PRO TIP: I use a browser separate from my go to that I can erase all the history and cookies in order to open up articles from sites (like Forbes or American Spectator) that regulate how many free articles you can access before a “pay wall” is set up and they block you from access to more. You may need to do this if you follow the links below.

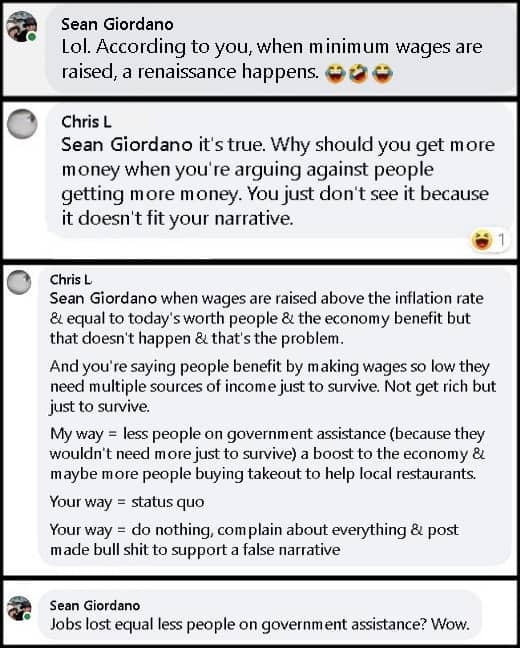

In a continuing discussion [of sorts], some more articles regarding the Davis Bacon Act (coming in a future post) and minimum wage issues have been linked/levied. I do not have time to respond to them all, but I will to some of the major articles. Here I will extend the discussion about employment… but the gist of our positions are as follows:

An article linked by Chris L. was an enjoyable read is from FORBES. While I believe parts of it are wrong, it was a good, digestible size. (And the reason he linked it had to do with a “living wage” 9point #1], but the article – even there – does not support Chris’s contention. Linking that article is actually a train wreck for Chris L., 🤓) HOWEVER, the portion about jobs is in full agreement with my position above. Here is my main point from the author’s seven that is still my main premise:

3) Myth: An increase in the minimum wage is bad for employers

Paying a higher wage to employees can also help employers cut costs in other ways, according to the Center on Budget and Policy Priorities. “Beyond simple supply and demand theory,” reads a comprehensive report on the economics of raising the minimum wage, “increasing the minimum wage may also spur businesses to operate more efficiently and employees to work harder.”

Yes, excellent, so, “more efficiently” is the same as saying “using less labour for the same output”. That is, they’ve just said that business will fire some people as a result of the higher wages. Or, as we keep saying, there will be unemployment as a result.

I believe Chris L. posted this article as a refutation of my position — and I clearly made the points that raising minimum wage leads to loss of jobs (almost always for the poorest among us).

CONTINUING with that article:

5) Myth: It will cost us jobs and raise unemployment

So far, there is no evidence that raising the minimum wage causes an increase in unemployment or job loss. In fact, in a Goldman Sachs analysis of the 13 states which have raised their minimum wage, found that “the states where the minimum wage went up had faster employment growth than the states where the minimum wage remained at its 2013 level.”

“No evidence” is a pretty strict test to have to meet. And that statement is entirely wrong:

We estimate the minimum wage’s effects on low-skilled workers’ employment and income trajectories. Our approach exploits two dimensions of the data we analyze. First, we compare workers in states that were bound by recent increases in the federal minimum wage to workers in states that were not. Second, we use 12 months of baseline data to divide low-skilled workers into a “target” group, whose baseline wage rates were directly affected, and a “within-state control” group with slightly higher baseline wage rates. Over three subsequent years, we find that binding minimum wage increases had significant, negative effects on the employment and income growth of targeted workers. Lost income reflects contributions from employment declines, increased probabilities of working without pay (i.e., an “internship” effect), and lost wage growth associated with reductions in experience accumulation. Methodologically, we show that our approach identifies targeted workers more precisely than the demographic and industrial proxies used regularly in the literature. Additionally, because we identify targeted workers on a population-wide basis, our approach is relatively well suited for extrapolating to estimates of the minimum wage’s effects on aggregate employment. Over the late 2000s, the average effective minimum wage rose by 30 percent across the United States. We estimate that these minimum wage increases reduced the national employment-to-population ratio by 0.7 percentage point.

And:

We review the burgeoning literature on the employment effects of minimum wages – in the United States and other countries – that was spurred by the new minimum wage research beginning in the early 1990s. Our review indicates that there is a wide range of existing estimates and, accordingly, a lack of consensus about the overall effects on low-wage employment of an increase in the minimum wage. However, the oft-stated assertion that recent research fails to support the traditional view that the minimum wage reduces the employment of low-wage workers is clearly incorrect. A sizable majority of the studies surveyed in this monograph give a relatively consistent (although not always statistically significant) indication of negative employment effects of minimum wages. In addition, among the papers we view as providing the most credible evidence, almost all point to negative employment effects, both for the United States as well as for many other countries. Two other important conclusions emerge from our review. First, we see very few – if any – studies that provide convincing evidence of positive employment effects of minimum wages, especially from those studies that focus on the broader groups (rather than a narrow industry) for which the competitive model predicts disemployment effects. Second, the studies that focus on the least-skilled groups provide relatively overwhelming evidence of stronger disemployment effects for these groups.

There may be evidence you’ve not seen, evidence you don’t know about, even evidence you’d prefer not to believe but the statement that there’s no evidence is simply flat out false.

The same author in another FORBES article refutes the idea that there is “no evidence” in the Card/Krugman study, in which the idea is found via Krugman:

- There’s just no evidence that raising the minimum wage costs jobs, at least when the starting point is as low as it is in modern America. — Paul Krugman

Said author slams this position well! As have I in a past posts:

(More Below Referencing This “Study”)

A N D, here is a article on the same topic via the DAILY SIGNAL:

1. It would be a job-killer.

The Congressional Budget Office report estimated that a $15 minimum wage would lead to 1.3 million lost jobs by the year 2025, with job losses rising over time due to compounding negative impacts.

The exact number of job losses are highly uncertain, but the report says losses would most likely range between zero and 3.7 million, with a not-insignificant chance that losses could exceed 3.7 million.

A 2011 Heritage Foundation estimate was even bleaker. It estimated a $15 minimum wage would lead to 7 million lost jobs.

Some groups have tried to minimize this part of the picture, focusing instead on the 17 million workers who currently earn below $15 that would receive an income boost. But this simply means that for every 13 workers who would get a wage boost, one worker would lose their job entirely.

Considering that a lost job can mean a family loses its home, not to mention a host of other long-term consequences, that doesn’t seem like a trade-off worth making.

One position is right, the other wrong. It may be the fact that most economists actually care about the poor and are not in Cris L.’s world all evil, greedy, GOP’ers… or as he put it: …”you’re going to post a portion of a book by a conservative economist…”

But the issue is not one economist, although he [Thomas Sowell], it really deals with history as most economists sift through it. Here, for example, is an article from FORBES:

…In a comprehensive, 182-page summary of the research on this subject from the last two decades, economists David Neumark (UC-Irvine) and William Wascher (Federal Reserve Board) determined that 85 percent of the best research points to a loss of jobs following a minimum wage increase.

As in any academic discipline, there are outliers. But even the outliers are problematic: For instance, the famous (or rather, infamous) New Jersey study that associated a higher minimum with increased employment was later refuted in the same academic journal that originally published it. More recently, the paper that the President relied on to make his case for a higher minimum was debunked in a study published by the National Bureau of Economic Research.

Of course, the goal of minimum wage policy is not to reduce employment, but rather poverty. Indeed, Stevenson says explicitly in her commentary that a higher minimum wage will achieve this end. But empirical evidence refutes her point. Twenty-eight states raised minimum wages in the four years prior to passage of the last federal minimum wage increase. Economists from Cornell and American Universities, writing in the Southern Economic Journal, found no associated reduction in poverty rates….

[As an aside, I have the 182-page summary {book} mentioned in the article… I tried to find it on my book shelves, but, I am afraid I moved it to a box and placed it on my stored books pallet.]

New York is a good model as well for recent examples:

…Over the past four years, the minimum wage for New York City restaurants that employ more than 10 workers went from $10.50 an hour to $15. That’s a whopping 43% increase. Next year, every restaurant, big and small, will have to pay their workers at least $15 an hour.

A big victory for workers, right? That’s how it’s depicted by the “Fight for $15” crowd. And, yes, if you held a full-time minimum-wage job over those years, your gross income would have gone up by $9,360.

But those massive wage hikes come at a painful cost that backers refuse to acknowledge. They kill jobs. Just like they’re doing right now in New York City.

In just the last three months of last year, 4,000 workers lost jobs at full-service restaurants, Bureau of Labor Statistics data show…

(IBD)

And in an article referenced in the above excerpt, we find this (via AEI):

An article in the New York Eater (“Restaurateurs Are Scrambling to Cut Service and Raise Prices After Minimum Wage Hike“) highlights some of the suffering New York City’s full-service restaurants are experiencing following the December 31, 2018 hike in the city’s minimum wage to $15 an hour, which is 15.4% higher than the $13 minimum wage a year earlier, and 36.4% higher than the $11 an hour two years ago. For example, Rosa Mexicana operates four restaurants in Manhattan and estimates the $15 mandated wage will increase their labor costs by $600,000 this year. Here’s a slice:

Now, across the city, restaurant owners and operators are reworking their budgets and operations to come up with those extra funds. Some restaurants, like Rosa Mexicano, are changing scheduling. Other restaurateurs are cutting hours and staffers, raising menu prices, and otherwise nixing costs wherever they can.

And though the new regulations are intended to benefit employees, some restaurateurs and staffers say that take home pay ends up being less due to fewer hours — or that employees face more work because there are fewer staffers per shift. The bottom line is, we have to reduce the number of hours we spend,” says Chris Westcott, Rosa Mexicano’s president and CEO. “And unfortunately that means that, in many cases, employees are earning less even though they’re making more.”

In a survey conducted by New York City Hospitality Alliance late last year, about 75% of the more than 300 respondents operating full-service restaurants reported they’ll reduce employee hours this year because of the new wage increases, while 47% said they’ll eliminate jobs in 2019.

Note also that the survey also reported that “76.50% of respondents report reducing employee hours and 36.30% eliminated jobs in 2018 in response to mandated wage increases.”…

So, to quote a “conservative” economist, Thomas Sowell, these raising wages — artificially, separate from the market — have consequences:

A majority of professional economists surveyed in Britain, Germany, Canada, Switzerland, and the United States agreed that minimum wage laws increase unemployment among low-skilled workers. Economists in France and Austria did not. However, the majority among Canadian economists was 85 percent and among American economists was 90 percent. Dozens of studies of the effects of minimum wages in the United States and dozens more studies of the effects of minimum wages in various countries in Europe, Latin America, the Caribbean, Indonesia, Canada, Australia, and New Zealand were reviewed in 2006 by two economists at the National Bureau of Economic Research. They concluded that, despite the various approaches and methods used in these studies, this literature as a whole was one “largely solidifying the conventional view that minimum wages reduce employment among low-skilled workers.”

[….]

Another group disproportionately affected by minimum wage laws are members of unpopular racial or ethnic minority groups. Indeed, minimum wage laws were once advocated explicitly because of the likelihood that such laws would reduce or eliminate the competition of particular minorities, whether they were Japanese in Canada during the 1920s or blacks in the United States and South Africa during the same era. Such expressions of overt racial discrimination were both legal and socially accepted in all three countries at that time.

Again, it is necessary to note how price is a factor even in racial discrimination. That is, surplus labor resulting from minimum wage laws makes it cheaper to discriminate against minority workers than it would be in a free market, where there is no chronic excess supply of labor. Passing up qualified minority workers in a free market means having to hire more other workers to take the jobs they were denied, and that in turn usually means either having to raise the pay to attract the additional workers or lowering the job qualifications at the existing pay level— both of which amount to the same thing economically, higher labor costs for getting a given amount of work done.

The history of black workers in the United States illustrates the point. As already noted, from the late nineteenth-century on through the middle of the twentieth century, the labor force participation rate of American blacks was slightly higher than that of American whites. In other words, blacks were just as employable at the wages they received as whites were at their very different wages. The minimum wage law changed that. Before federal minimum wage laws were instituted in the 1930s, the black unemployment rate was slightly lower than the white unemployment rate in 1930. But then followed the Davis-Bacon Act of 1931, the National Industrial Recovery Act of 1933 and the Fair Labor Standards Act of 1938— all of which imposed government-mandated minimum wages, either on a particular sector or more broadly.

The National Labor Relations Act of 1935, which promoted unionization, also tended to price black workers out of jobs, in addition to union rules that kept blacks from jobs by barring them from union membership. The National Industrial Recovery Act raised wage rates in the Southern textile industry by 70 percent in just five months and its impact nationwide was estimated to have cost blacks half a million jobs. While this Act was later declared unconstitutional by the Supreme Court, the Fair Labor Standards Act of 1938 was upheld by the High Court and became the major force establishing a national minimum wage. As already noted, the inflation of the 1940s largely nullified the effect of the Fair Labor Standards Act, until it was amended in 1950 to raise minimum wages to a level that would have some actual effect on current wages. By 1954, black unemployment rates were double those of whites and have continued to be at that level or higher. Those particularly hard hit by the resulting unemployment have been black teenage males.

Even though 1949— the year before a series of minimum wage escalations began— was a recession year, black teenage male unemployment that year was lower than it was to be at any time during the later boom years of the 1960s. The wide gap between the unemployment rates of black and white teenagers dates from the escalation of the minimum wage and the spread of its coverage in the 1950s. The usual explanations of high unemployment among black teenagers— inexperience, less education, lack of skills, racism— cannot explain their rising unemployment, since all these things were worse during the earlier period when black teenage unemployment was much lower. Taking the more normal year of 1948 as a basis for comparison, black male teenage unemployment then was less than half of what it would be at any time during the decade of the 1960s and less than one-third of what it would be in the 1970s.

Unemployment among 16 and 17-year-old black males was no higher than among white males of the same age in 1948. It was only after a series of minimum wage escalations began that black male teenage unemployment not only skyrocketed but became more than double the unemployment rates among white male teenagers. In the early twenty-first century, the unemployment rate for black teenagers exceeded 30 percent. After the American economy turned down in the wake of the housing and financial crises, unemployment among black teenagers reached 40 percent.

- Thomas Sowell, Basic Economics: A Common Sense Guide to the Economy, 4th Edition (New York, NY: Basic Books, 2011), 241; 249-251

And here is more info regarding job loss as the main reason most economists are against the minimum wage… that is because employment IS THEE most important thing to poorer people (while I quote more conservative sources… they themselves are quoting more middle of the road studies):

- Nearly 90 percent of surveyed economists believed an acceptable federal minimum wage should be less than $15 an hour. When asked what level of wage floor they would support, roughly 40 percent endorsed the current federal hourly minimum wage of $7.25 or less. And 66 percent said the minimum wage should be no higher than $10 an hour (FOX). The survey’s key findings include (PDF of survey can be found at EMPLOYMENT POLICIES INSTITUTE):

- 74 percent oppose raising the federal minimum wage to $15 an hour;

- 84 percent believe a $15 minimum wage will have negative effects on youth employment;

- Two-thirds of economists (66 percent) believe that an appropriate federal minimum wage is $10 an hour or less;

- Just six percent believe a $15 minimum wage is a very efficient means to target individuals in poverty, while 64 percent said the same thing about the Earned Income Tax Credit (EITC).

- The nonpartisan Congressional Budget Office said Monday that raising the federal minimum wage to $15 an hour, up from the current rate of $7.25 a hour, would likely cause 1.3 million people to lose their jobs. (WASHINGTON EXAMINER)

- Economists aren’t certain about many things, but on the minimum wage, nearly all of them (90 percent, according to one survey) believe that the case is open and shut. All else being equal, if you raise the price of something (for instance, labor), then the demand for it (for instance, by employers) will decline. That’s not just a theory; it’s a law. (James Glassman, “Don’t Raise the Minimum Wage,” Washington Post [Feb 24, 1998]

- …percentage of economists who agree…. A minimum wage increases unemployment among young and unskilled workers. (79%) (Robert M. Beren, Professor of Economics at Harvard University ~ [More: WINTERY KNIGHT])

These specialists are not promoting “a narrative,” but displaying historical consequences as common sense economic laws.

Another Real World Example

See another post where the “Billingsley” example is used: TAX THE RICH (Plus: CEO Pay vs. Worker Pay)

My statement still stands in response to keeping people off the government doll: