With economic pundits predicting disaster over the horizon for the Trump economy, Larry decides to compare the doom and gloom to the months prior to the 1992 presidential election, which propelled Bill Clinton to the presidency. Just what were the pundits saying leading up to that election, and what were they saying directly afterwards? How does this parallel the leadup to 2020? Larry answers all these questions and more. He also gives us a peak into a lucrative career path he decided to pass up, despite his obvious talent.

IBD

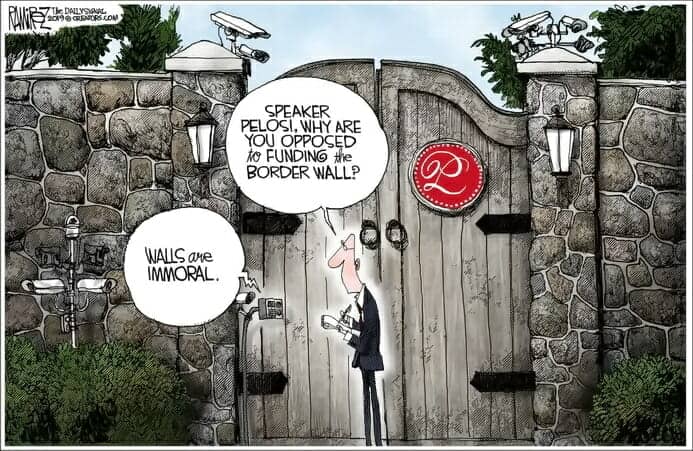

Crisis? Or No Crisis?

Here is a list of Democrats who said there was a “border crisis” before they said there wasn’t — via TOWNHALL

INVESTORS BUSINESS DAILY has a great article on the border topic:

…Border Crossings Climbing

NPR’s “fact check” — like countless others — dismissed Trump’s claim as false because “illegal border crossings in the most recent fiscal year (ending in September 2018) were actually lower than in either 2016 or 2014.”

What they aren’t telling you is border patrol agents apprehended more than 100,000 people trying to enter the country illegally in just October and November of last year. Or that that number is way up from the same two months the year before.

Nor do they mention that last year, the border patrol apprehended more than half a million people trying to get into the country illegally. And that number, too, is up from the year before.

Downplaying Number Of Illegals

Trump’s critics certainly don’t bother to mention that those figures only count illegals the border patrol caught. It does not count the ones who eluded border patrol agents and got into the country.

The Department of Homeland Security claims that about 20% of illegal border crossers make it into the country. Other studies, however, say border agents fail to apprehend as much as 50% of illegal crossers.

Even at the lower percentage, that means that 104,000 illegals made it into the country in 2018 alone.

Is that not a crisis at the border?

Massive Illegal Population

Pelosi and company also don’t bother to mention the fact that there are already between 12 million and 22 million illegals — depending on which study you use — in the country today.

Let’s put that number in perspective.

At the high end, it means that the illegal population in the U.S. is larger than the entire population of countries like Syria, Chile, the Netherlands and Ecuador. Even if the number is just 12 million, that’s still more than the entire population of Sweden, Switzerland, Hong Kong, Denmark, Finland, Norway, Ireland and New Zealand.

It is, in short, a massive number.

[….]

Illegals and Crime

Critics also complain that Trump overstated the risk of illegal immigrants committing crimes. They all point to a report from the Cato Institute, a pro-immigration libertarian think tank. Cato did a statistical analysis of census data and concluded that incarceration rates for Hispanic illegals were slightly lower than those of the native-born.

But the Center for Immigration Studies looked at federal crime statistics. It found that noncitizens accounted for more than 20% of federal convictions, even though they make up just 8.4% of the population.

“It is almost certain that a majority of noncitizens convicted of federal crimes are illegal immigrants,” said Steven Camarota of the CIS.

Texas also has been monitoring crimes committed by illegals. It reports that from 2011 to 2018, it booked 186,000 illegal aliens. Police charged them with a total of 292,000 crimes. Those included 539 murders, 32,000 assaults, 3,426 sexual assaults, and almost 3,000 weapons charges.

Even if Cato is right that the crime rate among Hispanic illegals is a bit lower than for natives, that’s cold comfort to victims of these crimes, which would not have happened had the border been more secure. They would likely agree with Trump about their being a crisis at the border…..

The Continued Call for Violence from the Left (UPDATED)

See a previous post regarding a deeper look at the issue, HERE. BTW, he looks like the creepy old man from Poltergeist.

….Mr. Reiner’s comments came less than two weeks after 66-year-old gunman James T. Hodgkinson shot House Majority Whip Steve Scalise and three others on an Alexandria, Virginia, baseball field. Mr. Hodgkinson, a former volunteer for Vermont Sen. Bernie Sanders’ presidential campaign, died after a shootout with cops during the attack on congressional Republicans.

“Maybe wait a few months past the last time someone on your team tried to assassinate a congressman before calling for ‘all-out war,’ ” National Review’s Kevin Williamson responded, The Blaze reported.

INVESTORS BUSINESS DAILY shows why the political landscape will be anything but civil:

For a brief moment after Rep. Steve Scalise was nearly killed by a crazed Bernie Sanders supporter, some prominent liberals uttered a few words about “toning down the rhetoric.” If that pledge was sincere at all, it barely lasted a week.

Actor JOHNNY DEPP took the prize last week, when at a film festival in England he asked, “Can we bring Trump here,” and followed that by asking “When was the last time an actor assassinated a president?” The audience roared with cheers and laughter.

Depp later “apologized,” saying it was a “bad joke” that “did not come out as intended.”

But Depp was hardly the only one to go back to using extreme, violent, incendiary rhetoric to talk about Republicans.

Earlier in the week, the head of the Nebraska Democrats. Jane Kleeb, ousted a party official after he was caught on tape wishing Scalise had died.

“I’m glad he got shot,” said volunteer co-chair of the state party’s technology committee PHIL MONTAG. “I’m not gonna (expletive) say that in public.”

“Well then what are you saying it to us for?” someone else in the recording asks.

“I wish he was (expletive) dead,” Montag replies.

In Ohio, police arrested 68-year-old E. STANLEY HOFF after he left a voice mail for Rep. Steve Stivers saying that “We’re coming to get every goddamn one of you and your families. Maybe the next one taken down will be your daughter. Huh? Or your wife. Or even you.”

JOSEPH LYNN PICKETT of Illinois was charged with threatening Trump on Facebook, after posting that “the secret service now has a heads up as to my plan to assassinate Trump … let’s see if they act.”

The left’s reaction to the relatively modest Senate health reform bill made it abundantly clear that their rhetoric continues to be unhinged.

JOSH FOX, the director of the documentary about fracking — “Gasland” — sent a tweet in which he called Mitch McConnell and President Trump terrorists and proclaimed that the Senate health reform bill “sentences poor people to death.”

Late night talk show host SETH MEYERS called the bill “breathtakingly cruel.”

Harvard professor DAVID CUTLER tweeted that “GOP congress may never again get a chance to kill so many people. Could rival the Iraq War in its total.”

Sen. BERNIE SANDERS sent a tweet saying that the GOP bill “could kill up to 27,000 in 2026 so they can give tax cuts to the wealthy.”

Sen. ELIZABETH WARREN tweeted that the Senate bill “is blood money. They’re paying for tax cuts with American lives.”

Sanders later deleted his tweet, but Warren’s is still there.

And BARACK OBAMA, in a Facebook post in which he starts by saying how we need “to listen to Americans with whom we disagree,” couldn’t resists the urge to decry the “fundamental meanness” of the Senate bill.

All of this reads like an open invitation to commit actual acts of violence against Republicans…..

YUGE Tax Cuts (Dennis Prager)

Dennis Prager reads from an IBD ARTICLE about the benefits from Trump’s tax plan… AS WELL AS starting out the show by showing the ludicrous nature of the envious Left. I include a dissenting call to end the upload.

GAY PATRIOT has some key bullet points:

- Slightly lower personal income tax rates. (Top rate from near-40% to 35%.)

- Eliminating almost all income tax deductions, except mortgage interest and charitable contributions.

- Much lower corporate income tax rates. (Top rate from 35%, one of the world’s highest, to 15%.)

- A one-time tax on overseas business profits. (That haven’t been repatriated to the U.S. Apple has a lot.)

- A “territorial system” where future profits that corporations earn abroad, are not taxed.

- Repealing a bunch of taxes and complications, most notably the Alternative Minimum Tax (AMT) and the estate tax.

Here is an excerpt from the article mentioned:

President Trump’s tax plan, unveiled on Thursday, slashes the corporate tax rate from a top rate of nearly 50% to 15%. It’s a smart move. Not only will it kick start the economy and job growth, but it’s likely he’ll be able to get bipartisan support.

Right now, there is no consensus on broad-based tax reform. So, at least for now, a broad tax reform package including tax cuts, fewer deductions and a flattening of tax rates may be tough to achieve. Even Republicans, who are eager for some kind reform, remain split on how it should be done.

But nearly everyone agrees that the current U.S. corporate tax rate is outrageous.

Sadly, average Americans often don’t agree. They believe that corporations pay no taxes. But that’s not true. U.S. corporations pay a top marginal rate of close to 40%, compared to an average of about 24% for all the OECD nations.

That puts U.S. companies at a tremendous disadvantage to other nations’ companies and reduces the money they have available for investing and hiring new workers.

We don’t know what else Trump’s tax reform will contain, but just cutting corporate taxes would be a big winner. Even President Obama supported the idea in 2015, when he and congressional Democrats were considering a deal that would cut corporate tax rates in exchange for spending more on infrastructure.

But apart from Washington political wrangling, the economic reasons for a corporate tax cut are even more compelling.

Back in 2015, the nonpartisan Tax Foundation ran the numbers and concluded that cutting the corporate rate to 15% would boost GDP by 3.7% and actually increase federal revenues by 0.3%.

More importantly, it would be a huge boon to working Americans: “Depending on the size of the corporate rate reduction, we would expect to see an additional 425,000 to 613,000 new jobs, and wages would increase between 1.9% and 3.6% over the long-term.”

That means higher after-tax incomes for all. Talk about a stagnation-buster. That’s a recipe for 3% plus annual GDP growth, something that never happened during the Obama years. The plan that was Trump unveiled Thursday said that one of the goals of tax reform was to “grow the economy and create millions of jobs.”

[….]

Nor is this a “tax cut for the rich,” as some have claimed.

As IBD noted last September, the “dirty little secret” of corporate taxes is that corporations don’t actually even pay them. Average Americans — that’s you — do. You pay it through lower wages, lower returns on investments and retirement accounts, and higher prices for the things you buy.

A study last year by The R Street Institute noted that “some studies suggest that as much as three-fourths of direct corporate income-tax costs are borne by a firm’s workers.”

High corporate tax rates are also why many big American companies are undergoing “inversions” — merging into a foreign company, then relocating their headquarters to the foreign country to avoid super-high U.S. taxes.

In short, our excessively high corporate tax rate does nothing good for the economy, for investors or for workers. While 15% is a very good rate, it would be better to get rid of it entirely….

Three Largest Muslim Advocacy Groups (ISNA,NAIT,CAIR) Have Ties To Terror~Kudos to Judge Solis

IBD Reports on a Federal Judges report and makes mention that “He refused requests to strike their names from the list.” Which tells me he was under pressure to xix these connections.

Islamofascism: Now that a federal judge has unsealed evidence showing the three most prominent Muslim groups in America support terror, Washington must cut all ties with them.

U.S. District Judge Jorge Solis has ruled there is “ample evidence” to support the Justice Department’s decision to blacklist the Islamic Society of North America (ISNA), the North American Islamic Trust (NAIT) and the Council on American-Islamic Relations (CAIR) as unindicted co-conspirators in the 2008 Holy Land Foundation terror trial.

He refused requests to strike their names from the list.

At the trial, which ended in guilty verdicts on all 108 counts, FBI agents testified that ISNA, NAIT and CAIR are fronts for the federally designated terrorist group Hamas, which has murdered countless Israelis and at least 17 Americans.

Indianapolis-based ISNA controls most of the Islamic centers and schools in the country through its NAIT subsidiary — a Saudi-funded trust that holds title to radical mosques, including the notorious 9/11 mosque in D.C. CAIR, headquartered within three blocks of the U.S. Capitol, is the nation’s largest Muslim-rights group. The trio for years have maintained they are “moderate” nonprofits that condemn terrorism.

However, “The government has produced ample evidence to establish the associations of CAIR, ISNA and NAIT with Hamas,” Solis said in his 20-page ruling, written in July 2009 and unsealed just last Friday.

Solis noted that investigators have traced “hundreds of thousands of dollars” from ISNA and NAIT bank accounts to Hamas suicide bombers and their families in Gaza and the West Bank.

He said CAIR also took part “in a conspiracy to support Hamas.” Phone lists and other documents introduced by the government reveal CAIR and its founding chairman Omar Ahmad have operated as key members of Hamas’ U.S. wing, known as the “Palestine Committee,” according to the ruling.

FBI wiretaps and agent testimony also placed both Ahmad and CAIR’s acting executive director — Nihad Awad — at a secret meeting held last decade with Hamas leaders in Philadelphia.

In a hotel room, participants hatched a scheme to disguise payments to Hamas suicide bombers and their families as charity. ISNA also was mentioned at the meeting.

You might ask, so what? Well, the radicals in this country aren’t the fringe; they represent the Muslim establishment.

Outrageously, these dangerous fronts, cloaked as they are in religious garb, still enjoy charitable tax status. The IRS exempts their funding, much of which comes from the Middle East.

More Job Killing Policies Put Forward By Democrats-which points to the importance of winning in 2010 and 2012

A new study warns that a value-added tax would kill 850,000 jobs in a year and cut retail spending by $2.5 trillion over 10 years. Sounds too bad for Washington to pass up.

An analysis for the National Retail Federation by Ernst & Young finds that adding a VAT to the U.S. tax system would reduce GDP for years, causing the loss of “850,000 jobs in the first year,” plus “700,000 fewer jobs 10 years later.”

If you are not aware of what the Value Added tax is (VAT), Dick Army explains it a bit:

….“But, I always believed that when the Democrats got the majority in both the House and the Senate – and I’ve told this to people for years – when they get the House and the Senate and the White House, they’re going to add a Value Added Tax to the existing income tax,” said Armey.

“It’s not going to be a VAT instead of – it’s in addition to, and, of course, they are doing exactly what I predicted. Why? Because they’ve got gluttonous spending habits, and they want to spend more, and they need to raise money to do it, and they can’t raise the money out in front of God and everybody for the taxpayer to recognize what they’re doing,” he said.

“So they are looking at that best instrument to hide the tax from the taxpayer. And that’s why the VAT tax is attractive. The VAT tax has never been attractive to anybody except tax leviers,” Armey added.

The VAT is a general sales tax added to the price of goods and services at each step of production whenever value is added to those goods and services. According to the Tax Policy Center, the VAT was first imposed by France in 1948 and then by the European Community (EC) in 1968. To date, over 100 countries impose some form of a VAT except Australia and the United States.

…(read more)…

VAT is a good idea (flat tax is the best) if you abolish the income and state taxes all-together. But the Democrats want to add this tax ON TO the already existing tax matrix, thus, hurting the poor the most. Charles Krauthammer has been saying almost immediately after liberal-care (Obama-care) passed. Here is his article on the issue:

…We are now $8 trillion in debt. The Congressional Budget Office projects that another $12 trillion will be added over the next decade. Obamacare, when stripped of its budgetary gimmicks — the unfunded $200 billion–plus doctor fix, the double-counting of Medicare cuts, the ten-six sleight-of-hand (counting ten years of revenue and only six years of outflows) — is, at minimum, a $2 trillion new entitlement.

It will vastly increase the debt. But even if it were deficit-neutral, Obamacare would still pre-empt and appropriate for itself the best and easiest means of reducing the existing deficit. Obamacare’s $500 billion of Medicare cuts and $600 billion in tax hikes are no longer available for deficit reduction. They are siphoned off for the new entitlement of insuring the uninsured.

This is fiscally disastrous because, as President Obama himself explained last year in unveiling his grand transformational policies, our unsustainable fiscal path requires control of entitlement spending, the most ruinous of which is out-of-control health-care costs.

[….]

What will it recommend? What can it recommend? Sure, Social Security can be trimmed by raising the retirement age, introducing means testing, and changing the indexing formula from wage growth to price inflation.

But this won’t be nearly enough. As Obama has repeatedly insisted, the real money is in health-care costs — which are now locked in place by the new Obamacare mandates.

That’s where the value-added tax comes in. For the politician, it has the virtue of expediency: People are used to sales taxes, and this one produces a river of revenue. Every 1 percent of VAT would yield up to $1 trillion a decade (depending on what you exclude — if you exempt food, for example, the yield would be more like $900 billion).

It’s the ultimate cash cow. Obama will need it. By introducing universal health care, he has pulled off the largest expansion of the welfare state in four decades. And the most expensive. Which is why all of the European Union has the VAT. Huge VATs. Germany: 19 percent. France and Italy: 20 percent. Most of Scandinavia: 25 percent.

[….]

Ultimately, even that won’t be enough. As the population ages and health care becomes increasingly expensive, the only way to avoid fiscal ruin (as Britain, for example, has discovered) is health-care rationing.

It will take a while to break the American populace to that idea. In the meantime, get ready for the VAT. Or start fighting it.