] overheard.”

A waitress to whom Morgan spoke just after the incident says, “She told me…she went up to offer them coffee and when she opened the door…there they were on the floor.” Morgan said explicitly, the other waitress goes on, that Kennedy had his pants down and his date “had her dress up,” and the two “ ‘were screwing on the floor.’ ”

Says another waitress to whom Morgan immediately related the episode, “She said she had walked in to ask them if they needed anything else before she gave them the check, and she just sort of found Senator Kennedy on top of this [woman] on the floor and they were sort of half under the table and half out.”

A copy of La Brasserie’s reservation list for that day shows that a luncheon table for two in the back room was reserved for Kennedy. A copy of the check, signed “Edward M. Kennedy,” shows he was billed for two bottles of Chardonnay.

Kennedy’s friends, family and aides are a little skittish about questions on any of this. I asked the senator’s nephew Massachusetts Congressman Joseph Kennedy II if the man portrayed so scandalously in gossip columns and tabloids was the Ted Kennedy that he knew. “Hey! Hey,” said Joe in alarm. “I got—I can’t—I, uh, have really no comment on that…There’s no answer I can give you that isn’t going to be explosive, that’s all.” Recovering slightly, he added, “You know, Teddy’s a grown man and he can do whatever he wants.”

When I asked Utah Senator Orrin Hatch—a conservative Republican who nevertheless works closely and likes Kennedy—if he thought his colleague had a drinking problem, I got a similarly telling response. “I wouldn’t comment on that. I wouldn’t comment on that. All I can say is that I consider him a friend,” said Hatch. “I have found [him to be] a vulnerable human being who has a very good side to him. I think he has some bad sides too, but there is a good side to him that I choose to look at.”

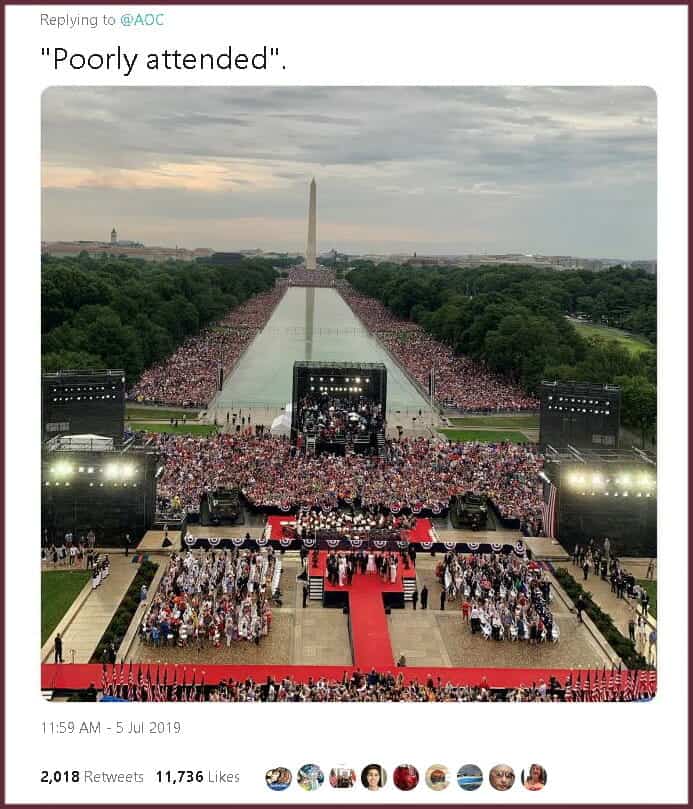

Kennedy’s staffers do what they can to suppress unflattering reports. In researching this article (three months, more than seventy interviews, fifteen books, a couple thousand pages of news reports and speeches), I asked for an interview with the senator. After a long, elaborate quizzing by his press secretary, Paul Donovan, and deputy press secretary, Melody Miller, about the nature of the article and the questions I might ask, Kennedy decided to stick to a blanket policy of not doing interviews with “life-style magazines.” Donovan explained: “Frankly he doesn’t do interviews with life-style magazines because they tend to ask life-style questions.”

I later asked Donovan if he or the senator would like to comment on or deny reports of heavy drinking or unusual behavior by Kennedy, and to comment specifically on the accounts of Kennedy’s behavior with the congressional page, the Brasserie waitress and the luncheon date on the floor. Donovan said Kennedy would stick to his standard reply: “It has been and remains his policy never to comment on this sort of endless gossip and speculation.” Donovan did say that the “slight tremor” in Kennedy’s hands is attributable not to drinking but to an inherited medical condition that worsens with age. (Brasserie co-owner Campet also declined to comment on either story involving his restaurant. Asked if he would care to deny the incidents, Campet said, “Did you hear me, sir? I have absolutely no comment.” Dodd’s press secretary did not return numerous phone calls.)

There is not, really, much else that Donovan can say. Kennedy’s personal life has always been a press secretary’s nightmare. During his twenty-two-year marriage, his extramarital affairs were numerous and barely hidden. “He was philandering from the moment he was married,” recalls old Kennedy-family associate Dick Tuck. “Not one-night stands, but not much more than that. Kind of affairs of convenience…I think most normal people might have more than one affair [during a marriage] but not every week, like Teddy. He was always chasing, looking for the conquest.”

Of odd and reckless behavior, there are many examples, including Kennedy’s photographed 1982 nude promenade on the public sands of Palm Beach, reportedly in the presence of several old ladies. The columnist Taki, chronicler of Europe’s idle rich, still calls Kennedy “a boorish and uncivilized philistine” because of an incident in the mid-Seventies. At the time, Taki was a UPI reporter in Athens and a well-known playboy. One day, he got a call from Kennedy’s staffers, who asked him to “round up two dates, American girls preferably,” for the senator and his nephew Joe during their brief visit to the Greek capital. Taki says he showed up at the Hotel Grande Bretagne, where the Kennedys were staying, with his girlfriend and dates for the Kennedys. “Teddy was…pretty much drunk,” says Taki. “In fact, he was really out of it.” Taki says he and the others left the senator and his date, a proper young Connecticut woman who was “very, very impressed with the Kennedys,” at the hotel while they went nightclubbing. Back home later than night, Taki was awakened by Kennedy’s hysterical date. Taki says the drink-befuddled young woman became frightened when she “saw Ted Kennedy coming naked at her,” and adds, “that would scare me too, and I would like to say I am a pretty brave man.”

Biographers first note obvious public drunkenness in the terrible aftermath of Bobby’s murder. In April 1969, flying back from a congressional trip to inspect the living conditions of poor Indians in Alaska, a hard-drinking Kennedy pelted aides and reporters with pillows, ranged up and down the aisles chanting “Es-ki-mo power” and rambled incoherently about Bobby’s assassination, saying, “They’re going to shoot my ass off the way they shot Bobby…”

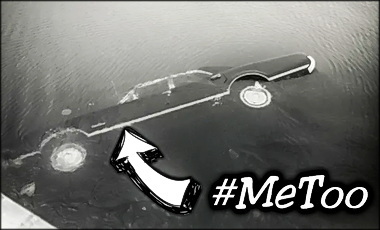

Three months later, on July 18, came the defining moment of Kennedy’s life, when he drove his Oldsmobile off a bridge on the island of Chappaquiddick, sending young Kennedy staffer Mary Jo Kopechne to her death and drowning his chances of ever getting to the White House. This much-explored accident is worth mentioning because the factors surrounding it are the same ones so apparent before and so apparent still in Kennedy’s personal life: a childish belief that the rules of human behavior do not apply to himself, a casual willingness to place himself in a compromising positions with an attractive young woman and, most probably, a reckless use of alcohol.

Kennedy has never told anything close to the whole story of Chappaquiddick, the details of which were covered up by Kennedy associates with the help of compliant local authorities, but he has denied that he was driving drunk, or on his way to an assignation when he turned down the deserted dirt road to Dike Bridge. No writer who has seriously studied the events of the night—and there have been many—has believed him. Leo Damore, whose 1988 book, Senatorial Privilege: The Chappaquiddick Cover-Up, is the most thorough examination of the accident, offers strong evidence that Kennedy was probably drunk behind the wheel and probably on his way to a tryst (not, as he claimed, to the ferry to Martha’s Vineyard). Indeed, it is otherwise difficult to explain the actions Kennedy himself called “irrational and indefensible and inexcusable and inexplicable”: leaving the party alone with Kopechne and without his driver; failing to notice that the had taken a ninety-degree turn that led down a very bumpy dirt road away from the smooth asphalt road that led to the ferry; never calling the police for help in rescuing the trapped drying Kopechne but relying solely and clandestinely on his two closest aides; and failing to report the accident until after it was discovered ten hours later.

There have been many theories advanced to explain Kennedy’s behavior, all of which make much of the extraordinarily competitive and amoral atmosphere (especially as far as the treatment of women was concerned) in which the Kennedy boys were raised. As Garry Wills makes clear in his elegant The Kennedy Imprisonment, Ted Kennedy was born and bred to act like the last of the Regency rakes: to be a boor when it pleases him, to take what he wants, to treat women as score-markers in the game of sport-fucking and to revel in high-stakes risks. Joseph Kennedy Sr. flaunted his affairs in front of his wife and children, made crude passes at his sons’ dates and well past his middle years was still chasing doxies. John Kennedy’s mad womanizing—frolicking with nudettes in the White House swimming pool, banging a call girl in Lincoln’s bed, carrying on barely secret affairs with admitted mobster girlfriend Judith Campbell Exner, with Marilyn Monroe and Jayne Mansfield—was beyond anything Teddy has ever done or, for that matter, anything anybody has ever done. Neither Joe nor Jack was punished by church, state or wife for such behavior and the late-born Teddy, coming into the family when its adult behavior patterns were already mythologized, presumably figured that neither the rules of decency nor of retribution applied to a Kennedy. The boy grew to manhood without learning how to be an adult. His drinking suggests nothing so much as a frat boy on a toot. His actions with women seem to be more evidence, as writer Suzannah Lessard put it in 1979, of “a severe case of arrested development, a kind of narcissistic intemperance, a huge, babyish ego that must constantly be fed.”

Kennedy’s only real grown-up job has been serving as a U.S. senator, and the greatest men’s club in the world became his second family, giving him the same kinds of special privileges and protections as his first. Michael Barone, coauthor of The Almanac of American Politics, sees Kennedy as a victim of environmentally induced inertia. “In the old days, you could get away with this stuff,” says Barone. “The senator would be at his desk and there would be a pair of high heels sticking out from underneath and you weren’t supposed to notice it. Maybe Ted Kennedy didn’t realize times have changed.”

But arrested development doesn’t explain why Kennedy seems to be getting worse as he gets older. According to a theory currently popular in Washington, such incidents at Brasserie I and II are evidence that Kennedy, freed at last by the knowledge that he will never be president, is simply giving his natural inclinations full vent. In the opinion of Roll Call’s Thomas, “He’s beyond caring about anything since he knows he’s not going to be president…He’s what Kennedys always were, and [as] the only thing that kept them under control was the ambition for higher office…he’s no longer under control.” Says another Washington reporter, “He seems to be going through a second adolescence…I think he realizes his day in the sun is over. Whereas he might have made a pretense of being a good family man years ago, he doesn’t have to pretend anymore…He figures he is never going to run for president again. He has no great ambition beyond being the once almost prince.” In short, with nothing left to lose politically (he’d have to hit the pope and pee on the Irish flag to lose his Senate seat) and long inured to ridicule, he has become the Kennedy Untrammeled, Unbound.

All the theories, however, still leave you wondering. Neither family history nor generational attitudes nor a lifetime as one of the privileged elite nor the liberation of renouncing the presidency fully explain Kennedy’s behavior, although all play a part.

A longtime associate of Kennedy’s thinks the full explanation must take into account one other factor. He says, “The problem with Kennedy theories is that people are looking for psychological Rosetta stones when the answer is a far more common malady. If you forget he’s a Kennedy, it’s textbook, it’s just textbook.”

This man, who asked that he not be identified, is a recovering alcoholic who spoke because he believes Kennedy needs help. He thinks Kennedy’s episodes of disgraceful behavior are due to the simple fact that he periodically drowns his few, faint natural inhibitions in a sea of booze. “He’s what we call in the trade a binge drinker,” says this man, who says he has seen Kennedy drunk enough to lapse into baby talk with his young dates. “We are talking serious binge drinking, really pouring it down.” He adds, “There is an extensive conspiracy effort” among Kennedy’s close friends “to make him face up to the fact that he’s got a problem…There are occasional plots of confrontation and one thing or another to shake some sense into him. The conversation is far more than idle and it involves just about anyone you can think of who has been exceptionally close to him, especially in the last five or six years.” There have been, he says, “hints dropped here and there. You put a hook in the water and see if he bites.”

This man, who has known the senator for many years, says Kennedy goes for relatively long periods without drinking “and then, every once in a while, ka-boom”—a binge triggered by the breakup of a brief affair or a break in work. Is drinking the sole explanation for his behavior? Obviously, no. Lots of men, including some of his fellow senators, got tanked pretty regularly and don’t end up on the floor of a restaurant. A cosseted upbringing, a juvenile nature, a powerful sexual greed, the liberation of putting aside the White House, the arrogance of vanity inherent to a Kennedy, the tragedies of his life—they all play a big part too. But periodic excessive drinking does seem to be the catalyst that brings those forces together and releases them.

Certainly, the anecdotal evidence relating to Kennedy’s drinking suggests relatively long periods of sobriety interrupted by bouts of excessive drinking. Younger son Patrick says his father “has the most disciplined life of anybody I know as far as the seriousness with which he takes his work.” There are “other times,” says Patrick, when he is less disciplined, but “those represent such an infinitesimal part of who my dad is that I get disturbed when people get a misunderstanding of it.” Many who speak of his drinking talk of his ability to hold great amounts of liquor and his discipline about exactly when he drinks. “He can control when he drinks,” says long-time associate Milton Gwirtzman. “He never drinks when he’s working.” Former legislative aide Thomas Susman says he has never seen Kennedy drink except socially at night, and he adds, “I have been at his house as early as six in the morning and he’s up. He may have been slosh-faced until four [but] he’s never staggered in, he’s never had trouble getting started, he’s never had to have a little hair of the dog before he could work…”

On the other hand, eyewitness reports of heavy drinking are plentiful. Washington Times editor John Podhoretz recalls seeing Kennedy, at La Brasserie in 1986, drink a bottle and a half of wine by himself in twenty-five minutes. A recent dinner guest at Kennedy’s home recalls with similar amazement Kennedy’s guzzling three screwdrivers in one twenty-minutes period. “I was chugging to keep up with him,” the guest says. “I’ve drunk with the best of them, and he’s the best I’ve ever seen.”

A former La Brasserie waitress calls Kennedy and Dodd “drinkers’ drinkers” whose demands led management to put a makeshift bar near their habitual table. “They drank so much you couldn’t get to the [regular] bar fast enough,” she relates. In a “standard evening,” she says, each man would knock off half to three quarters of a bottle of hard liquor, then switch to wine or champagne, and sometimes then to after-dinner drinks: “They would [sometimes] stay at the restaurant till three o’clock in the morning, just drinking and drinking. By the time they got up, they could hardly stand.”

A woman in her mid-twenties who dated Kennedy steadily a few years ago also describes the senator as largely controlled, occasionally drunk. It was true, she says, that “when you go out with Chris Dodd, go out with the boys, you do get drunk and so on.” But Kennedy drank little when he was with her, and the couple would often spend the evening by the fire at the senator’s home, reading books or talking. The Ted Kennedy she knew was not the Bad Boy of La Brasserie but “a golden retriever,” a “romanticist” who let her have the last bite of his dessert at night and kissed her good-bye on the forehead in the morning. Yet it is hard to believe that this picture is wholly accurate. At the time this woman was dating Kennedy, she was a fixture on the nightclub scene and a heavy partyer.

But even giving the woman the benefit of the doubt and assuming that she and Kennedy did pass many quiet, contented evenings together, I question whether it would have been that fascinating for the 57-year-old senator to sit cozily around the fire, engaged in conversation with a woman who says that she developed a crush on him largely because they both had “blue eyes and fair hair” and who was surprised to learn that her ex-boyfriend had been the subject of several biographies. I wonder whether Kennedy is even really enjoying any of this anymore.

As the former girlfriend and I were finishing up our talk, she told me of a big party to which she was going that night. “It’s going to be reeelly, reeelly great!” she said. “They’re going to have these drinks called sharks, which are reeelly, reeely fun. You have this plastic shark in your glass and you also have a plastic mermaid and you push the shark and the mermaid together and then pour some red stuff over the mermaid that looks like blood.”

“Grenadine?” I said.

“I think so,” she said.

At what age does it stop being fun and start being hell on earth to spend your evenings with someone who gets reeelly, reeelly excited about novelty cocktails?

The recovering alcoholic quoted earlier thinks Kennedy has passed that point: “He is a very unhappy man personally. He’s very unhappy and lonely [because of] his inability to find someone after his marriage fell apart…Getting laid has long since ceased being fun.”

Fun? A Boston reporter recalls seeing Kennedy on a morning after: “I had to cover him taking part in the Hands Across America thing on Boston Common and, Christ, it was like someone had poured Jack Daniel’s in his hair. It was like he was shpritzing Jack Daniel’s. And he’s holding hands with these two 50-year-old ladies, and it was just really pathetic. You look at the guy and you think, My God, he must be dying for a drink. You think, He’s really killing himself.”

Fun? “He has the kind of personal wealth where he can do just about anything he wants to do,” says Orrin Hatch. “But I wouldn’t trade life with him for ten seconds. I’d rather be poor and in the condition that I’m in than trade with Ted.”

The better part of Ted Kennedy’s life is found, as it is with so many men, in his work and in his children. When Teddy came to the Senate in 1962, inheriting the seat his big brother John had vacated when he was elected president, he was conspicuously only in his youth and inexperience. Twenty-eight years later, his is the fifth-ranking member and the liberal leader of what remains, despite all its current confusion, the most important legislative body in the world.

The American Enterprise Institute’s Congress watcher, Norman Ornstein, only goes a little beyond others when he declares that “Kennedy is going to go down as one of the most significant senators in history, in terms of concrete things accomplished and things put on the agenda that will get accomplished in years to come.” Illinois Democrat Paul Simon calls his colleague one of the “three or four shapers of what happens in the Senate,” and adds, “in terms of moving the agenda of the Senate, I can’t think of anybody who has had a greater impact.” Republican hatch calls Kennedy “the most powerful, effective liberal in the Senate” and says history will view him as “one of the all-time-great senators.”

Even a partial listing of the major bills in whose passage Kennedy has played a part is impressive. Whether you admire them or not, these are the measures that transformed—mostly liberalized—America in our time: the first Immigration Reform Act; the Voting Rights Act and its extensions; the Freedom of Information Act; the Gun Control Act; the Campaign Financing Reform law; the Comprehensive Selective Service Reform Act; the Eighteen-Year-Old Vote law; the Occupational Safety and Health Act; the War on Cancer bills; the recodification of federal criminal laws; the Bilingual Education Act; the Fair Housing Acts; the Age Discrimination Act; the Airline and Trucking Deregulation bills; the Job Training Partnership Act; the South African sanctions; and the Grove City Civil Rights Restoration Act.

Far more than either of his brothers, who were lackluster senators, Kennedy, over the past three decades, has been responsible for changes in the complexion of this country and in the lives of its citizens. He has been an ally of blacks, American Indians, the poor, the sick, the aged, the mentally ill, starving refugees worldwide and immigrants. He has been an outspoken liberal, unafraid to take the controversial positions—on issues such as busing, abortion, gun control, the Vietnam War (late but forcefully), the nuclear freeze and capital punishment—that other senators clearly avoided.

Since Kennedy assumed the chairmanship of the Labor and Human Resources Committee in 1986, upon the Democrats’ regaining control of the Senate, his power has grown markedly and he is now, by all accounts, in the prime of his career. He has become not only the most consistent counterforce to the long-running Republican administrations in pushing for government activism in health, education, labor and science, but has also become adept at building Republican-Democrat, Right-Left coalitions that can ensure passage of compromise domestic-policy legislation. Hatch, for instance, says he “came to the Senate to fight Ted Kennedy.” Yet, because Hatch likes him and trusts him—and because with Kennedy behind it, a bill automatically receives serious attention—he now often joins Kennedy in sponsoring relatively uncontroversial measures.

Kennedy has abandoned the costly Utopian reforms he pushed in the Seventies—such as government-financed universal health insurance and welfare payments that guaranteed an income above the poverty level for all—and now focuses on less-budget-busting programs. He is increasingly successful and increasingly prolific. The 100th Congress (1987-1988) was the best period he or almost any senator has ever had: Kennedy moved more than twenty major pieces of his own legislation through the Senate, including a comprehensive plan to assure medical care, support services and discrimination protection for people with AIDS.

A great part of his legislative strength comes from the fact that he likes his colleagues and they like him. A clubman at heart and endowed with a youngest son’s natural deference, he is as uncommonly decent toward his peers as he is uncommonly indecent toward his lesser. Senator Joseph Biden, the Delaware Democrat who chairs the Judiciary Committee, says he will never forget the way Kennedy treated him during the seven months in 1988 that Biden was recovering from a brain aneurysm. “He would call my home and speak to my wife and offer to make contacts with doctors he thought were good,” Biden recalls. “Once, he got on the train and came to the house in Wilmington, sat up here all day with me, talking. He brought a gift, too—a lovely engraving of an Irish stag.” Much more importantly, says Biden, Kennedy did not take advantage of his associate’s illness and reassert his authority over the Judiciary Committee, which Kennedy had previously chaired.

Another great strength is his staff—the best and probably the hardest-working on Capitol Hill—which numbers about a hundred people, including committee staffers. Kennedy depends heavily on four or five top advisers, while dozens of mid-level staffers work under great pressure to keep churning out the bills. His public appearances are carefully scripted and stage-managed. For committee hearings, Kennedy’s staff provides him with big black briefing books that can run to more than a hundred pages, with an opening statement, detailed questions, background on the issues involved and bios of the speakers he will hear. Moreover, Kennedy has continued his brother John’s habit of gathering experts from Harvard and elsewhere for informal briefings, holding frequent “issues dinners” at his home. No senator has ever had greater access to a wider range of paid and free counsel.

But no matter how excellent it may be, staff work can take you only so far. Much of what Kennedy does every day he must do himself, no matter how he feels in the morning. And you can’t look at his labors without being impressed by his willingness to stick to the tedious daily tilling of the legislative field. Take congressional hearings. Please. As chairman of the Labor and Human Resources Committee and of the Judiciary Committee’s Subcommittee on Immigration and Refugee Affairs, and as a member of the Armed Services Committee and of the Joint Economic Committee, Kennedy must chair or attend a couple hundred hearings a year. And while some of them are fascinating, a great many more are dull morality plays. Even more so than life itself, congressional hearings are not one damn thing after another but the same damn thing over and over again. Still, unlike many senators, who are content to make only brief appearances at these hearings, Kennedy often plays an active role even in the hearings that he does not chair.

“He does work at being a senator,” says Michael Barone of The Almanac of American Politics. “And that’s impressive. He could easily sink in a life of alcoholism and do-nothingism. He doesn’t have to do anything to get elected.”

There are times, however, when patience and collegiality do not meet the occasion. When it comes to a clear-cut Left-versus-Right fight, says Hatch, Kennedy “will murder you, he’ll roll right over you…He’ll trample you in the ground and then he’ll grind his heel in you.”

Robert Bork still has Kennedy’s heel marks on his forehead. Forty-five minutes after President Reagan nominated Bork for a Supreme Court seat in 1987, Kennedy was on the floor of the Senate and on the attack: “Robert Bork’s America is a land in which women would be forced into back-alley abortions, blacks would sit at segregated lunch counters, rogue police would break down citizens’ doors in midnight raids…”

It was, in the words of Kennedy’s former aide Thomas Susman, “outrageous…pretty tough and pretty early on and pretty judgmental and very aggressive.” Bork recently told me with still-hot bitterness, “There was not a line in that speech that was accurate…It was a series of untruths. I didn’t want police breaking down your door. I didn’t want evolution banned from public schools. I didn’t want to force women to have back-alley abortions. The whole thing was false.”

Even Judiciary Committee Chairman Biden, Kennedy’s close ally and coleader of the stop-Bork forces, says Kennedy’s speech was “technically accurate but unfair” and that it “drew lines in ways that were starker than reality.” Biden says he wouldn’t have made such a speech. But, he admits, he is glad Kennedy did. Both he and ranking Republican committee-member Hatch say that without that speech, and without Kennedy’s aggressive personal lobbying against Bork with hundreds of civil-rights leaders and liberal activists around the country, the candidate probably would have been confirmed.

Kennedy’s role in the Bork fight stems from and illustrates his overarching position in American politics. In a rare moment of irritation with the American Civil Liberties Union, the senator once said, “The ACLU thinks that it defines liberalism in the country. I define liberalism in this country.” He was exaggerating only a little. In the religion of liberalism, Kennedy is the guardian of orthodoxy. He is the voice of the interest groups that define the Democratic Party; the black activists, the trade unions, the feminists, the environmentalists, the teachers’ unions and the perennial progressives.

Kennedy is strong and unswerving in his beliefs because they are personal, rooted not in theory but in an emotional commitment to government activism—a continuation and expansion of the leftward direction in which his brother Robert had been heading before his murder. Milton Gwirtzman, who wrote speeches for both Bobby and Ted, says the latter does not have “an articulated set of principles” that rises to the level of an ideology. “There’s no such thing as ‘Kennedy’s thoughts,’ ” says Gwirtzman. “It’s reactions, gut instincts. And they’ve been bent occasionally, but they have always remained the same.”

The world, however, has changed. For all of Kennedy’s achievements as a senator, there is a strong sense of anachronism about him as a politician. Alvin From, executive director of the centrist Democratic Leadership Council, among other critics, says Kennedy’s “soft, cuddly liberalism, his politics of entitlement,” have achieved a viselike grip on the mind of the Democratic Party. And perhaps that is true; as one Democratic National Committee insider says, “It’s not as if we’re all sitting around thinking we’ve got to do more for [Kennedy’s] cause. It’s just that everyone [on the committee] thinks the same way he does.”

But while Kennedy’s politics maybe influential in the party hierarchy, the party hierarchy isn’t influential with the voters—or even with other elected Democratic officials. Says former party chairman John White, “It’s the dilemma of Teddy Kennedy and it’s the dilemma of the party.”

“Kennedy is always invited to speak at the convention, always make a speech in prime time, but when it comes to the general-election campaign, if you bring Kennedy to Texas, you send him down to Rio Grande Valley to speak to the Hispanics,” says political reporter Jack Germond. “If you bring him to Florida, you send him to Miami to talk to the blacks. He is always used exclusively to talk to special interests. And not all of that is related to Chappaquiddick; its is related to issues.”

Patrick Kennedy says his father gets depressed about feeling left out in the cold as the political climate shifts. “He genuinely gets sick when the country doesn’t go in the right direction in his view,” says Patrick. “He gets upset because, you know, he’s trying to change it and he just feels as if he’s run up against the wall sometimes.”

There is a solution available, of course. Kennedy could escape dinosaur status by doing what the oldest male Kennedy is supposed to do—run for president. A lot of people, including many of the aides and advisers close to Kennedy, say he is content in the Senate. But Patrick and his cousin Michael Kennedy, Bobby’s fourth son, say Ted would, in fact, very much like to run for president again. “I think he still says, you know, I could be a better president than these other jokers,” Michael says. “I mean, who else is on the horizon, particularly on the Democratic side?” He says his uncle knows that Chappaquiddick remains “the first question out of the box, so that would make very difficult for him to run on a national level” but that Ted holds out hope that there will come a “backlash” against the reporting of “this personal stuff” that is so damaging to him and thinks “therefore, I’ll be able to run in 1998, or whatever.”

My own guess is that Kennedy does still harbor presidential dreams of varying degrees of seriousness, depending on his mood (he has apparently never accepted Chappaquiddick as the career killer that it was; he seriously considered running in 1984 and 1988, despite the fact that the voters had made their feelings brutally clear in 1980), but ultimately he won’t run. It’s time to sink gracefully into the tar pits; the next chance goes to the next generation.

In the end, dynasty is everything. Joseph Kennedy Sr. is the only man in history who ever consciously set out to make one of his sons the President of the United States of America—and succeeded. The father taught his children that that goal could be won. They have never let it be forgot. To the Kennedys, the White House is the once and future home. It is Ted’s duty to help make sure one of them gets it back. There are twenty-eight members in the up-and-coming generation of Kennedys, and they are coming up fast. Joe II, elected twice to the House, makes no secret of his hopes to step higher. Michael, who succeeded Joe as the head of a Boston-based nonprofit company that sells fuel at a discount to the poor, did not make an expected run for state office last year but says he “would not be averse to serving in politics” in the relatively near future. Kathleen Kennedy Townsend, Michael and Joe’s sister, lost in her 1986 bid for a Maryland congressional seat but plans to run again. In New York, crown prince and teen heartthrob John F. Kennedy Jr. is being groomed for a big job—if he can ever pass the bar exam.

And, of course, there are Ted’s own sons. Ted junior, 28, harbors ambitions in Massachusetts. And Patrick, a sweet-natured 22-year-old senior at Providence College, was elected to the Rhode Island Legislature in 1988, despite opposition to his candidacy even within the Democratic camp. After all, Jack Skeffington, the man who had held the seat for nine years, had lived in the blue-collar Ninth District all his life, was backed by the state Democratic Party and was a Kennedy supporter as well. Some raised eyebrows over the fact that young Patrick’s expenditures were the greatest in the history of the state to win one of the $300-per-year jobs: $87,694, or $66 for each of the 1,324 votes he won. And, some people said, the emphasis on the fact that Patrick was a Kennedy was a little naked, what with the kid’s dad and mom and brother and sister and cousins John, Joe and Michael posing for snapshots with everybody at the polling booths on Election Day.

But let them say what they want. They said the same kind of stuff about Teddy twenty-eight years ago, when the family gave him his first job. The family is the thing. The family is everything. No man is a failure if he does right by his children. And even if the senator was a lousy husband, he is, by all accounts, a caring father. Sitting in his district office in Providence, Patrick—a fair, fragile-looking young man, gentle like his mother and with a shy, skinny kid’s way about him—talks about his father. His voice is as soft and as loving as a puppy. “I don’t think I can ever be as giving a person as he has been to me,” he says. “He’s the most important person in my life.” On the wall of Ted Kennedy’s Senate office, prominent among all the pictures of his famous brothers, hangs one of himself and Patrick taken the day Patrick won his seat in the state legislature. Patrick has inscribed on it “To my dad, my friend and my hero.”

“Ted Kennedy never was born to be president or wanted it terribly,” says Milton Gwirtzman. “I think the reason he ran has to do with something his father once said to him: ‘If there’s a piece of cake on the plate, take it. Eat it.’ ”

The last Kennedy had so few choices, really. He was born to be the baby of the family, not the patriarch; the fourth brother, not the only one; the also-Kennedy, not the President Kennedy. When he was a chubby-cheeked little boy, the family was packed with grown-ups. They all went away. Joseph junior died when Teddy was 12. Kathleen died when he was 16. Jack died when he was 31. Bobby died when he was 36. The king himself, Joe senior, died when he was 37.

“To be truly human,” Ted Kennedy once said, “is to shape your own world.” And he has, far more than most men dream of, done just that. He has made laws. He has been at the front of sweeping change, improving the lives of many people. He has helped perpetuate a dynasty. The truth is, however, the world shapes us far more than we shape it. The truth is, the forces of the world—the rules of primogeniture, the warp of genetics and the woof of environment, the killing power of bullets and the grip of alcohol—shaped Ted Kennedy and shape him still. It is the sad irony of his life that while he has wrought his will on the world at large he remains unable still to control his own life. He started out in this world dangling from strings held by his father and his brothers. They’re gone now, but Teddy dangles still, dancing to the echoes of an old and tired tune.