(This post was originally uploaded in Jun, 2015)

SEE OTHER POSTS AS WELL:

- Maldives Building MORE Airports (AKA: Climate Change is a Joke!)

- Global Warming Good For Island Growth

- UCSB Students Note Rising Sea Levels

Breitbart makes fun of the idea that loans and insurance could ever be had if these Islands are soon to underwater… unless these banks and insurance companies know that “Climate Change” is more political than science

Great news from the scuba-diving tropical paradise Maldives. They’ve just opened another airport.

This means that the Indian Ocean island nation now has four international airports and seven domestic ones. Quite a lot for a country with a population of less than 400,000. Presumably they have high hopes for their tourist industry as they develop luxury resorts on ever more remote atolls.

[….]

Here’s the World Bank: “Climate change presents a challenge for every island in the Maldives, which all lie on the sea level. Any changes in the climate will greatly affect the Maldivian way of life.”

Here’s the UN Foundation: “Climate change is a serious threat to low lying islands like Maldives whose landmass is close to sea level. The projected rise in sea level over the next century due to climate change is commonly agreed to be about one meter. The highest point on this island nation is one meter. Learn more about the existential threat of climate change on this island and learn more about how the country is pressing for global action on climate change.”

And let us never forget the tragically moving, yet cheery-in-the-face-of-disaster underwater cabinet meeting staged by the Maldives government in 2009 to draw international attention to the terrible and imminent threat these poor islands face.

Luckily I have thought up a brilliant solution to this problem. Maybe the lucky Maldives (the thriving tourist paradise) could help the unlucky Maldives (the one about to be drowned by global warming) with money and material aid. Perhaps it could use its vast tourist revenues to mitigate against any problems caused by this terrible “climate change” thing. Perhaps it could use its 11 airports to help evacuate the other Maldives’ climate refugees.

(GATEWAY PUNDIT): Seven years ago ABC News warned viewers that New York City will be under water by 2015 due to global warming. (See also NEWSBUSTERS)

New York City underwater? Gas over $9 a gallon? A carton of milk costs almost $13? Welcome to June 12, 2015. Or at least that was the wildly-inaccurate version of 2015 predicted by ABC News exactly seven years ago. Appearing on Good Morning America in 2008, Bob Woodruff hyped Earth 2100, a special that pushed apocalyptic predictions of the then-futuristic 2015. The segment included supposedly prophetic videos, such as a teenager declaring, “It’s June 8th, 2015.”

“One carton of milk is $12.99.” (On the actual June 8, 2015, a gallon of milk cost, on average, $3.39.) Another clip featured this prediction for the current year: “Gas reached over $9 a gallon.”

The only way food would be soo high is if Obama’s war on affordable energy works it’s course!

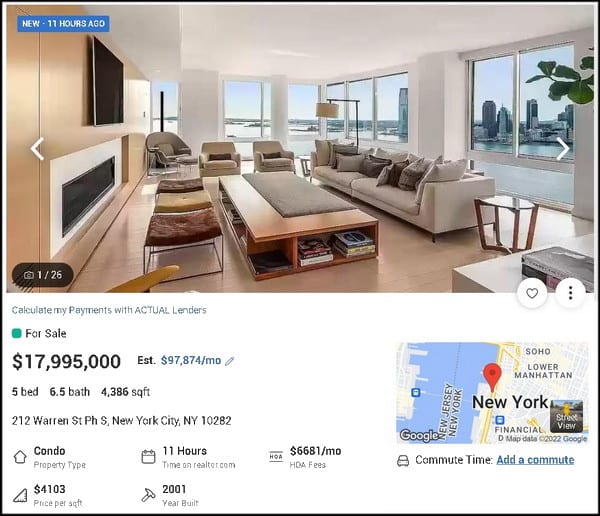

How come Manhattan property is through the roof!

(Breitbart) In 2006, on NBC’s Today Show, former-Vice President Al Gore predicted that Manhattan would be flooded in “15 to 20 years.” He added, “In fact the World Trade Center Memorial site would be underwater.” Just 3 years ago, the New York State Energy Research and Development Authority predicted that within the next ten years, “Irene-like storms of the future would put a third of New York City streets under water and flood many of the tunnels leading into Manhattan in under an hour because of climate change[.]”

By hook or crook, through super storms or glacier melt, Global Cooling Global Warming Climate Change has doomed the Big Apple.

What we have here are two of the most respected environmental voices among the political Left — Gore and the government — warning of dire flooding hitting Manhattan within the next 10 years. And at least according to their activism, the predominantly left-wing, Global Warming believers of Manhattan are listening. Furious about the lack of wealth-distribution that will save the planet and their small island, just 6 months ago, more than 300,000 took to the streets of Manhattan to protest.

And yet, a funny thing is happening in the real world of the free market. Manhattan might be the elite media/entertainment/intellectual hub of the cult of Global Warming, but where the rubber meets the bottom line, the cult obviously doesn’t really believe in its own propaganda. If they did, Manhattan real estate prices would be collapsing, not hitting record highs as they currently are.

If people truly believe an area is going to be flooded as soon as in the next decade, those same people would be selling off their real estate. Not just to escape but to sell before conditions worsened and real estate prices bottomed out further. As the deadline loomed closer, prices would decrease further.

What’s happening, though, is the exact opposite.

The average Manhattan home price is now over $1.7 million. With some apartment prices now breaking nine figures, it’s time to take a look at the booming New York real estate market and explore where middle class families fit into the picture.

At 157 West 57th Street, the most expensive New York home sale was just completed with the penthouse of this new building going for over $100 million.

Howard Lorber, the chairman of Douglas Elliman, the city’s largest residential brokerage, told me that there is no sign of this trend slowing down. He called New York a safe place for people around the world to invest in real estate.

Maybe what’s happening is that Manhattan’s left-wing Global Warming believers are suckering right-wing Climate Deniers into buying doomed real estate at record prices?

THE ELITE

How come those that warn us about sea rise keep buying property by the sea?

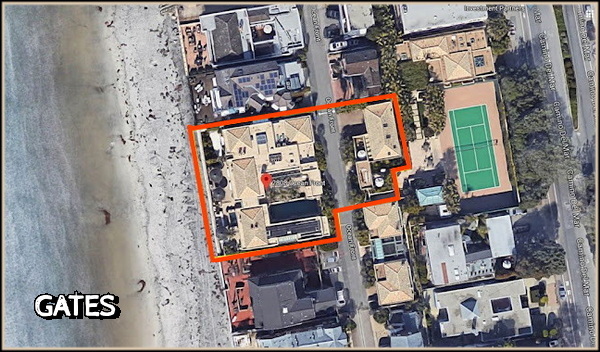

BILL GATES:

(BREITBART) Microsoft founder Bill Gates has been exposed as the ultimate climate-denier with the purchase of a $43 million oceanfront home.

Riddle me this…

If you truly believe in Global Cooling, Global Warming, Climate Change, or whatever-these-proven-frauds-are-calling-it-now is a real and imminent crisis, that means you believe the oceans are destined to rise and flood the coasts and that this will happen in your lifetime… So why would anyone who professes to believe such a thing — as Gates regularly does — invest $43 million in oceanfront real estate?

They wouldn’t — unless they are a madman or a liar, and when it comes to Gates and the rest of the climate phonies, my money is always on the latter.

The facts are this…

If you judge Gates by his meaningless words, he is not a climate denier. But where it matters… In his actions, his behavior, his multi-million dollar investments, Gates is one of the biggest climate deniers in the history of climate denying.

No one — not even if you’re worth billions — pisses away $43 million. Which proves that just like CNN and Barack Obama, Bill Gates is a Climate Change activist who knows it’s all a hoax (and trust me, it is) because no one who truly believes the oceans will flood the coasts would invest 43 million goddamned dollars on a doomed house that sits right on the ocean…..

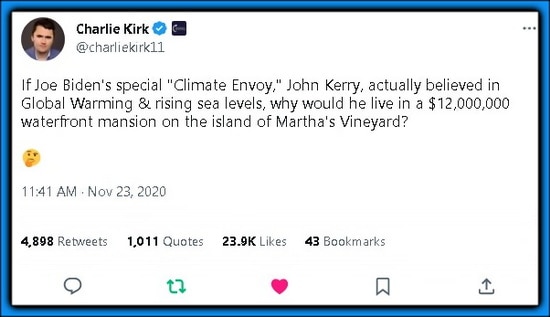

JOHN KERRY:

(DAILY WIRE) In 2017, Kerry bought historic waterfront property at Seven Gates Farm in Chilmark. Using a private realty trust, Kerry paid $11.75 million for 18.5 acres and a house overlooking Vineyard Sound.

“The seven-bedroom house dates to 1924 and sits on one of 39 original sites that were created over time by the Seven Gates Farm Corporation on land originally collected by Nathaniel Shaler in the 19th century,” The Vineyard Gazette reported. “The Seven Gates Farm property is tucked into a rolling hillside with distant views of the Elizabeth islands, where Mr. Kerry, a member of the Forbes family on his mother’s side, has long ties.”

The ironic juxtaposition caught the attention of Charlie Kirk, a conservative commentator and founder of Turning Point USA. “If Joe Biden’s special ‘Climate Envoy,’ John Kerry, actually believed in Global Warming & rising sea levels, why would he live in a $12,000,000 waterfront mansion on the island of Martha’s Vineyard?”

Kerry’s house is not far from the mansion bought by former President Barack Obama, who famously declared that his 2008 election marked “the moment when the rise of the oceans began to slow and our planet began to heal.”

The Obamas bought a 29-acre beachfront plot with a nearly 7,000-square-foot main house. It’s got seven bedrooms and 8½ bathrooms, TMZ reported last year. But Obama spent eight years in the White House saying melting ice caps would cause sea levels to rise, at some point washing over islands and pushing into oceanside communities. Take a look here.

That, too, drew reaction on social media. “If you truly believe that climate change is going to be as devastating as the pundits are saying (ex: the island of Manhattan will soon be underwater), why would you gamble $15M to buy an island estate directly on the water?”….

OBAMA:

(YAHOO NEWS) …Marty Nesbitt, a close friend of the Obamas and chairman of the Obama Foundation, purchased a tract of land in Hawaii for $8.7 million in 2015, miles from where the two families would visit every Christmas during the president’s time in office, and is building a trio of houses on the beachfront estate.

The Obamas are believed to be planning to occupy at least one of the houses when construction is complete.

The project has been controversial locally, in large part because the developers requested and received an exemption from Hawaii’s environmental laws to leave in place an old sea wall on the beach.

Environmental experts say sea walls contribute significantly to beach erosion and should be removed, but plans were submitted to the state to expand the sea wall on the property.

The Obamas own an $11.75 million mansion in Martha’s Vineyard, near the water as well…..

GORE:

- Even Al Gore, whose warnings about the danger of climate change have been among the most dramatic from a politician, has invested in property overlooking the ocean he says will wipe out coastal towns. (WASHINGTON EXAMINER)

FAILED PREDICTIONS

- For more than 50 years Climate Alarmists in the scientific community and environmental movement have not gotten even one prediction correct, but they do have a perfect record of getting 41 predictions wrong. In other words, on at least 41 occasions, these so-called experts have predicted some terrible environmental catastrophe was imminent … and it never happened. And not once — not even once! — have these alarmists had one of their predictions come true. aei

Below are the 41 failed doomsday, eco-pocalyptic predictions (with links):

1. 1967: Dire Famine Forecast By 1975

2. 1969: Everyone Will Disappear In a Cloud Of Blue Steam By 1989 (1969)

3. 1970: Ice Age By 2000

4. 1970: America Subject to Water Rationing By 1974 and Food Rationing By 1980

5. 1971: New Ice Age Coming By 2020 or 2030

6. 1972: New Ice Age By 2070

7. 1974: Space Satellites Show New Ice Age Coming Fast

8. 1974: Another Ice Age?

9. 1974: Ozone Depletion a ‘Great Peril to Life (data and graph)

10. 1976: Scientific Consensus Planet Cooling, Famines imminent

11. 1980: Acid Rain Kills Life In Lakes (additional link)

12. 1978: No End in Sight to 30-Year Cooling Trend (additional link)

13. 1988: Regional Droughts (that never happened) in 1990s

14. 1988: Temperatures in DC Will Hit Record Highs

15. 1988: Maldive Islands will Be Underwater by 2018 (they’re not)

16. 1989: Rising Sea Levels will Obliterate Nations if Nothing Done by 2000

17. 1989: New York City’s West Side Highway Underwater by 2019 (it’s not)

18. 2000: Children Won’t Know what Snow Is

19. 2002: Famine In 10 Years If We Don’t Give Up Eating Fish, Meat, and Dairy

20. 2004: Britain will Be Siberia by 2024

21. 2008: Arctic will Be Ice Free by 2018

22. 2008: Climate Genius Al Gore Predicts Ice-Free Arctic by 2013

23. 2009: Climate Genius Prince Charles Says we Have 96 Months to Save World

24. 2009: UK Prime Minister Says 50 Days to ‘Save The Planet From Catastrophe’

25. 2009: Climate Genius Al Gore Moves 2013 Prediction of Ice-Free Arctic to 2014

26. 2013: Arctic Ice-Free by 2015 (additional link)

27. 2014: Only 500 Days Before ‘Climate Chaos’

28. 1968: Overpopulation Will Spread Worldwide

29. 1970: World Will Use Up All its Natural Resources

30. 1966: Oil Gone in Ten Years

31. 1972: Oil Depleted in 20 Years

32. 1977: Department of Energy Says Oil will Peak in 1990s

33. 1980: Peak Oil In 2000

34. 1996: Peak Oil in 2020

35. 2002: Peak Oil in 2010

36. 2006: Super Hurricanes!

37. 2005 : Manhattan Underwater by 2015

38. 1970: Urban Citizens Will Require Gas Masks by 1985

39. 1970: Nitrogen buildup Will Make All Land Unusable

40. 1970: Decaying Pollution Will Kill all the Fish

41. 1970s: Killer Bees!

Update: I’ve added 9 additional failed predictions (via Real Climate Science) below to make it an even 50 for the number of failed eco-pocalyptic doomsday predictions over the last 50 years.

42. 1975: The Cooling World and a Drastic Decline in Food Production

43. 1969: Worldwide Plague, Overwhelming Pollution, Ecological Catastrophe, Virtual Collapse of UK by End of 20th Century

44. 1972: Pending Depletion and Shortages of Gold, Tin, Oil, Natural Gas, Copper, Aluminum

45. 1970: Oceans Dead in a Decade, US Water Rationing by 1974, Food Rationing by 1980

46. 1988: World’s Leading Climate Expert Predicts Lower Manhattan Underwater by 2018

47. 2005: Fifty Million Climate Refugees by the Year 2020

48. 2000: Snowfalls Are Now a Thing of the Past

49.1989: UN Warns That Entire Nations Wiped Off the Face of the Earth by 2000 From Global Warming

50. 2011: Washington Post Predicted Cherry Blossoms Blooming in Winter

But somehow this time will be different, and the ‘experts’ and 16-year olds of today will suddenly be correct in their new predictions of eco-doom and eco-disaster? Not.

[….]

This is my most concise expose of climate fraud. Please pass it around to everyone you know and your elected officials. The video is short, but cuts right to the heart of the matter.