[p.>71] 3.4.5 Reactions to the State Case Studies

The case studies that constitute the other strand of the new minimum wage literature soon generated considerable controversy. Some labor economists embraced the studies as praiseworthy examples of the usefulness of the natural experiment approach to studying the economic effects of policy changes (e.g., Freeman 1995). Others, however, were more critical of these studies. For example, referring to the descriptions of these studies in Myth and Measurement, Welch writes: “I am convinced that the book’s long-run impact will instead be to spur, by negative example, a much-needed consideration of standards we should institute for the collection, analysis, and release of primary data” (1995, 842). Likewise, Hamermesh concludes that “even on its own grounds, CK’s [Card and Krueger’s] strongest evidence is fatally flawed” (1995, 838).

The criticisms of the case study approach focus on three main issues. The first concerns the adequacy of the control groups used in the studies. On its face, for example, it seems reasonable to question the use of Georgia, Florida, and Dallas/Ft. Worth as appropriate control groups in Card’s (1992b) study of the California minimum wage increase, given that these places are far from California and likely influenced by very different demand conditions. But even for states in close geographic proximity, using one state as a control for analyzing a policy change in another state can sometimes be problematic. For example, Deere, Murphy, and Welch (1995) point out that teenage employment [p.>72] rates in New Jersey diverged significantly from those in Pennsylvania beginning in 1988, casting doubt on Card and Krueger’s claim that restaurants in Pennsylvania provided a sensible control group with which to compare restaurants in New Jersey. More broadly, Hamermesh notes that the variance in employment seems to be dominated by demand shocks, which suggests that “any changes in the relative demand shocks” affecting two geographic areas will easily “swamp the effect of a higher minimum wage” (1995, 837). In our view, this issue highlights a potential advantage of a larger panel with many minimum wage increases, over which these demand shocks would be much more likely to be, on average, uncorrelated with minimum wage changes.

A second criticism concerns the timing of the surveys used in the case study analyses. In each of the fast-food case studies, the posttreatment observation comes less than a year after the relevant minimum wage increase. As we noted earlier, however, there is substantial empirical evidence that the disemployment effects of an increase in the minimum wage may occur with a lag of one year or more. For the same reason, both Brown (1995) and Freeman (1995) suggest that these studies are more appropriate for examining the short-run effects of minimum wage changes than for estimating their long-run effects.

A third concern involves questions about the reliability of the data used in these case studies. In each study, the researchers conducted their own telephone surveys of fast-food restaurants, which were not subject to the same rigorous standards as those employed in developing the surveys used in government statistical programs. Welch (1995) expresses significant doubts about the quality of the data, noting in particular some puzzling features of the sample collected for the analysis in Card and Krueger (1994). In Neumark and Wascher (2000), we document what seems to us to be an unusually high degree of volatility in the employment changes measured with Card and Krueger’s survey data.

In light of these concerns, a number of researchers subsequently reexamined the results reported in the initial round of state-specific case studies. For example, Kim and Taylor (1995) revisit Card’s study of the effects of California’s 1988 minimum wage increase on employment in the low-wage retail sector. Using data for the retail trade sector as a whole, Kim and Taylor first replicate Card’s finding that employment growth in California around the time of the minimum wage increase was not statistically different from retail employment growth for the United States as a whole. However, they also point out that the [p.>73] volume of retail sales in California rose much more rapidly during that period than in the United States, which raises questions about the validity of this experiment. Kim and Taylor then turn to more-detailed industry data within the retail sector and examine whether differences across industries in wage growth in California relative to the United States as a whole were negatively correlated with differences across industries in California versus U.S. employment growth in various years. The results show a negative and statistically significant correlation for the changes from March 1988 to March 1989, the period that included the minimum wage increase, but not for the changes in earlier years; they interpret this result as consistent with a negative employment effect of the minimum wage. A similar result emerges from their analysis of county-level employment growth and wage growth. The implied minimum wage elasticities that they calculate from their estimates range from —0.15 to —0.2.31

In Neumark and Wascher 2000, we revisit Card and Krueger’s analysis of New Jersey’s minimum wage increase, paying particular attention to data quality issues. In particular, we collected administrative payroll records on hours worked from 235 fast-food establishments that were in the universe from which Card and Krueger drew their sample, and compare the two data sources. The Card-Krueger data were elicited from a survey that asked managers or assistant managers “How many full-time and part-time workers are employed in your restaurant, excluding managers and assistant managers?” This question is highly ambiguous, as it could refer to the current shift, the day, or perhaps the payroll period, and the respondents’ interpretation of it could differ in the observations covering the periods before and after the minimum wage increase. In contrast, the payroll data referred unambiguously to the payroll period used by the restaurant. Reflecting this difference, the data collected by Card and Krueger had much greater variability across the two observations than did the payroll data, with changes that were sometimes implausible.32

We then replicate Card and Krueger’s difference-in-differences test after replacing their survey-based data with observations taken from the payroll records. In contrast to Card and Krueger’s results, the results from our replication indicate that the minimum wage increase in New Jersey led to a decline in employment (FTEs) in the New Jersey sample of restaurants relative to the Pennsylvania sample. The elasticities from our direct replication analysis were a little larger than —0.2, while additional sensitivity analyses suggested a range of elasticities [p.>74] from —0.1 to —0.25, with many (but not all) of the estimates statistically significant at conventional levels.

In their reply, Card and Krueger (2000) present several additional analyses of the effects of New Jersey’s minimum wage increase using both their original data and our payroll records. In addition, they report results from a separate longitudinal sample of fast-food restaurants obtained from BLS records. In contrast both to their original study and to our replication, their reanalysis generally finds small and statistically insignificant effects of the increase in New Jersey’s minimum wage on employment, and they conclude that “the increase in New Jersey’s minimum wage probably had no effect on total employment in New Jersey’s fast-food industry, and possibly had a small positive effect” (1419). Of course, had this been the conclusion from Card and Krueger’s original analysis, there would have been much less scope for casting doubt on the standard competitive model of labor markets.

A more recent case study is contained in a paper by Powers, Baiman, and Persky (2007), who revisit the question of the effects of the minimum wage on employment and hours in the fast-food industry based on an increase in the minimum wage in Illinois. Their research design parallels very closely the original design of the Card and Krueger 1994 study, using survey data to examine employment changes in counties along the Illinois-Indiana border between the fall of 2003 and the fall of 2005, when the Indiana minimum wage was unchanged and the Illinois minimum wage rose from $5.15 (the federal minimum) to $6.50 in two steps.

As in Card and Krueger, Powers, Baiman, and Persky (2007) use two estimators: (1) a simple difference-in-differences comparison of employment changes in Illinois to those in Indiana, and (2) a regression of employment changes on the wage gap between the average starting wage before the minimum wage increase and the new minimum wage. As dependent variables, they look at the change in FTE employees (weighting part-time workers at 0.5), changes in the numbers of full-time and part-time employees separately, and the change in weekly hours. In all cases, they examine both absolute and percentage changes.

One significant improvement in this study is the use of a more precise employment question that asks “How many people … were on your restaurant’s payroll during the last pay period?” The responses to this question should correspond much more closely to the type of in‑[p.>75]-formation we collected from payroll records. Unfortunately, however, Powers, Baiman, and Persky do not provide any information on the distribution of employment changes to confirm that they obtained far fewer of the implausibly large employment changes that we documented in Card and Krueger’s data (Neumark and Wascher, 2000).

For the entire 2003-2005 period, the state difference-in-differences specifications for FTE employment yield an estimate of zero for the absolute changes, and a negative but insignificant (and imprecise) estimate for the relative changes, with an implied elasticity in the latter case of -0.14. For the gap specification, they also obtain negative but insignificant estimates. When they estimate specifications for part-time and full-time employees separately, the evidence for part-time employment points to negative effects, while the evidence for full-time employment points to positive (and generally much smaller) effects. However, the only significant estimate is a negative effect for the absolute change in part-time employment in the state difference-indifferences specification. When they break the sample into 2003-2004 and 2004-2005 changes, they find significant negative effects on FTE employment from the second minimum wage change using both the difference-in-differences and gap specifications, but little evidence of any effect from the first minimum wage change. For the 2004-2005 period, the estimated elasticity for the difference-in-differences specification is -0.75, which is very large. The stronger evidence of negative effects for the latter change could reflect the fact that the minimum wage only rose by 35 cents in January 2004, while it rose by $1.00 in January 2005, as well as the possibility that the 2004-2005 change includes some lagged effects from the first increase.33

Powers, Baiman, and Persky conclude from this research: “While we can reasonably conclude that the Illinois-Indiana comparison shows no positive response to minimum wages (the most striking claim of the original Card-Krueger study), we cannot yet confidently assert that the overall response is negative (the conventional hypothesis)” (2007, 26). This statement closely parallels our conclusion based on our reevaluation of the Card and Krueger study.34

Regardless of what the case studies of the fast-food industry show, we think that their importance is overstated. For one thing, there is no reason to expect the predicted negative employment effect to show up in studies of a particular state minimum wage increase—especially in light of Hamermesh’s point about the importance of relative demand shocks in generating fluctuations in employment. In addition, as we [p.>76] discussed in section 3.2, the interpretation of evidence from case studies of a specific industry is unclear, given that the neoclassical model does not predict that employment in a particular sub-sector of the economy will decline in response to a general increase in the minimum wage. For example, it is possible that fast-food restaurant chains are less intensive in low-wage labor than are their competitors, in which case the effect of the higher wage floor on prices at the low-wage-intensive establishments could induce greater consumer demand for fast-food output and an increase in fast-food employment. As a consequence, the absence of an employment decline for a narrow industry should not be viewed as a contradiction of that model.

Finally, two recent studies attempt, in one way or another, to explore some of the explanations of the differences in results between the industry-specific case studies and the panel data analysis of broader affected groups. Dube, Lester, and Reich attempt to broaden the analysis by studying the restaurant industry as a whole, rather than the fast-food sector in isolation, and by computing difference-in-differences estimates for a large number of minimum wage increases over many geographic areas. Their preferred specifications yield estimated minimum wage effects that are near zero. The authors suggest that because they look at the entire restaurant industry, for which substitution in consumption between the output of subsectors of the industry is not problematic, their study can help to reconcile the findings of the fast-food studies and the state-level panel data studies of groups of low-skill workers (2007, 3 and 39).

In general, it seems preferable to estimate minimum wage effects from a large set of increases over many regions, in order to avoid the undue influence of idiosyncratic shocks that may plague a case study of a single minimum wage increase in an isolated region; and certainly, in that sense, their study is more like the state-level panel analyses. However, their focus on the restaurant industry is complicated by two factors. First, tip credits—which are important for non-fast-food restaurants—vary across states, making measurement of the effective minimum wage complicated.35 Second, as discussed earlier with reference to the paper by Wessels (1997), monopsony-like effects can arise in an industry with tipped workers, raising questions about whether these results can be generalized to other industries (aside from other industry differences). As a result, the implications of these results for more aggregate state-level panel data studies are unclear.36

Hoffman and Trace (2007) attempt to bridge the gap between the state-level panel data analyses and the fast-food case studies in a differ‑[p.>77]-ent way. They focus on teenagers and other low-skill groups, as in the state-level panel data analyses, but they restrict their attention to New Jersey and Pennsylvania in the 1991-1993 period surrounding the minimum wage increase in New Jersey that Card and Krueger (1994) studied. In addition, they examine a “reverse” experiment for these two states for the 1995-1998 period, when Pennsylvania’s minimum wage went up faster than New Jersey’s in 1996 and 1997 because of the federal minimum wage increases in those years (coupled with New Jersey’s higher minimum wage prior to the federal increases).

Their results are mixed. For the 1991-1993 period, they find a negative but insignificant effect on the employment of teenagers, but a positive and significant effect for non-teenage dropouts. In contrast, in the 1995-1998 period, they find that employment of sixteen- to nineteen-year-olds and sixteen- to twenty-four-year-olds and of non-teenage high-school dropouts declined in Pennsylvania relative to New Jersey, with the results especially strong in a triple difference estimate that compares employment changes for these groups with changes in the employment of thirty- to forty-nine-year-olds. They also examine changes in the shares of teenagers in the restaurant industry in each state and find weak evidence suggesting that minimum wages reduced this share in the 1995-1998 period, but evidence of a positive effect in the 1991-1993 period. Thus, this study also does not successfully reconcile the fast-food case studies and state-level panel data analyses, although it does help to emphasize the fragility of results from studies that estimate minimum wage effects from the impact of an isolated minimum wage increase in a single pair of nearby regions.

FOOTNOTES

31. A potential shortcoming of Kim and Taylor’s analysis is the absence of a direct wage measure in the County Business Pattern data they used (Card and Krueger 1995a; Kennan 1995). In particular, they computed wage rates by dividing total payrolls for the first quarter of each year by total employment for a single pay period in March, which may induce measurement errors associated with differences in the timing of the numerator and denominator and with variation in the average number of hours included in the pay period. Kim and Taylor were well aware of this data problem and noted that there is no indication of a negative correlation in years in which the minimum wage was constant; they also showed that IV estimates that use lagged wages and average firm size in the industry as instruments produce similar results. Card and Krueger address the first point by showing that there is a negative correlation in the 1989-1990 change (although this could reflect a lagged effect from the 1988 increase in the minimum wage). In addition, they point out that the significant negative coefficient in the IV estimates relies on the inclusion of average firm size as an instrument, which they argue is inappropriate.

32. The same problem likely exists in the Katz and Krueger (1992) study. Although the paper is not very specific about the nature of the questions used to elicit the employment data for the Texas study, the survey instrument appears to be included in an appendix to a related paper (Katz and Krueger 1991), with wording similar to that used in Card and Krueger’s New Jersey study. Figure 2 in the 1992 study similarly indicates some very large changes in employment.

33. The estimates for total hours are somewhat stronger. All four estimates (for the two specifications, and with hours changes measured in absolute and percentage terms) are negative, with the state difference-in-differences estimates statistically significant at the 5 percent level. However, the estimated effects are very large, with the implied elasticities ranging from —0.85 to —0.92. The authors indicate that they are less confident about the hours results, however, because of measurement problems.

34. We concluded, “The payroll data raise serious doubts about the conclusions CK drew from their data, and provide a reasonable basis for concluding that New Jersey’s minimum-wage increase reduced fast-food employment … in New Jersey relative to the Pennsylvania control group. Combined with the new evidence from the ES-202 data that CK present … we think we can be more decisive in concluding that New Jersey’s minimum-wage increase did not raise fast-food employment in that state” (2000, 1391).

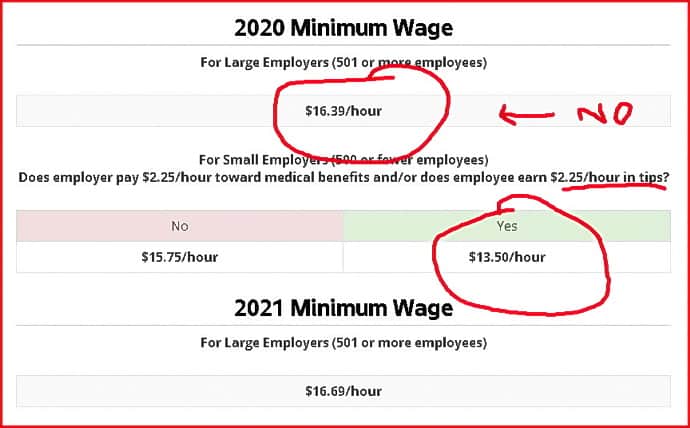

35. Tip credits specify a dollar or percentage amount of the minimum wage that can be made up by tips. For example, a 50 percent credit coupled with a $5.00 minimum wage would imply that as long as hourly tips exceed $2.50, the employer has to pay only a base hourly wage of $2.50. The paper makes no reference to taking account of tip credits in defining state minimum wages, and tip credits vary across states; see http://www.dol .gov/esa/programs/whd/state/tipped.htm (viewed November 6, 2007).

36. Indeed, earlier work by Partridge and Partridge (1999) noted the potential for the tip credit to render results for the restaurant industry inapplicable to other industries. In their study, they present some evidence of disemployment effects for the retail sector as a whole and for the retail sector excluding eating and drinking establishments. However, the estimated effects for eating and drinking establishments, although negative, are mostly insignificant. That said, we also have doubts about their analysis, as they find significant negative effects of the minimum wage on overall nonfarm employment growth as well, which seems implausible.

REFERENCES

Brown, Charles. 1995. “Myth and Measurement: The New Economics of the Minimum Wage: Comment.” Industrial and Labor Relations Review 48, no. 4 (July): 828-830.

Deere, Donald, Kevin M. Murphy, and Finis Welch. 1995. “Employment and the 19901991 Minimum-Wage Hike.” American Economic Review Papers and Proceedings 85, no. 2 (May): 232-237.

Freeman, Richard B. 1995. “Myth and Measurement: The New Economics of the Minimum Wage: Comment.” Industrial and Labor Relations Review 48, no. 4 (July): 830-834.

Hamermesh, Daniel S. 1995. “Myth and Measurement: The New Economics of the Minimum Wage: Comment.” Industrial and Labor Relations Review 48, no. 4 (July): 835-838.

Kim, Taeil, and Lowell J. Taylor. 1995. “The Employment Effect in Retail Trade of California’s 1988 Minimum Wage Increase.” Journal of Business and Economic Statistics 13, no. 2 (April): 175-182.

Neumark, David, and William Wascher. 2000. “Minimum Wages and Employment: A. Case Study of the Fast-Food Industry in New Jersey and Pennsylvania: Comment.” American Economic Review 90, no. 5 (December): 1362-1396.