California’s Half-Trillion-Dollar Pension Fund Mess: Blame Jerry Brown

By Jane Jamison

California is the nation’s shameful example of what happens when Democrats influenced by big-government labor rule the statehouse for forty years.

With 12.5% unemployment (up from 4.5% a mere three years ago) and a “recognized” budget deficit of $21 billion, California has just found that out it is in much, much more financial trouble than anyone, especially a Democrat, really wants to admit.

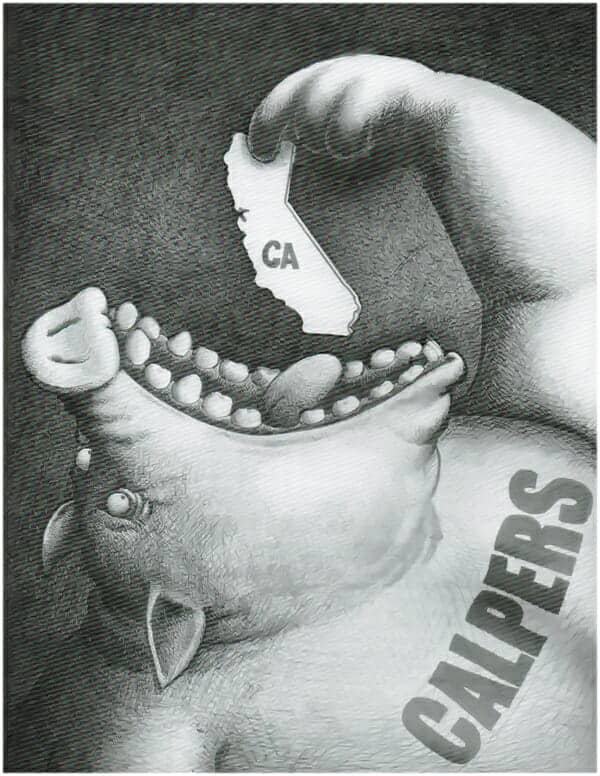

California’s governor Schwarzenegger commissioned a study by Stanford University, which has found that California’s three public employee pension funds (The California Public Employees’ Retirement System [CalPERS], California State Teachers’ Retirement System [CalSTRS], and University of California Retirement System [UCRS]) lost $109.7 billion in portfolio value in one year (June ’08 to June ’09) and are currently in shortfall of “more than half a trillion dollars.”

By law, California taxpayers are required to pay the public employees’ pensions shortfalls that may occur. Local governments cannot “print money” as the federal government does to cover budget deficits.

What should have been considered a huge scandal in the state pension fund system in the past year got little attention but is more pertinent now: The two largest plans, CalPERS and CalSTRS, were reportedly near bankruptcy in 2009 after it was learned the funds had lost from 25%-41% of their value due to risky investments in real estate and the stock market. Former employees of the state plans were accused in January of getting huge fees to direct pension investments to certain banks or ventures.

There are outrageous examples of abuse in the California public pension system.

PensionTsunami.com, which has been tracking the pension fund liability issue for five years, has found that 9, 233 retired members of CalPERS or CalSTRS receive more than $100,000 per year in retirement benefits, amounting to more than a billion dollars a year.

The retired city administrator of Vernon, California, Bruce Malkenhorst, receives an annual pension of $449,675 from CalPERS. Vernon, a Los Angeles suburb, has 92 residents.

California’s state employee pension fund liabilities have ballooned for years with increased numbers of state employees, many of whom can retire at age 50, can “spike” their last years’ income with overtime to increase their retirement, and can then move on to other government or private jobs without losing their pensions.

Why should Californians care about this confusing, complicated budget problem with a huge, unfathomable invoice attached? David Crane, writing for the Los Angeles Times, says that today’s pension fund shortfall is tomorrow’s budget cut to something some Californian is likely to miss.

In California’s case, past pension underfunding means reduced funding of current programs. This explains why pension costs rose 2,000% from 1999 to 2009, while state funding for higher education declined over the same period.

Californians are feeling the pain of the budget crisis, but they often misplace their criticisms.

Let’s go to the videotape this year of the many demonstrations on the many University of California campuses, where students have rioted against proposed 32% state tuition increases and program cuts.

Approximately 22,000 California teachers have just received “pink slips” indicating that they may be laid off due to budget cuts next fall. An additional 20,000 were laid off last year. California is cutting “live” teachers out of classrooms in order to pay for retired teachers.

California schools have gone from number one in the country in the 1970s to at or near the bottom in performance and funding.

Who is to blame for this ticking-time bomb of unfunded public pension liability?

“Thank” Jerry Brown. As Governor “Moonbeam” of California in 1978, he signed the “Dill Act,” which gave California public employees the right to collective bargaining.

Brown, who has been governor, Oakland mayor, and attorney general, now wants to be California governor…again. Four big, grateful government labor unions are backing him…again.

Speaking recently to the Service Employees International Union, Jerry Brown “the populist” said he was proud to have given state employees “the choice” to belong to unions in the ’70s, and he will “take a look” at the pension funds to make sure that they are actuarially sound. Big applause line.

Speaking to another union group in Sacramento, Brown was caught on videotape asking the labor leaders to “do the dirty work” and “attack” Republican candidates who oppose him in the governor’s race. (Hear it here.)

Who else is to blame?

Since Brown gave them a green light in the 1970s, public employee unions have become a muscular, dominating force in California politics. State employee unions spent a whopping $31.7 million on state races just from 2001-2006, according to the California Fair Political Practices commission — higher than any other group, including corporations. The majority-Democrat California legislature has voted accordingly.

What can be done?

Jerry Brown the rerun, who is running technically unopposed by any other candidate in the Democratic primary, has been oddly silent on his state’s dire budgetary woes. His campaign site news releases do not mention budget problems.

At the same time, it has been noted by the tabloid media that Jerry Brown has been weirdly over-involved as California’s attorney general, his current job, in the celebrity death investigations of Anna Nicole Smith, Michael Jackson, and Corey Haim. His office spent several months investigating ACORN employees who were caught in a videotape sting organizing houses of prostitution in government housing. Brown has just determined that there will be no prosecution of ACORN in his state.

Brown also went to the unusual extra step to seal his gubernatorial records from his 1970s-’80s term for fifty years. (U.S. presidents can seal records only up to twelve years for national security purposes.)

Brown refuses to join with fourteen other states’ attorneys general in challenging the recently-passed health care reform law, even though it will mandate billions more in unfunded expenses to the financially-strapped California Medicaid program. He says that to challenge Obamacare would be to engage in “poisonous partisanship.”

Republican gubernatorial candidates are tacking the pension fund liability:

Steve Poizner says he supports a “two-tier” system for current and new state employees but doesn’t think that a new governor will be able to come in and “steamroll” the unions.

Meg Whitman has campaigned on cutting state employee rolls and advocates “401(k)” style pensions for government workers and higher retirement ages (from age 50 to 55 or 65).

What can California do?

The U.S. Constitution technically does not allow for states to go bankrupt. Vallejo, California was the first city in the country to go bankrupt and has been establishing new “tiers” of retirement plans for police and fire employees.

The newly-elected governor of New Jersey, Chris Christie, is tackling government employees’ unions to some effect. Christie has announced his intentions to cut substantially from government executive positions, privatize other state jobs, and cut positions.

There has been criticism of increased funding and budget overruns for state prisons due to the influence of the California prison guards’ union.

The Citizen Power Campaign seeks to “unplug” the public employee unions and is endorsed by many of the conservative candidates for office in California, including Republican Steve Poizner for governor.

One thing California clearly does not need is the déjà vu “hair of the dog” in the person of 1970s retread Democrat Jerry Brown.