Larry Elder destroys the Democrats talking points on Trump not paying taxes. Like I have said before this is not an argument against Trump but an argument against the progressive tax system as currently in our tax law code.

Taxes

The New York Times Dodges Paying Taxes

The NYT’s was against paying taxes before they were for it. This isn’t an argument against Trump (or the New York Times) as much as is is against the progressive tax code.

To set this story up, we will travel to THE YOUNG CONSERVATIVES regarding the New York Times and Trump’s taxes:

The New York Times ‘illegally obtained’ a copy of Donald Trump’s 1995 tax returns the other day.

The billionaire businessman has said he’d release everything once a routine audit was complete, or he’d do so during the audit against his lawyers wishes if Hillary Clinton released her 30,000 deleted emails.

The ’95 returns show Trump took a $916 million hit that year. Meaning, that loss alone could be why Trump didn’t pay federal income taxes for a number of years.

From New York Times:

Donald J. Trump declared a $916 million loss on his 1995 income tax returns, a tax deduction so substantial it could have allowed him to legally avoid paying any federal income taxes for up to 18 years, records obtained by The New York Times show.

The 1995 tax records, never before disclosed, reveal the extraordinary tax benefits that Mr. Trump, the Republican presidential nominee, derived from the financial wreckage he left behind in the early 1990s through mismanagement of three Atlantic City casinos, his ill-fated foray into the airline business and his ill-timed purchase of the Plaza Hotel in Manhattan.

Tax experts hired by The Times to analyze Mr. Trump’s 1995 records said that tax rules especially advantageous to wealthy filers would have allowed Mr. Trump to use his $916 million loss to cancel out an equivalent amount of taxable income over an 18-year period….

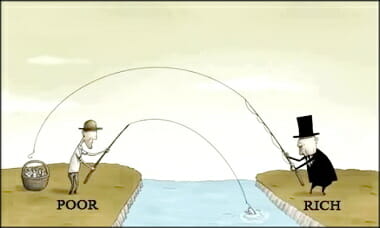

The only problem is, that, the New York Times didn’t pay any taxes as well. Why? Becuase when you are a business/business owner and you have loses… then you can claim those loses. L-E-G-A-L-L-Y! Here is the story from BREITBART:

The New York Times has excited the Clinton campaign and the rest of the media with a revelation that Republican nominee Donald Trump declared a $916 million loss in 1995 that might have resulted in him not paying taxes in some subsequent years.

The implication, reinforced by CNN’s Jake Tapper on State of the Union on Sunday morning, is that Trump “avoided” paying taxes, when in fact his tax liability was zero.

But the Times itself has “avoided” paying taxes — in 2014, for example.

As Forbes noted at the time:

… for tax year 2014, The New York Times paid no taxes and got an income tax refund of $3.5 million even though they had a pre-tax profit of $29.9 million in 2014. In other words, their post-tax profit was higher than their pre-tax profit. The explanation in their 2014 annual report is, “The effective tax rate for 2014 was favorably affected by approximately $21.1 million for the reversal of reserves for uncertain tax positions due to the lapse of applicable statutes of limitations.” If you don’t think it took fancy accountants and tax lawyers to make that happen, read the statement again.

Is America’s Tax System Fair?

Is the U.S. tax system fair? Are the rich paying too little or too much? What about the middle and lower class? New York Times bestselling author Amity Shlaes answers these questions, and offers a tax solution that most Americans could get on board with.

Trump Is NOT “America First”

In this clip Mark Levi explains some basics in conservative economics 101. I include a couple calls and Mark gets worked up in the process of “laying down the law”!

BTW, this is a great refutation of those who think tariffs are a good thing. The movie BREXIT does a great job explaining how this thinking killed European competitive markets.

Some Misconception About the Rich and Taxes

A caller challenged Michael Medved on the “system” backing the rich… to which Michael responded with some counter-points. The conversation turned to taxes, and I learned a bit about the flat-tax and the “graduated” aspect of even it.

Great call and great learning curve of a response.

Here is a related issue via the great Milton Friedman:

L.A. City Controller Says Turf Removal Wasteful

Here is the story in part via the Los Angeles Times:

Los Angeles’ turf rebate program saved less water per dollar spent than other Department of Water and Power conservation programs, an audit released by the city controller said Friday.

Auditors found that money spent for rebates on items such as high-efficiency appliances yielded a water savings almost five times higher than turf replacement. They also found that the DWP does not prioritize water conservation projects based on which are the most cost-effective.

City Controller Ron Galperin called on the water provider to focus its conservation programs in order to achieve more sustained and cost-effective water savings.

“If money is no object, turf replacement rebates are a relatively expedient way to save water,” Galperin said. “But, of course, money is an object.”

In fiscal year 2014-15, the DWP spent $40.2 million on customer incentive and rebate programs, Galperin’s office said. Nearly $17.8 million of that went to turf rebates. Each dollar invested in turf rebates is expected to save 350 gallons of water over the estimated 10-year “life expectancy” of residential turf replacement, the audit said.

In comparison, the department spent $14.9 million on rebates for high-efficiency appliances and fixtures. Those rebates yield a per-dollar savings of more than 1,700 gallons of water over their estimated lifetimes of up to 19 years, Galperin’s office said.

The turf rebate program “had value as a gimmick that … probably spurred a heightened awareness,” Galperin said at a news conference, adding: “It’s the job of my office to look at return on investment.”…

When the government of L.A., or for that matter our one party state, uses tax-payer monies… “money is no object.” The California boondoggles of solar power and trains come to mind. Or even the Democrats teaming up with eco-fascists to create water shortages! (See the “drought” posts here)

Upstate New York Is Becoming Detroit With Grass

How high taxes and regulation are killing one of the most prosperous states in the nation

Upstate New York is becoming Detroit with grass.

Binghamton, New York — once a powerhouse of industry — is now approaching Detroit in many economic measures, according to the U.S. Census. In Binghamton, more than 31 percent of city residents are at or below the federal poverty level compared to 38 percent in Detroit. Average household income in Binghamton at $30,179 in 2012 barely outpaces Detroit’s $26,955. By some metrics, Binghamton is behind Detroit. Some 45 percent of Binghamton residents own their dwellings while more than 52 percent of Detroit residents are homeowners. Both “Rust Belt” cities have lost more than 2 percent of their populations.

Binghamton is not alone. Upstate New York — that vast 50,000-square mile region north of New York City — seems to be in an economic death spiral.

The fate of the area is a small scene in a larger story playing out across rural America. As the balance of population shifts from farms to cities, urban elites are increasingly favoring laws and regulations that benefit urban voters over those who live in small towns or out in the country. The implications are more than just economic: it’s a trend that fuels the intense populism and angry politics that has shattered the post-World War II consensus and divided the nation.

[….]

“Basically what you’ve got in New York is a state tax code and regulatory regimen written for New York City,” says Joseph Henchman, vice president for state projects at the Tax Foundation in Washington. “Legislators say, `Look, New York is a center of world commerce. Businesses have to be here. It doesn’t matter how high we tax them.’ I hear that a lot. But when you apply that same logic to upstate, the impact is devastating.”

The exodus

The lives of Bill and Janet Sauter, brother and sister, sum up the sad story of upstate New York. They grew up in the Long Island suburbs. He went to Clarkson College in Potsdam, N.Y., near the Canadian border, studied software and enjoyed a highly successful career in Texas’ oil industry.

Janet went upstate too, marrying a minister and settling in rural East Chatham, 30 miles south of Albany. In 1999, she and her husband wanted to move to Texas to be closer to their daughter. But they couldn’t sell their home. Months passed without a single inquiry. For Janet, there was no escape from New York. Her neighbors had similar experiences, she said.

Bill is now retired and living in Steamboat Springs, Colo., where he skis at every opportunity — while Janet and her husband Bob are trying to eke out a living in what has become one of the poorest regions in the country. “There just isn’t much work around here,” says Janet, who supplements her husband’s income by working all night in a home for the elderly. “I’m lucky to have this job.”

Industry has fled upstate New York. “In 1988, Kodak employed 62,000 people in Rochester,” says Sandra Parker, president of the Rochester Business Alliance. “Today it employs 4,000. Xerox has moved most of its people out while Bausch & Lomb, which was founded in Rochester in 1858, has left entirely.”

As a result, Rochester is now the fifth poorest city in the country, with 31 percent of the population living in poverty. Buffalo is right behind at No. 6 (30 percent).

Syracuse was devastated when Carrier, the nation’s largest manufacturer of air conditioners, General Electric and auto-parts manufacturer Magna International shuttered their last manufacturing plants in Onondaga County. A Wall Street Journal survey of the nation’s 2,737 counties, shows that only nine other counties have suffered greater job losses per capita than Onondaga County since 2009.

Bob and Janet Sauter were not alone in their desire to leave New York for more prosperous parts of the country. New York state has lost 350,000 people in the past three years, according to the Empire Center for New York State Policy, an Albany-based research group. This is the largest out-migration of any state.

New York was the most populous state in the union in 1960, with 45 representatives in Congress. By 2012, New York fell to third place and its congressional delegation plummeted to 28. The 2020 Census will likely cost New York even more congressional seats. Without the hundreds of thousands of immigrants moving into New York City, the state’s depopulation would be even greater. A remarkable 36 percent of New York City is foreign born — twice the percentage in 1970….

[….]

The city of Buffalo tried to disincorporate itself in 2004, so it could shift its Medicaid burden onto surrounding Erie County. The state wouldn’t allow it. It’s probably just as well, say county officials. “Our entire property tax goes to supporting Medicaid,” says Erie County executive Mark Poloncarz.

States generally have three potential sources of revenue: the income tax, the sales tax and the property tax. “Usually a state will concentrate on one and go low on the other two,” says Joseph Henchman of the Tax Foundation. “New York is in the top six states for all three.”

The Tax Foundation rated New York dead last among the 50 states for business climate in 2013.

Larry Elder Slams Biden, Amtrak, and 1% Mantras

In “Sage” style, Joe Biden gets worked up one side and Democrat delegates down the other. In a previous podcast Larry gets into the CATO study a bit more: https://youtu.be/BwzIskt8qfw

For more clear thinking like this from Larry Elder… I invite you to visit:

http://www.larryelder.com/ ~AND~ http://www.elderstatement.com/

The Tax Cheats At MSNBC Lecture the Common People

Gateway Pundit points out that the above people lecturing us on “paying your fair share” are themselves tax cheats. Here are just a couple excerpts on what they owe:

- “Today, Mr. Sharpton still faces personal federal tax liens of more than $3 million, and state and federal tax liens.”

- “Last month, New York filed a $4,948.15 tax warrant against Joy-Ann Reid, who serves as managing editor of theGrio.com and until earlier this year hosted MSNBC’s The Reid Report

- Earlier this year, the IRS slapped Perry and her husband with a $70,000 bill for delinquent taxes from 2013.

- “In September 2013, New York issued a state tax warrant to [Touré] Neblett and his wife, Rita Nakouzi, for $46,862.68. Six months later, the state issued an additional warrant to the couple for $12,849.87,” National Review’s Jillian Kay Melchior reported on Wednesday.

See also HotAir

From the above Rush video description:

Rush Limbaugh (4/22/15): “Toure Neblett owes the IRS $59,000. Joy-Ann Reid owes the State of New York $5,000 in back taxes. Melissa Harris-Perry owes the IRS $70,000, she and her husband together. They’re actively not paying their taxes. Of course, the Reverend Sharpton’s tax bill is upwards of $3 million to $4 million.” 4 MSNBC Hosts Owe IRS Back Taxes, Not Paying “Fair Share”

Do the Rich Pay Their Fair Share? (UCLA Professor Lee Ohanian)

Do the rich pay their fair share of taxes? It’s not a simple question. First of all, what do you mean by rich? And how much is fair? What are the rich, whoever they are, paying now? Is there any tax rate that would be unfair? UCLA Professor of Economics, Lee Ohanian, has some fascinating and unexpected answers.

$Ringing$ In the New Year With Higher Gas Prices

In total, Exxon makes about 8 cents on the dollar for everything it does, soup to nuts: Its profit margin for the past 20 quarters averages 8.26 percent. That is, it is worth noting, a good deal lower profit margin than Wired parent company Conde Nast generally achieves, according to the company’s CEO, Charles Townsend. Apple’s profit margin runs about three times Exxon’s. Chip-maker Linear Technology’s profit margins routinely run four times those of Exxon. Energy is a high-volume business, not a high-profit-margin business. (National Review)

This comes by way of Breitbart:

Effective January 1st, drivers in California will be in for a shock as gas prices jump. This overnight price increase has nothing to do with the fluctuations of the market, nor will drivers be getting a better grade of gasoline. It’s simply the price of supporting a government that wants to control your every move.

Under complete Democrat domination, Gov. Jerry Brown’s appointee to the California Air Resources Board (CARB), Mary Nichols, has decreed that every driver must pay for another level of government control. As California singlehandedly attempts to combat the ever-elusive “global warming”—now conveniently renamed “climate change”—CARB is putting gasoline and diesel fuel under the Cap-and-Trade scheme authorized by AB32 (known as the Global Warming Solutions Act).

It doesn’t matter that theres no evidence that raising the cost of fuel will do anything to alleviate a problem that is rooted in llaklitics instead of science. By requiring refiners to buy a permit, this unelected board is doing nothing more than confiscating capital from ordinary Californians. Even though the cost is passed on at the pump, it will be paid by more than just drivers: the cost of every product that must be transported on California roads will cost more.

And for what? The only clear beneficiary of this hidden tax on fuel are the bureaucrats whose ranks will increase, and the Democrat politicians whose socialist programs will be funded, further solidifying their control over every Californian. This is how government continues to grow faster than the economy at large—and the never-ending growth of government is the greatest threat to our future, and our freedom. Tomorrow, 900 new laws take effect, many of which limit our freedom or raise the cost of living in the most oppressed state in the union….

So let us recap some of the taxes imposed on California drivers per gallon of gasoline (a sorta update to an older post):

- State Underground Storage Tank Fee: The state underground storage tank fee is currently 1.4 cents per gallon.

- State and Local Sales Tax: An average state sales tax rate of 2.25% percent is used in the calculation of the distribution margin although the actual sales tax rate does vary throughout California.

- State Excise Tax: The California state excise tax is currently 35.3 cents per gallon.

- Federal Excise Tax: The federal excise tax is currently 18.4 cents per gallon

That adds up to roughly 55-cents per gallon, not including state and local sales tax. This new tax will add a minimum of about 10-cents to this… meanwhile “Evil Big Oil” makes out like a bandit! with their 8-cents a gallon profit margin. Here’s an old 2007 Neil Cavuto discussion about essentially the above… lackluster profit margins for evil oil companies (my 2nd ever uploaded video onto my YouTube channel):

And as Fox already pointed out, these taxes like others will go to pet projects. Now, Jerry Brown’s pet projects versus covering the 500-billion dollars in un-subsidized retirement promises to California workers.

Reforming Tax Rates & Obama-Care Will Boost Domestic Investment

Via IBD Editorial, “American Companies Think The Unthinkable — Leaving The U.S.“

Taxes: Walgreen, America’s venerable drug-store chain, is thinking the unthinkable: relocating to Europe. Not because it sees growth and opportunity there, but because of onerous taxes here in the U.S. It’s an ominous trend.

The Financial Times of London calls it “one of the largest tax inversions ever.” That is, a company seeking to avoid punitive taxes in one market by moving to another.

No doubt the FT is right. And after its recent $16 billion takeover of Swiss-based Alliance Boots, it would be easy for Walgreen to remake itself as a Swiss company.

If it did, the Democratic Party’s liberals would no doubt call Walgreen unpatriotic for wanting to lessen its tax burden. In fact, they are responsible for an economic environment so hostile to capital and investment that companies now find it intolerable.

As we’ve noted, corporate tax rates in the U.S. are the highest among the developed nations. The average rate in America in 2013 was 39.13%; for all of the Organization for Economic Cooperation and Development nations, it stood at 28.2%.

In short, being headquartered here is a major competitive disadvantage for American firms.

According to an analysis by UBS, Walgreen’s U.S. tax rate is 37.5% — compared with Alliance Boots’ rate in Europe of about 20%. That’s a huge gap, worth billions of dollars a year.

But it’s even worse than that. A recent OECD study says the “integrated tax rate” — taxes on capital and income — for U.S. companies is a nightmarish 67.8% vs. 43.7% for the OECD….

[….]

A total of 547 companies — including Apple, GE, Microsoft and Pfizer — have dramatically expanded their so-called foreign indefinitely reinvested earnings overseas, which let them avoid the punishing rates here at home.

“The new numbers … certainly highlight what is one of the key challenges for tax reform,” said Wyden. No kidding.

Wyden and his fellow Democrats will try to raise taxes even higher or gut foreign tax exemptions. If so, it will backfire. Companies won’t invest here if government takes more of their money; they’ll just find new ways to put it out of reach.

And why shouldn’t they?

Not only are taxes too high, but also new laws such as Dodd-Frank and ObamaCare, a vast expansion of regulation, debt and the size of government, the federal takeover of entire industries, the bullying of Wall Street and demonization of CEOs, and forced CO2 cuts that will hammer manufacturers have made this the least pro-free market U.S. government in generations….