Fox News’ Jesse Watters DEMOLISHES Kamala Harris FAILED presidential campaign.

“She raked in more than $1 billion and is somehow now in debt.”pic.twitter.com/DYoa3qr88Y

— Resist the Mainstream (@ResisttheMS) November 10, 2024

SEE: How Kamala Harris plowed through $1 billion (WASHINGTON EXAMINER)

It was ultimately no use. On Tuesday, Donald Trump made history and became only the second former president to win a nonconsecutive term. After surviving two assassination attempts on the campaign trail, Trump dominated Harris in battleground states to emerge as the president-elect. And he did so with far less cash.

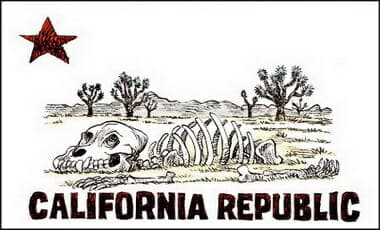

The story of how Harris pocketed record sums while failing to gain support from voters will be studied by campaigns for decades to come. Democrats who successfully pressured octogenarian President Joe Biden to pass the torch to the former California senator are now conducting an internal autopsy of the 2024 race, in which Trump raised and spent hundreds of millions of dollars less than Harris.

“A billion dollars paled in comparison to the increased prices Americans were seeing across the country,” Tom Fitton, president of the conservative group Judicial Watch and a longtime Trump ally, told the Washington Examiner. “Voters weren’t fooled.”

The Harris campaign and its affiliated committees dropped more than $654 million on advertising from July 22 to Election Day, whereas Trump spent $378 million, or 57% less, in the same category, according to data from AdImpact.

Future Forward, the $500 million “ad-testing factory” and super PAC that supported Harris, was a reliable clearinghouse for checks from wealthy Democrats such as Reid Hoffman, George Soros, Michael Bloomberg, and Dustin Moskovitz. And anonymous donations, or so-called “dark money,” also benefited Harris at a faster and more substantial clip than Trump thanks to lax federal laws that progressives often criticize but, nonetheless, exploited in 2024.

The Harris campaign declined to comment on its finances. A fuller portrait will be public after the election, as the Federal Election Commission mandates post-general election reports for candidates within 30 days.

In mid-October, the Harris campaign disclosed that it had spent over $880 million this election, almost $526 million greater than the roughly $354 million that the Trump campaign had disclosed spending, according to a Washington Examiner analysis of federal filings. Much of the Harris campaign’s spending was allocated for digital media advertising, polling, and travel from state to state, including to a private jet company called Advanced Aviation.

Payroll and the taxes that accompanied it accounted for $56.6 million of the Harris campaign’s spending. In comparison, the Trump campaign reported spending $9 million on payroll — employing hundreds fewer staff members.

There was also the army of political, digital, and media consultants who were paid over $12.8 million by the Harris campaign, filings show.

… read it all …

LOTS O-MONEY via OFF THE PRESS:

Finger-pointing has erupted over the Kamala Harris campaign blowing up to $20 million on swing-state concerts Monday night, hours before the VP’s spectacular election loss to Donald Trump — prompting concern that everyday staff and vendors won’t get paid amid reports the campaign is in debt by the same amount.

Members of the defeated Harris team tell The Post that the concerts had a ruinous effect on the Democratic campaign’s coffers and that fact was no secret — with one planned performance by ’90s alt-rock goddess Alanis Morissette getting scrapped to save money.

The seven swing-state concerts on election eve featured performances by Jon Bon Jovi in Detroit, Christina Aguilera in Las Vegas, Katy Perry in Pittsburgh and Lady Gaga in Philadelphia — with 2 Chainz joining Harris on Nov. 2, three days before the election, for an eighth concert in Atlanta.

Two sources said that Obama campaign alum Stephanie Cutter pushed the concert concept as a way to woo lower-propensity voters to the polls.

While the performers donated their time and talent, the sets still required an immense commitment of manpower and financial resources. ….

They’re falling apart…pic.twitter.com/xJGpLxljhA

— Defiant L’s (@DefiantLs) November 10, 2024

LOTS O-MONEY via PJ-MEDIA:

… Most of it went for advertising, which is a reasonable expenditure for a presidential campaign. The Washington Examiner reported Friday that “the Harris campaign and its affiliated committees dropped more than $654 million on advertising from July 22 to Election Day, whereas Trump spent $378 million, or 57% less, in the same category, according to data from AdImpact.” A good chunk of what was left went for polling and travel, which is reasonable, but the Harris campaign wasn’t going to risk getting dirty by hobnobbing with the hoi polloi: the travel expenses includes payment to “a private jet company called Advanced Aviation.”

Neo-Marxist apparatchiks don’t come cheap, and so the Harris camp shelled out a princely $56.6 million for payroll and the accompanying taxes. On top of that, Kamala and her henchmen plunked down $12.8 million for “political, digital, and media consultants,” all of whom promptly proved that they don’t know their own business and are wildly overpaid.

To get some idea of how disproportionate that is, note that the Trump campaign spent all of $9 million on payroll. There are some very wealthy Commies out there today courtesy of Kamala Harris, although to be sure, her campaign employed far more people than Trump’s did.

Harris also spent over $15 million to hire the parade of icky celebrities she trotted out to boost attendance at her allies, and sent a cool million to Oprah Winfrey for hosting a town hall with her and appearing at her final rally. Oh, you thought Oprah was appearing out of conviction, love for our country, and thoughtful support for the candidate she thought would best lead us through the perilous coming four years? Come on, man!

Worst of all, however, was the fact that “the Harris campaign spent six figures on building a set for Harris’s appearance on the popular Call Her Daddy podcast with host Alex Cooper. The interview came out in October and was reportedly filmed in a hotel room in Washington, D.C.” Wait a minute. Doesn’t this notorious sex podcast have a studio? Yes, but it’s in Los Angeles, and apparently Kamala and her minions decided that it would be better to spent over a hundred thousand dollars to build a new set rather than have the candidate fly all the way out to a state she already had in the bag.

The set that the Harris campaign built was not exactly a masterpiece. The Daily Caller asked trenchantly: “How the heck could this have cost six figures? How? The chairs, shelves, and knick-knacks on the shelves are ugly and cheap-looking, like Chinese-made Amazon basics furniture. In a couple of trips to the local Home Depot, the boys and I could whip up something better with a fraction of the budget. Although $100,000 is a drip in an ocean of billions, it’s emblematic of the poor spending choices of the campaign that got them nowhere. Also, to spend it for an hour-long appearance on a trashy sex podcast? What an utter waste of money and time.” ….