“One of the great non sequiturs of the left is that, if the free market doesn’t work perfectly, then it doesn’t work at all-and the government should step in.” — Thomas Sowell

No really! The Russian jeep carrying the ashes of the late Cuban leader

Fidel Castro broke down and had to be pushed for a period on Saturday.

- 3-Questions Liberals Never Ask (EXTENDED VIDEO)

- 10 Myths About Government Debt

- America’s Debt Crisis Explained (Video)

- Are Regulations Causing Pain at the Pump? (PragerU)

- Concepts: “What Does ‘Free’ Mean?” (Smaller Government)

- California Has Debt, Not Surplus

- California’s Unfunded Liabilities

- Can the Government Run the Economy? (PragerU)

- Capitalism Works (See Video)

- Corporations Pay ZERO% In Taxes

- Crony Capitalism ~ What Is It

- Do the Rich Pay Their Fair Share? (PragerU)

- Does the Minimum Wage Prevent Poverty? (PragerU)

- Free Enterprise Is About Morals, Not Materialism

- Food Stamp Mantra[s] from Democrats Rebutted

- Game of Loans (PragerU)

- Gender-Gaps, The Peace Index, and Happiest Countries

- Gender Wage-Gap Myths

- Gender Wage-Gap Debunked ~ yet again (PragerU)

- Greedy Rich Stuff Mattresses with Their Money

- Hayek vs. Keynes

- Housing Crisis of 2008 Revisited

- How Regulations Hurt Small Businesses (PragerU)

- How This Government Agency Hurts Us All (PragerU)

- How to Solve America’s Spending Problem (PragerU)

- I Pencil ~ The Invisible Hand

- Income Inequality is Good (PragerU)

- Is Capitalism Moral? (PragerU)

- Is the Unemployment Rate Lying to You? (PragerU)

- Is America’s Tax System Fair? (PragerU)

- Lemonade Stand Economics (PragerU)

- Lower Taxes, Higher Revenue – Laffer Curve (PragerU)

- Military Spending ~ We Spend More On It Than Education and Health

- Milton Freidman on the Phil Donahue Show – “Greed” (VIDEO)

- Money in Politics (PragerU)

- Myths, Lies and Capitalism (PragerU)

- Poverty Causes Terrorism?

- Price Gouging During Emergencies | Are There Benefits?

- Private Sector vs. Public Sector (PragerU)

- Profits Are Progressive (PragerU)

- Quantitative Easing (Inflation)

- Rich and Greedy Republicans Influencing Politics

- Rich Get Poorer ~and~ Poor Get Richer (+More Mantras Destroyed)

- [Evil] Rich HIDE Their Money

- TAX THE RICH! (Plus: CEO Pay vs. Worker Pay)

- Taxes Are Killing Small Businesses (PragerU)

- The Bigger the Government… (PragerU)

- The Case for a Flat Tax (PragerU)

- The Democratic Party Are Run By Old, Rich, White (Obstructionist) Men

- The General Welfare | Righting Constitutional Misconceptions

- The Progressive Income Tax: A Tale of Three Brothers (PragerU)

- The Promise of Free Enterprise (PragerU)

- The War on Work (PragerU)

- There Is Only One Way Out of Poverty (PragerU)

- Trickle Down Economics Myth

- Tuition Costs ~ “Game of Loans”

- Wealth Inequality in America ~ Critiques On Inequality

- What Creates Wealth? (PragerU)

- What’s Killing the American Dream? (PragerU)

- Which Is More Dangerous: Big-Business or Big-Government? (Video)

- White House Use Beer Drinking Story To Explain Tax Cuts (Video: White House Press Secretary Sarah Huckabee Sanders)

- Why Is America So Rich? (PragerU)

- Why Are Americans Working Fewer Hours? (PragerU)

- Why Are Your Payroll Taxes So High? (PragerU)

- Why Do American Companies Leave America? (PragerU)

- Why is College So Expensive? (PragerU)

- Why Is Healthcare So Expensive? (PragerU)

- Why You Love Capitalism (PragerU)

- Working Overtime or Working Less? (PragerU)

- Zero Sum Myth

SOCIALISM

- America’s Socialist Origins (PragerU)

- Democratic Socialism’s Failure – Some Examples (Video)

- Democratic Socialism is Still Socialism (PragerU)

- How’s Socialism Doing in Venezuela? (PragerU)

- How Socialism Ruined My Country (PragerU)

- Immigrants! Don’t Vote for What You Fled (PragerU)

- Jamie Foxx | Plus: Caller From Caracas, Venezuela (Audio)

- John Stossel vs. Noam Chomsky on Venezuela (Video)

- Larry Elder – Bernie Sanders’s Socialist Paradise (Audio)

- Milton Friedman – Why Socialism doesn’t work (Audio)

- Questions To Ask a Socialist – Charlie Kirk Crushes Socialism (Video)

- Scandinavian Socialism

- Scandinavian Socialism Works #BecauseNorthAmerica (Audio)

- Should Government Bail Out Big Banks? (PragerU)

- Socialism Defined (Professor DiLorenzo)

- Socialism’s Failure (Professor DiLorenzo)

- Socialism Makes People Selfish (PragerU)

- The Venezuela Diet! (Video)

- Viva La Venezuela! (Video)

- What’s Wrong with Socialism? (Prager University Videos)

- Who Is Karl Marx (PragerU)

- Why “Democratic” Socialism Doesn’t Work (Video)

Dennis Prager Series – Left vs. Right:

- How Big Should Government Be?

- Does it Feel Good or Does it Do Good?

- How Do You Judge America?

- How Do You Deal With Painful Truths?

- How Do We Make Society Better?

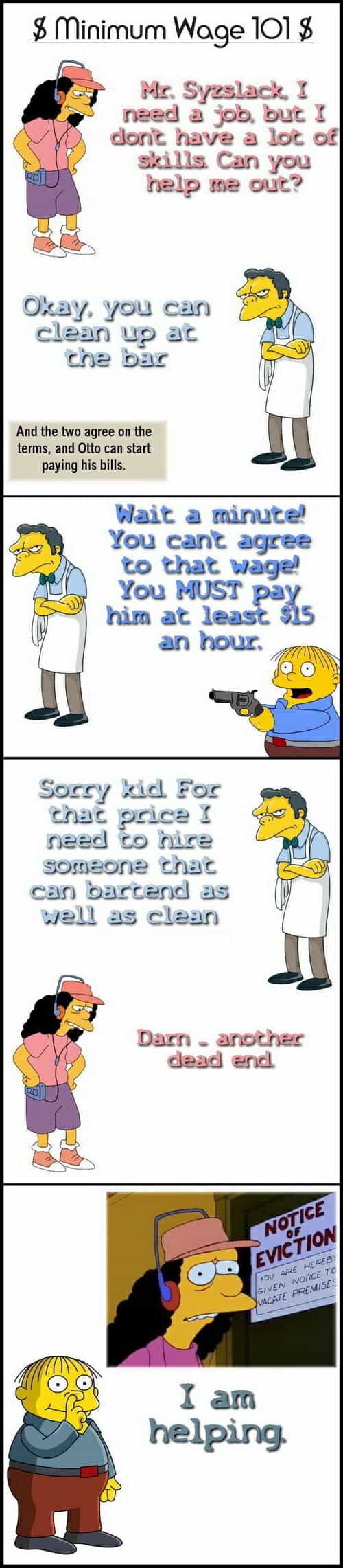

MINIMUM WAGE (>>> Main Page <<<)

What happens when politicians decide they are in a better position than business owners to know how much workers should be paid? We don’t have to guess. Cities like Seattle and New York have already done so with their $15/hour minimum wage mandates. Simone Barron, a lifelong restaurant worker, recounts how “helping” her impacted her wallet, her career, and her life.

Corporations can absorb this “do-goodism”, small business owners cannot!

“Any Econ 101 student can tell you the answer: ‘The higher wage reduces

the quantity of labor demanded, and hence leads to unemployment’.”

(Larry Elder)

- $15 an Hour Minimum Wage Backfiring on Workers? (Video)

- $15 Minimum Wage: What We Can Expect | Forbes (Video)

- Applebees Franchisee On Min Wage Impact (Video | TownHall)

- BLACK UNEMPLOYMENT (WALTER WILLIAMS)

- Dunkin Donuts vs. Minimum Wage (Audio)

- Former McDonald’s CEO Ed Rensi Speaks About Minimum Wage

- Gutfeld: Seattle’s minimum wage hike failures (Video)

- How Does the Minimum Wage Work? (PragerU)

- How High Would You Make the Minimum Wage? We Asked L.A. Residents (Video)

- How the Minimum Wage Hurts Young People (PragerU)

- Is Raising Minimum Wage A Bad Idea? – Learn Liberty (Video)

- John Stossel – Minimum Wage, Maximum Folly (Video)

- John Stossel – The Politics of Income (Video)

- L.A.’s Garment Dist vs. Left-Coast Values (Audio)

- L.A.’s Minimum Wage Law Hurts Poor/Middle-Class People

- Larry Elder Discusses $15 Minimum Wage (Audio)

- Liberal Bias at the L.A. Times and Minimum Wage Debates ~ Michael Hiltzik & David Neumark (Audio)

- McDonald’s & The Minimum Wage (Video)

- Minimum Wage and Automated Kiosks (Audio)

- MINIMUM WAGE AND BLACK FAMILIES ~ WALTER WILLIAMS (AUDIO & VIDEO)

- Minimum Wage Basics

- MINIMUM WAGE, MAXIMUM FOLLY (WALTER WILLIAMS, PDF)

- Minimum Wage Realities

- Minimum Wage and Regulations Killing L.A.’s Garment District

- Neumark/Wascher Bitch Slap Card/Krueger

- Ontario minimum wage increase “not about helping poor people” (Video)

- Popeye’s CEO on $15 minimum wage (Video)

- The “Card-Krueger” Study Debunked

- The Cruelty of the $15 Minimum Wage (Video)

- The Fifteen Dollar Minimum Wage is NONSENSE (Video)

- What’s the Right Minimum Wage? (PragerU)

- White Castle vs. New York Values (Audio)

See more on their website, HERE.

- Economists aren’t certain about many things, but on the minimum wage, nearly all of them (90 percent, according to one survey) believe that the case is open and shut. All else being equal, if you raise the price of something (for instance, labor), then the demand for it (for instance, by employers) will decline. That’s not just a theory; it’s a law.

James Glassman, “Don’t Raise the Minimum Wage,” Washington Post (Feb 24, 1998).

- A majority of professional economists surveyed in Britain, Germany, Canada, Switzerland, and the United States agreed that minimum wage laws increase unemployment among low-skilled workers. Economists in France and Austria did not. However, the majority among Canadian economists was 85 percent and among American economists was 90 percent. Dozens of studies of the effects of minimum wages in the United States and dozens more studies of the effects of minimum wages in various countries in Europe, Latin America, the Caribbean, Indonesia, Canada, Australia, and New Zealand were reviewed in 2006 by two economists at the National Bureau of Economic Research. They concluded that, despite the various approaches and methods used in these studies, this literature as a whole was one “largely solidifying the conventional view that minimum wages reduce employment among low-skilled workers.”

Thomas Sowell, Basic Economics: A Common Sense Guide to the Economy, 4th Edition (New York, NY: Basic Books, 2011), 241. [Link to 5th edition]

- …percentage of economists who agree…. A minimum wage increases unemployment among young and unskilled workers. (79%)

Robert M. Beren, Professor of Economics at Harvard University ~ (More: Wintery Knight)

- Economically, minimum wages may not make sense. But morally, socially, and politically they make every sense…

Jerry Brown (Reason.org)

Last Friday, I wrote about how 81% of economists agree that rent controls are bad policy. In a field so renowned for its fractiousness, this degree of consensus might seem rather surprising.

The same is true with minimum wages. In 2015 the Employment Policies Institute surveyed 166 economists based in the United States on the subject. They found that

- Nearly three-quarters of these US-based economists oppose a federal minimum wage of $15.00 per hour.

- The majority of surveyed economists believe a $15.00 per hour minimum wage will have negative effects on youth employment levels (83%), adult employment levels (52%), and the number of jobs available (76%).

- When economists were asked what effect a $15.00 per hour minimum wage will have on the skill level of entry-level positions, 8 out of 10 economists (80%) believe employers will hire entry-level positions with greater skills.

- When economists were asked what effect a $15.00 per hour minimum wage will have on small businesses with fewer than 50 employees, nearly 7 out of 10 economists (67%) believe it would make it harder for them to stay in business.

- A majority of surveyed economists (71%) believe that the Earned Income Tax Credit (EITC) is a very efficient way to address the income needs of poor families; only five percent believe a $15.00 per hour minimum wage would be very efficient.

- The economists surveyed are divided on the impact of a $15.00 per hour minimum wage will have on poverty rates, as well as the impact it would have on the spending level for public programs such as the EITC, TANF, or others.

- At lower levels (under $11.00 per hour) of proposed federal minimum wages, economists are divided largely by self-identified party identification as to an acceptable rate with a majority of Republicans and Independents who responded favoring lower minimum wages ($7.50 per hour or less) and a plurality of Democrats who responded preferring a minimum wage between $10.00 and $10.50 per hour.

This isn’t surprising. After all, as I’ve written before, the balance of empirical evidence suggests these things to be true…..

TeXaS vs CaLiFORNia

- America’s Future: California Or Texas? If California Is America’s Future, Then That Future Is Overrun With Poverty

- What is the cost of living difference between Texas and California?

- Texas v. California: The Real Facts Behind The Lone Star State’s Miracle

- California Wins ‘Worst State to do Business’ for 11th Year

- ‘Two-States of California’- Victor Davis Hanson at American Freedom Alliance (Video)