There is a law in economics, it deals with artificially propping up businesses, “goods” politicians deem necessary, production, etc. George Gilder notes this in a clip I isolated in an interview:

- “A fundamental principle of information theory is that you can’t guarantee outcomes… in order for an experiment to yield knowledge, it has to be able to fail. If you have guaranteed experiments, you have zero knowledge”

R-PT’s note: this is how the USSR ended up with warehouses FULL of “widgets” (things made that it could not use or people did not want) no one needed in the real world. This economic law enforcers George Gilder’s contention that when government supports a venture from failing, no information is gained in knowing if the program actually works. Only the free-market can do this.

This applies to the real world in many ways, one being the co$t of college. Here is a very short video explaining this well:

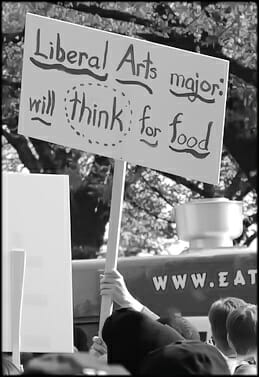

OF course, one of my favorite videos of ALL TIME shows how students “benefit” from a subsidizing of college majors when in reality if they had to pay for college themselves it would be (a) cheaper, and (b) they would go into careers other than their majors… like sign flippers and bartenders (or other fields that are hurting):

The great conundrum of the U.S. economy today is that we have record numbers of working age people out of the labor force at the same time we have businesses desperately trying to find workers. As an example, the American Transportation Research Institute estimates there are 30,000 – 35,000 trucker jobs that could be filled tomorrow if workers would take these jobs–a shortage that could rise to 240,000 by 2022.

While the jobs market overall remains weak, demand is high for in certain sectors. For skilled and reliable mechanics, welders, engineers, electricians, plumbers, computer technicians, and nurses, jobs are plentiful; one can often find a job in 48 hours. As Bob Funk, the president of Express Services, which matches almost one-half million temporary workers with employers each year, “If you have a useful skill, we can find you a job. But too many are graduating from high school and college without any skills at all.”

The lesson, to play off of the famous Waylon Jennings song: Momma don’t let your babies grow up to be philosophy majors.

[….]

Kids commonly graduate from four year colleges with $100,000 of debt and little vocational training. A liberal arts education is valuable, but it should come paired with some practical skills.

Third, negative attitudes toward “blue collar” work. I’ve talked to parents who say they are disappointed if their kids want to become a craftsman–instead of going to college.This attitude discourages kids from learning how to make things, which contributes to sector-specific worker shortages….

(HERITAGE)

(For full disclosure, my degree — theology — is one of the lowest paying degrees out there, and the lowest in employment opportunities.) In a short debate of the issue, Peter Schiff notes this “propping up” of useless degrees:

In the above discussion, Diana Carew seems to want jobs created by the government to fit the degrees earned. Otherwise, how would you force the private sector to create such opportunities unless you artificially demand [create] such opportunities? ~ There was zero unemployment in Soviet Russia, but all this “opportunity” collapsed due to economic laws… “this is how the USSR ended up with warehouses FULL of “widgets” (things made that it could not use or people did not want) no one needed in the real world. This economic law enforcers George Gilder’s contention that when government supports a venture from failing, no information is gained in knowing if the program actually works. Only the free-market can do this.” (Peter Schiff gets into the weeds a bit in this video.)

Here is another great PRAGER U video discussing the issue:

This is one of the areas Gary Johnson was correct — supply and demand:

FORBES notes well that most on the Left-end of the spectrum “don’t hate entrepreneurship and innovation,” but that their Econ 101 “part of the brain that deals with economics tends to shut down when discussing sectors like higher education (or healthcare).”

A WASHINGTON FREE BEACON post relates findings from a Federal Reserve Bank (NY) study showing that the federal student loans have increased the cost of college tuition while at the same time college enrollment did not increase:

The expansion of federal student loans has caused tuition prices to increase without increasing college enrollment numbers, according to a report from the Federal Reserve Bank of New York.

The report evaluated student financial data as well as federal student aid programs “to identify the impact of increased student loan funding on tuition.”

According to the report, yearly student loan originations grew from $53 billion to $120 billion between 2001 and 2012, an increase of about 126 percent. During this time frame, average sticker-price tuition nearly doubled, rising from $6,950 to $10,200 in constant 2012 dollars.

The report found that for each dollar of federal aid applied, tuition increased as well.

“We find that each additional Pell Grant dollar to an institution leads to a roughly 55 cent increase in sticker price tuition,” the report says. “For subsidized loans, we find a somewhat larger passthrough effect of about 70 percent.”

[….]

The report makes reference to a hypothesis put forth by William Bennett, the Reagan-era secretary of education. The so-called “Bennett Hypothesis” holds that “increases in financial aid in recent years have enabled colleges and universities blithely to raise their tuitions, confident that federal loan subsidies would help cushion the increase.”

Many have compared the market for postsecondary education to the housing market…. [see video at the top]

Which brings me to finish this post with a humorous look at the hipster douche-bags scratching his or her head in regard to high tuition costs via REASON-TV:

POST-SCRIPT

In an article entitled, Why Is College Tuition Rising So Much? And What Can You Do?, that updates some of the numbers we are dealing with, I found this part sad (and I include myself in this paradox), because often times the young person takes as much money as they can get for the semester rather than get the bare minimum and subsidize the rest with income from work. (Editor’s note: this in part delays adulthood and why matters important to our body politic being expressed in an elementary way at the college level.) Here is the section:

As of 2015, there was over $180 billion in available financial aid for undergraduates. Of that, 67% was in federal grants and loans.

While federal aid has been valuable to those who otherwise would not be able to afford higher education, it has created something of a paradox.

Students accept whatever aid they can get, potentially failing to weigh the long-term financial risk once they earn that degree. The thinking goes that the debt will get paid back in time once they get a well-paying job.

The higher institutions, for their part, understand that with someone else footing the bill, they have very little accountability to the student to keep their costs in line. The institution will get paid no matter their tuition and fees.

Once that student does graduate, the burden becomes theirs.

It’s a heavy one too.

Currently, student loan debt in the U.S. is close to exceeding $1.5 trillion dollars.

Compare that to the over $750 billion owed in credit cards.

Wow.

Mary Bromley, the articles author, while making some good points didn’t include the idea that getting liberal arts degrees is not prepping the student for the shift towards technological needs for the future, nor did she deal with getting degrees that are actually useful in the real world environment. Mind you, that wasn’t the main idea or push of the article and may be a good “part deux,” but one of the main reasons tuition has risen IS BECAUSE the Federal Government is involved… practical ways to keep costs down that are in the article aside.

Likewise, automation (“robots”) will increasingly replace people in a “growing number of jobs, the skills employers are now looking for are technical skills.” But that doesn’t mean people will lose work over the issue, it means that society as a whole will need to change their focus to more technologically minded degrees. Frank Roberts in an earlier article continues:

What specific skills those might be will depend on the specific job you are looking at.

But, basically those skills would include

- Computer skills

- Problem Solving Skills

- Communication Skills

- Finance Skills

- Business Skills

- Science Skills

[In the article much is made of jobs being filled by persons holding bachelor degrees, but, that may merely be a reflection of the over supply of degrees. It should be noted that at the same time a higher percentage of those turned down for work were also bachelor degree holders.]

So a change to practical degrees dealing with the change in society is a requirement. NOT TO MENTION the trades that support families well should be encouraged as well. (Like a master tool maker, a carpenter, or a plumber, etc., these are high paying jobs that society will always need — and jobs like these are more apprenticeship driven rather that degree driven.)

FORBES notes one study that challenges the status quo:

- …Beyond.com, found that a striking 64% of hiring managers said they would consider a candidate who hadn’t gone to a day of college. At the same time, fewer than 2% of hiring managers said they were actively recruiting liberal arts grads….

A person starting out in life should consider all of the above. Their choices made now will have lasting effects — speaking from experience.