(UPDATED)

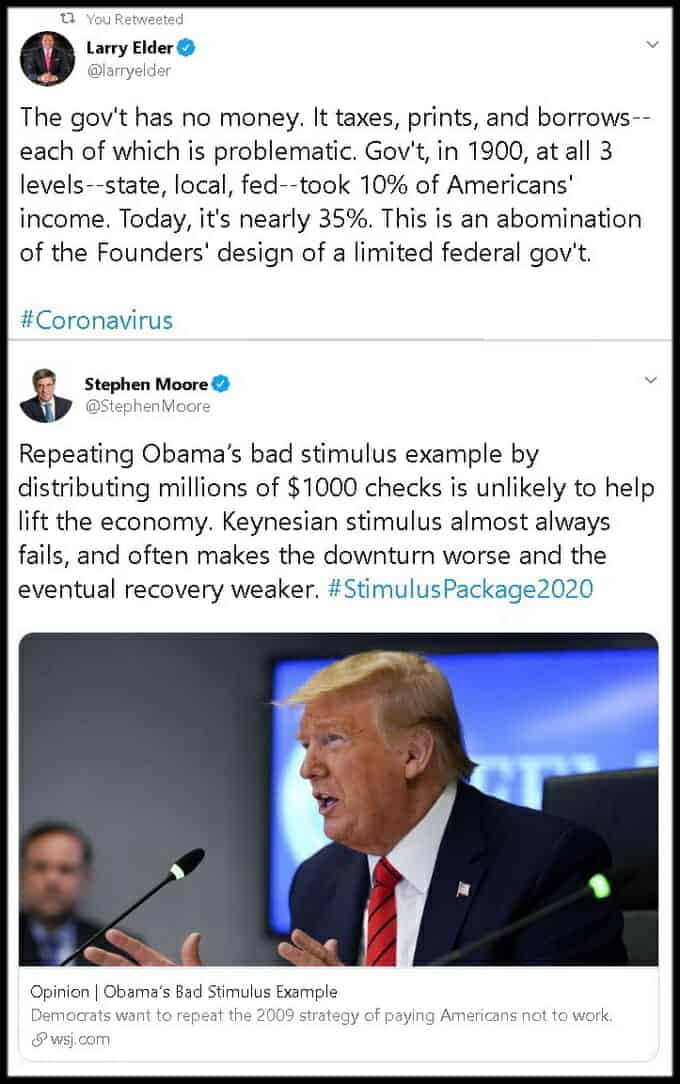

We’re supposed to be the United States of America. But in many ways, we’re now divided into two very different nations: red states and blue states. Which ones are succeeding? Which ones are failing? And why? To answer these questions, economist Stephen Moore compares them side-by-side.

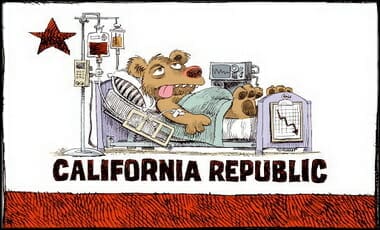

Why are millions of people leaving California and moving to other states? What do those states have that California doesn’t? PragerU’s first mini-documentary explores the root causes of this mass exodus from the Golden State. “Fleeing California,” featuring PragerU’s own Will Witt, sheds light on one of the most significant but underreported stories of our time.

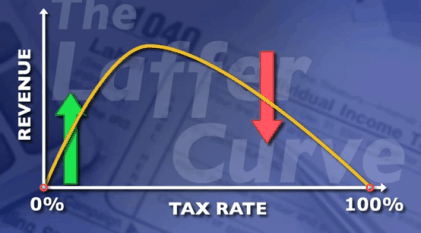

Dave Rubin of The Rubin Report talks to Bryan Callen (Actor, Comedian, Podcaster) about Americans desire for Socialism, the ignoring of black conservatives who don’t think what they’re supposed to and if leaving California is what all Los Angeles residents should consider. Bryan talks about whether leaving California or staying and fighting is the best option. Under the leadership of people like Governor Gavin Newsom and Los Angeles Mayor Eric Garcetti he has seen the homeless encampments near his home in Venice grow year after year while the state income tax goes higher and higher. Is fleeing California and their high taxes to move to Texas or Florida the only option left to escape California’s inevitable financial crisis from it’s wasteful spending, and endless chants of “tax the rich”? (FULL INTERVIEW HERE)

kkkkkkkkkkkkkkkkk

kkkkkkkkkkkkkkkkk

It used to be the California Dream. Now, it’s the California nightmare. That was basic.

In case you haven’t heard, a TON of people are fleeing California. You can’t blame them. We’ll get into all the reasons why later, but the overall theme here is – California kinda sucks now.

A total of 691,321 people moved from California to another state last year. That’s more than the whole state of Wyoming – every single year!

And that was more than the previous year. It’s like a damn breaking and all the California people are spilling out all over the place.

Sure, there are a lot of people moving here, too. About a half million people decided to move to California last year, for whatever reason I don’t know. Maybe cause it’s warmer? Or for a job maybe.

Anyways, the negative migration was the 9th year in a row for California. There are only a handful of other states that can claim that.

(You can find more on my YouTube about California’s woes) California is the one of the most beautiful states in the union, however, its high taxes, excessive regulations on business, high cost of living, and out of control housing market has forced much of the middle class to move to other states. We show the stats of why people are leaving in droves out of CA and show where they are going through in this documentary of The Golden State.

A followup video to our “Leaving California,” above.

hhhhhhhhhhhhhhhhhhhhhh

ppppppppppp

ppppppppppppp

BONUS: The Salton Sea

What happened to the Salton Sea in California? In my first travel documentary about this strange yet fascinating place in California’s Imperial Valley, I explore the sea and surrounding communities of Bombay Beach, Slab City, East Jesus, and Salton City. The area was also the inspiration for the fictional desert town of Sandy Shores which appears in the popular video game Grand Theft Auto V and Grand Theft Auto Online. In the game, Trevor Philips acquires a small landing strip in the area which may be in reference to the Salton City airport. I encourage you to read more about the lake’s history and the current ecological crisis it has become. You can find an interesting article written by Ian James and Sammy Roth on USA Today here: THE DYING SALTON SEA