Via AUTOMOTIVE REVIEWS:

VIDEO DESCRIPTION:

In this episode, we uncover the shocking story of Lucas Turner, who faced a staggering $20,000 bill for a hybrid battery replacement in his used car. The key takeaway: buyers must prioritize pre-purchase inspections for hybrid and electric vehicles to avoid unexpected expenses.

We discuss the discrepancy in replacement costs, the importance of understanding warranty limitations, and the need for consumers to research alternative sources for more budget-friendly options. This cautionary tale serves as a reminder for listeners to stay informed and prepared for potential challenges in the world of hybrid and electric car ownership. Drive safely!

Here is an update [of sorts] to EV costs and normal repair costs, and the faltering sales of EVs as people realize they are shite! But first, because I use some sites that I do not recommend wholeheartedly, I feel the need to preface this post:

BTW, even though I go to this it, I do not recommend it – Liberty Daily. Having been immersed in the conspiratorial view of history for years, I know what red flags to look for. The owner/contributors are big Alex Jones fans… and Alex is a disgrace to real news. What I tell my boys is “if you find a story that goes back to Prison Planet, Infowars, or Alex Jones in any way. Don’t use it. Find other sources for the article or news piece.

All that said, there are links below that I have not checked out in full. I can say that Discern Report is another shite site, but like Liberty Daily, there are topics and stories that are good and do not get into bat-shit-crazy stuff and are useful info for the reader. That said, enjoy the critique I pull together here by others hard work… this is a good post to branch out from. Here is my canned response for when I post stuff on Facebook:

- While I like their rants (Paul Watson, Mark Dice, and others) and these commentaries hold much truth in them, I do wish to caution you… he is part of Info Wars/Prison Planet and Summit News network of yahoos, a crazy conspiracy arm of Alex Jones shite. Also, I bet if I talked to him he would reveal some pretty-crazy conspiratorial beliefs that would naturally undermine and be at-odds-with some of his rants. Just to be clear, I do not endorse these people or orgs.

I will offer red ![]() marks to designate which sites deal in conspiracy issues in other arenas of politics. I will throw in an “I don’t know guy 🤷♂️for sites that I haven’t checked out. No marks mean the site is just about oil/fossil fuel outlooks, the automotive industry, etc, or political sites I trust.

marks to designate which sites deal in conspiracy issues in other arenas of politics. I will throw in an “I don’t know guy 🤷♂️for sites that I haven’t checked out. No marks mean the site is just about oil/fossil fuel outlooks, the automotive industry, etc, or political sites I trust.

Okay, the EV “revolution” is meeting the free market… and even with the attempt to route the market through legislations and tax-payer funded incentives, people are not having it. So at some point he car manufacturers and dealers will have to bow to what the consumer wants, or else face bankruptcy. Legislation is another issue, government will have to physically enforce these failed policies… which… if you are a student of history, is not that far-fetched.

This story has surely changed to include more disgruntled EV buyers: 1 in 5 EV Buyers Switch Back to Gas-Powered Cars: Study (THE DRIVE | Apr 30, 2021) And this story about costs of repairs and downtime of the customers car doesn’t help the outcomes either: Repair costs, turnaround times higher for EVs. This is all factoring into decisions such as these three stories:

Only Half of All Ford Dealers Agree to Sell EVs Next Year

Ford said on Thursday that half of all 1,550 Ford dealers chose to sell electric vehicles in 2024—down from two-thirds that said this time last year that they would opt in to sell EVs for 2023.

The other half of Ford dealers will sell—and service—ICE and hybrid models. “EV adoption rates vary across the country, and we believe our dealers know their market best,” Ford spokesman Martin Günsberg told the Detroit Free Press. …

There is a very mature statement by corporate! “we believe our dealers know their market best” Amen! Buick, on the other hand, is not so intelligent as to understand the market. And I assume that corporate is just wanting the hand-outs from the Feds for such changes (BREITBART):

According to GM, almost 1,000 of its nearly 2,000 Buick dealerships across the U.S. chose to take buyouts from the parent company rather than investing potentially millions into retooling and prepping dealers to service and sell EVs.

The buyouts mean that GM will now have just about 1,000 Buick dealerships across the nation as the automaker moves forward with adhering to President Joe Biden’s green energy agenda.

The Wall Street Journal reports:

Dealers who are taking the buyout would give up the Buick franchise and no longer sell the brand, he said. The dealer can continue to sell other GM models, such as Chevrolet or GMC, that often account for a higher percentage of sales. [Emphasis added]

The Journal reported in late 2022 that the automaker planned to offer buyouts to its U.S. Buick dealer network. The move came after the Detroit automaker gave them a choice: Invest at least $300,000 to sell and service EVs, or exit the Buick franchise. The investments would cover electric-vehicle chargers and worker training, among other initiatives. [Emphasis added]

The move comes as U.S. car dealers are so concerned with EV sales that they are urging Biden to abandon his EV mandates and carbon emission regulations that would effectively force all-electric cars on consumers.

“The reality, however, is that electric vehicle demand today is not keeping up with the large influx of [EVs] arriving at our dealerships prompted by the current regulations. [EVs] are stacking up on our lots,” the car dealers write:

With each passing day, it becomes more apparent that this attempted electric vehicle mandate is unrealistic based on current and forecasted customer demand. Already, electric vehicles are stacking up on our lots which is our best indicator of customer demand in the marketplace. [Emphasis added]

At the same time, a bombshell Consumer Reports survey recently revealed that EVs spur nearly 80 percent more problems for car owners than gas-powered cars using traditional combustion engines.

So, Democrats wax-long about being for the little guy, the small business, and the like. But their policies push the little guy into going out of business or selling to the large corporation. But some companies do see the warning of the market and respond to it. Audi for one, is reading the tea-leaves properly (🤷♂️ SLAY NEWS):

German automaker Audi has announced that it is slashing production of electric vehicles (EVs) and halted future plans as demand for the products has plummeted.

Audi, which is owned by auto giant Volkswagen, revealed that demand for expensive EVs has now fizzled as consumers are put off by high prices and poor infrastructure.

The company says consumers are instead choosing gas-powered vehicles.

As Slay News has reported, car and truck dealers across America have been warning that their lots are stacking up with EVs that they can’t sell.

Thousands of American auto dealers have signed a letter to Joe Biden, urging the Democrat president to scrap his electric vehicle (EV) mandate….

So, here is a good article by a site I do not recommend as a whole… but this article excerpt is decent (![]() LIBERTY DAILY):

LIBERTY DAILY):

The “Electric Vehicle Revolution” Is DOA

In the early days of the push for electric vehicles to replace gas-powered vehicles, they were novelties used for virtue signaling. As the push from government leftists ramped up quickly, millions worldwide jumped onboard willingly or reluctantly as it appeared that an EV future was inevitable.

Now that the market has matured, challenges are evident. Electric vehicles are unreliable. They are expensive to repair. The infrastructure to power them is insufficient today even though they only make up a tiny percentage of what’s on the road. Behind all of these roadblocks is an underlying reality: Far fewer people are joining the climate change cult than the powers-that-be had hoped.

Force-feeding us through regulations, incentives, and massive ESG bullying campaigns have failed miserably. Now, the chickens are coming home to roost for a fearmongering industry that couldn’t deliver on any of their promises. Is the “Electric Vehicle Revolution” dying?

No. It was dead before it got here.

Audi is joining U.S. automakers in slashing production of EVs. On the retail side, Ford dealers are backing away from even offering EVs. Reports of coming challenges for EV drivers are making the Christmas news cycle. This isn’t the future that climate change cultists were promised and it’s impacting faith in the movement.

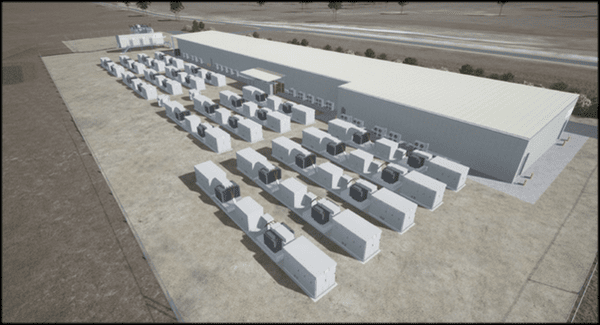

Below is an article highlighting the worst indicator of them all: Lack of used EV enthusiasm. Vehicles with staying power enjoy popularity through all stages of existence. They sell well when they’re bought or leased new. They then sell well again as program vehicles, certified pre-owned, or plain old used cars. Some, particular trucks, enjoy extended usefulness as owners sink money and effort into keeping them on the roads for decades. With EVs, none of those scenarios are panning out. The results have been predictable as EV graveyards have started popping up across the western world. Here is the article generated from corporate media reports by Discern Reporter…

More from JUST THE NEWS:

Half of Ford and Buick dealers balk at investing in EVs, citing high costs, underperforming sales

Experts say that automakers and the federal government grossly overestimated consumer interest in the vehicles. “The government can’t really dictate everything it wants to dictate to the market. Seems to me we have to learn this lesson in the United States every 10 to 20 years,” said energy writer and analyst David Blackmon.

…..Energy expert Robert Bryce has been documenting Ford’s losses on its EV lines over the past year. In the third quarter of this year, the company lost $62,016 for each of the 20,962 EVs it sold during the period. It was an improvement over second quarter losses, Bryce wrote, which were more than $70,000 for each EV it sold.

Despite the hits Ford took on its EV lines, Ford posted Q3 net income of $1.2 billion compared to an $827 million loss in the same quarter in 2022. The profit was the result of strong outcomes in its Ford Blue line, which includes gas-powered and hybrid vehicles, which are vehicles that have a gas engine that can power the car or charge the vehicle’s battery. Some of the cars in that are designed to attract sports car enthusiasts and others who want high-performance vehicles…..

FLASHBACK: