This is to bring into one place a few of my past posts regarding the tax reforms Trump passed via the TCJA (Tax Cuts and Jobs Act). They are not reforms in the way conservatives think of them. But neither did they overwhelmingly benefit “the rich” and large corporations and did little or nothing to help middle class families — as Democrats state it.

In March, Speaker of the House Nancy Pelosi, D-Calif., called the 2017 Trump tax cuts a $2 trillion “GOP tax scam.”

Sen. Bernie Sanders, I-Vt., accused Republicans of hypocrisy for supporting the tax cuts but opposing Congress’ massive spending spree.

The Biden White House issued a press release claiming “the Trump tax cuts had added $2 trillion to deficits over a decade.”

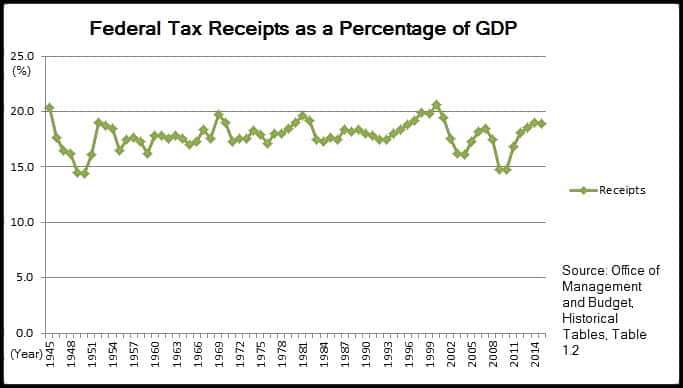

But the numbers tell a different story. Despite the political rhetoric, tax revenues are up.

(DAILY SIGNAL – June 1, 2022)

I will date my posts as I add them in a mixed order. But first… let us start this grand flashback with YAHOO NEWS (February 13, 2019):

…data reflects a single week of tax filing season and it is likely that the size of refunds will increase as tax season continues – Morgan Stanley analysts have predicted that refunds will increase by 26 percent.

In addition, the size of a tax refund means nothing without also comparing the change in paychecks. In net, the overwhelming number of filers will be better off as an estimated 90 percent of Americans are seeing a tax cut.

[….]

the success of the TCJA is clear. In the months following passage of the tax cuts, unemployment fell to a 49-year low and key demographics including women, African-Americans and Hispanics have seen record low unemployment rates.

Job openings have now hit a record high of 7.3 million and over 300,000 jobs were created last month, as most private-sector businesses continued hiring despite the government shutdown. Year-over-year, wages have grown 3.2 percent and the economy is projected to grow at 3.1 percent over 2018.

This positive news is not anecdotal.

According to Guy Berkebile, the owner of Pennsylvania-based small business Guy Chemical and one of the witnesses at the Ways and Means hearing, the bill has been a net positive for businesses.

“On the business expansion front, Guy Chemical was able to build a new laboratory that was five-times larger than our previous one, invest in new chemical compounding equipment and purchase new packaging line,” Berkebile told lawmakers on Wednesday.

Not only was this good for the businesses, it also benefited employees as noted in the testimony of Mr. Berkebile: “We were also able to pass down much of the financial savings to employees. More specifically, we were able to raise wages, expand bonuses by up to 50 percent, start a 401(k) retirement program and create 29 new jobs. These changes also instilled a sense of optimism among our staff, which has produced a less stressful and more enjoyable work environment.”

This is not an isolated story. Workers across the country have seen increased take-home pay, new or expanded education and adoption programs, and increased retirement benefits, while consumers are seeing lower utility bills.

More Good News

To use a few examples, Firebird Bronze, an Oregon-based manufacturer was able to afford to give its nine employees health insurance for the first time while McDonald’s has used tax reform to allocate $1,500 in annual tuition assistance to every employee working more than 15 hours a week.

Visa has doubled its 401(k) employee contribution match to 10 percent of employee pay, while Anfinson Farm Store, a family-owned business in Cushing, Iowa (population 223) has given its employees a $1,000 bonus and raised wages by 5 percent.

In addition to these employee benefits, America’s middle class is seeing direct tax relief.

A family of four with annual income of $73,000 is seeing a 60 percent reduction in federal taxes — totaling to more than $2,058. According to the Heritage Foundation, the typical American family will be almost $45,000 better off over the next decade because of higher take-home pay and a stronger economy.

Tax reform doubled the child tax credit from $1,000 to $2,000, giving over 22 million American families important tax relief. The standard deduction was doubled from $6,000 to $12,000 ($12,000 to $24,000 for a family) giving tax relief for over 105 million taxpayers that took the deduction prior to tax reform and simplifying the code for tens of millions Americans that will not take the standard deduction instead of itemizing.

While the rhetoric of the left has sought to portray the Republican tax cuts as a negative for the middle class, nothing could be further from the truth. The reality is, the middle class has seen strong tax reduction, higher take home pay, more jobs and more economic opportunity……

NOTE:

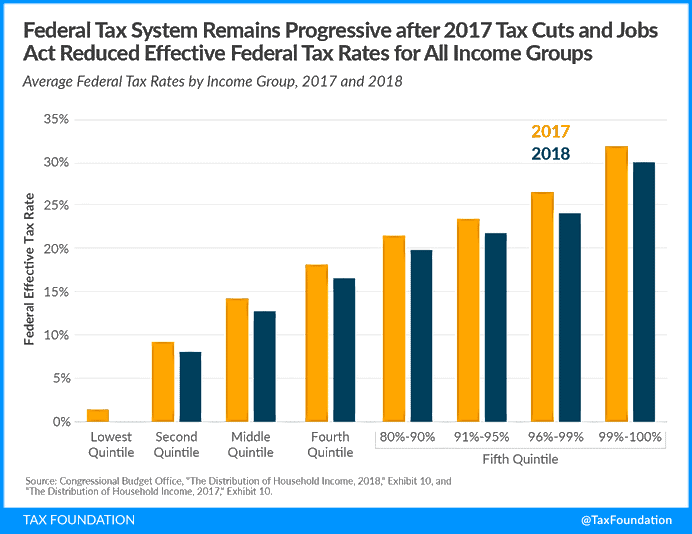

- The TCJA reduced the average federal tax rate from 20.8 percent to 19.3 percent for all filers. The bottom 20 percent of earners saw their average federal tax rate fall from 1.2 percent to nearly 0 percent. (TAX FOUNDATION | August 5, 2021)

RPT: December 28, 2017

(As an aside, I sent the “calculator” linked below to my wife’s uncle as he expressed concern in a private discussion to him paying more.)

Larry Elder plays CBS’ tax special with three families (watch the CBS video here at TOWNHALL) from different incomes: (a) little under $40,000 a year; (b) more than $150,000 a year; (c) couple’s combined income was $300,000. Turns out ALL THREE will get a tax return. The Democrats know they are in trouble!

Here Are The Winners And Losers Of The New Tax Law — In that article is a link to THIS TAX CALCULATOR

END

There are critics however, as noted by Robb Sinn at THE FEDERALIST (November 02, 2020):

Many on the left refuse to admit President Trump’s populist policies have provided massive benefits to working-class Americans. Matthew Yglesias argued at Vox that Trump’s refusal to endorse a federal $15 per hour minimum wage proves Trump has abandoned populist ideals. Progressives claim the Trump economy helps billionaires, not workers, and snidely dismiss his outreach to minorities.

Yet, during the first three years of the Trump presidency, wage growth was off the charts, especially for low-income workers and African Americans. The third-quarter economic data released Thursday confirm once again that Trump is on the job for U.S. workers.

The Biden campaign has tried to tie COVID-linked economic devastation to Trump’s leadership. The new third-quarter economic data once again shows that’s wrong. The total number of U.S. wage earners increased more than 5 percent in that period, and the third-quarter rebound for African Americans occurred at a 17 percent faster rate than for wage earners as a whole.

Trump campaigned on exiting the China-centric Trans-Pacific Partnership and renegotiating North American Free Trade Agreement (NAFTA). Trump claimed his tax and trade policies would benefit American workers.

Even though evidence shows they are highly effective, Trump’s economic ideas have consistently underwhelmed pundits. Democrats hated his tax cuts. Liberals predicted a worldwide economic crisis if he was elected in 2016 and scoffed at Trump’s “middle class miracle.” Leading up to the 2016 election, economists including eight Nobel laureates derided his economic ignorance and called his proposals “magical thinking.”

[….]

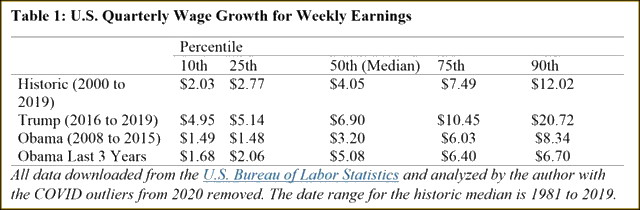

The story grows quite interesting when we focus on wage earners in lower brackets. According to data from the U.S. Bureau of Labor Statistics, the 20-year growth trend for the 10th percentile weekly wage was $2.03 per quarter. For Trump’s first three years, wage growth was $4.95.

What about in the Obama era? Even cherry picking Obama’s last three years and ignoring the 2009 recession leaves us with growth of $1.68 per quarter, well below both the historic trend and Trump’s. Table 1 shows striking wage growth under Trump, a reversal of prior patterns, not a continuation, especially in the lowest wage brackets.

Trump Benefited Black Americans More Than Obama Did

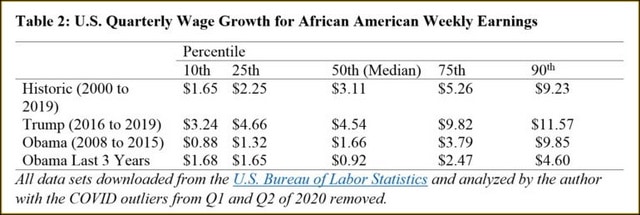

During the final presidential debate, President Trump boldly stated he has done more for black Americans than any president since Abraham Lincoln. And he is not so sure Abe did better. While liberals fact-checked his hyperbole, we may employ the quaintly anachronistic approach of using data and logic. The Obama era proved dispiriting for many African American wage earners. The first three years of the Trump administration were a comparative godsend.

Obama oversaw the addition of 2.1 million African American wage earners during eight years in office, about 250,000 per year. Table 2 reveals the tepid results in terms of wage growth. Trump oversaw the addition of 1.3 million African American wage earners in his first three years, more than 400,000 per year. Excellent wage growth occurred across the spectrum. The results for the 10th and 25th percentiles were remarkable.

The 10th percentile U.S. weekly wage grew by $3.25 per quarter for African Americans during Trump’s first three years, nearly double the historic rate of $1.65. The best Obama growth rate was only $1.68. Perhaps having a businessman at the helm of the world’s largest economy is not such a bad idea. Will any deniers admit they were wrong?

……

Here are the links one should enjoy spending time in via my membership retirement org, AMAC:

- TCJA lowered the average federal tax rate for all filers: TCJA reduced the average federal tax rate from 20.8percent to 19.3 percent for all filers.

- The lowest income earners paid less in taxes: The bottom 20 percent of earners saw their average federal tax rate fall from 1.2 percent to 0 percent – a lower rate than the previous 40-year average.

- The highest earners paid the highest share of taxes: The top 1 percent of households saw their share of federal taxes paid increase from 25.5 percent in 2017 to 25.9 percent in 2018.

And please note this as well:

- …Wages for all workers and measures of real wages show similar upticks. Census Bureau data also show that real household income reached an all-time high in 2019, growing by $4,400 (a 6.8% one-year increase). … (HERITAGE FOUNDATION | March 24, 2021)

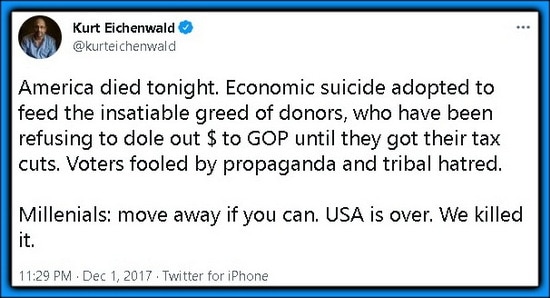

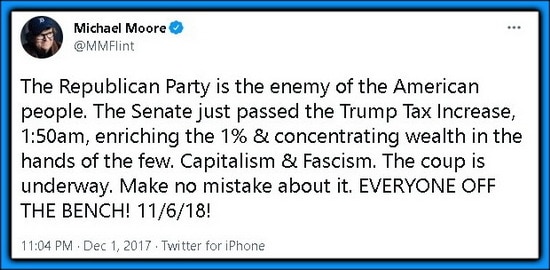

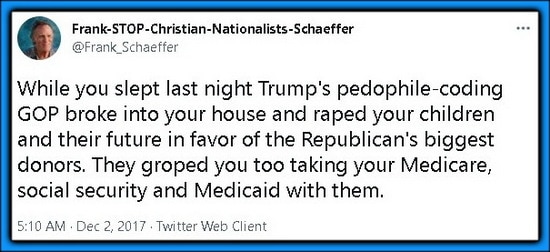

RPT: December 4, 2017

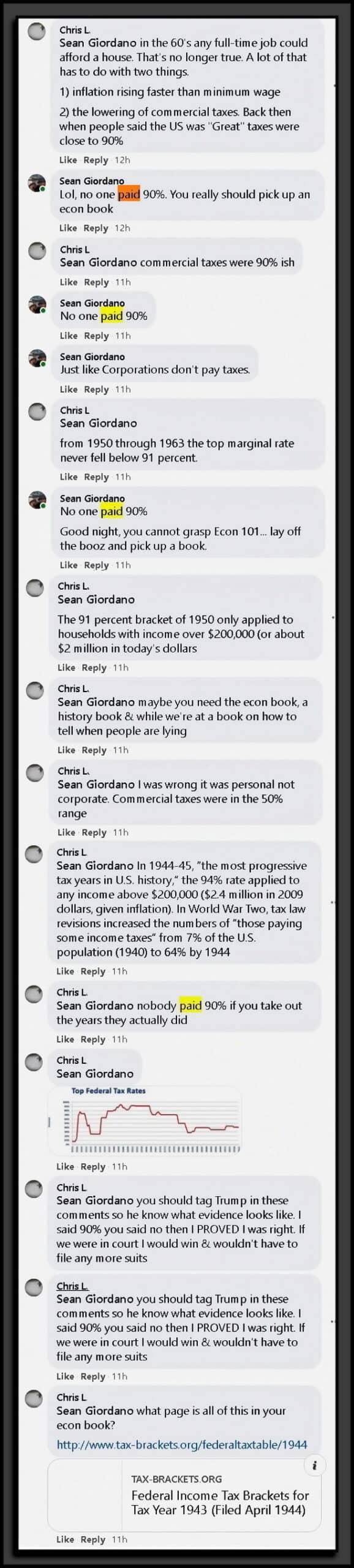

GAY PATRIOT [now, sadly, defunct] comments on the main idea that the Left are a bunch of babies with almost zero understanding of anything economic:

The tax “reform” bill the US Senate passed last night is pretty lame, actually. It keeps the current ridiculous progressive structure of seven separate tax rates. (The House reduced it to four, and the correct number ought to be one.) Susan Collins was bought off by retaining the mortgage interest deduction on vacation homes for millionaires. Freeloaders at the lower income brackets still pay nada. Some high income progressives from blue states are whining because some of their state and local taxes are no longer deductible. Sucks that you progressives in high tax blue states forgot to elect any Republican senators.

There has also been a lot of howling from the “suddenly we’re concerned about the debt” progressive left that the bill will add $1.5 Trillion to the National Debt over ten years. That figure represents less than 3% of Government expenditures in that time period. Cut Government spending 3% (I’m sure we can get by on 97% of the Government). Problem solved.

It’s a lame bill. Really, the best part of the Senate Bill passing has been watching the histrionic meltdown on the Progressive Left. (But even that gets a little boring considering the progressive left has a histrionic meltdown at literally everything Donald Trump does.)

Oh, Patti, don’t feel so bad. There are lots of other countries you can move to. Have you considered Mexico? No Republicans there. Strict gun control, too. The Government is very progressive, taxes are very progressive, and economic activated is highly regulated. It’s a lot like California, come to think of it. But with fewer Mexicans……..

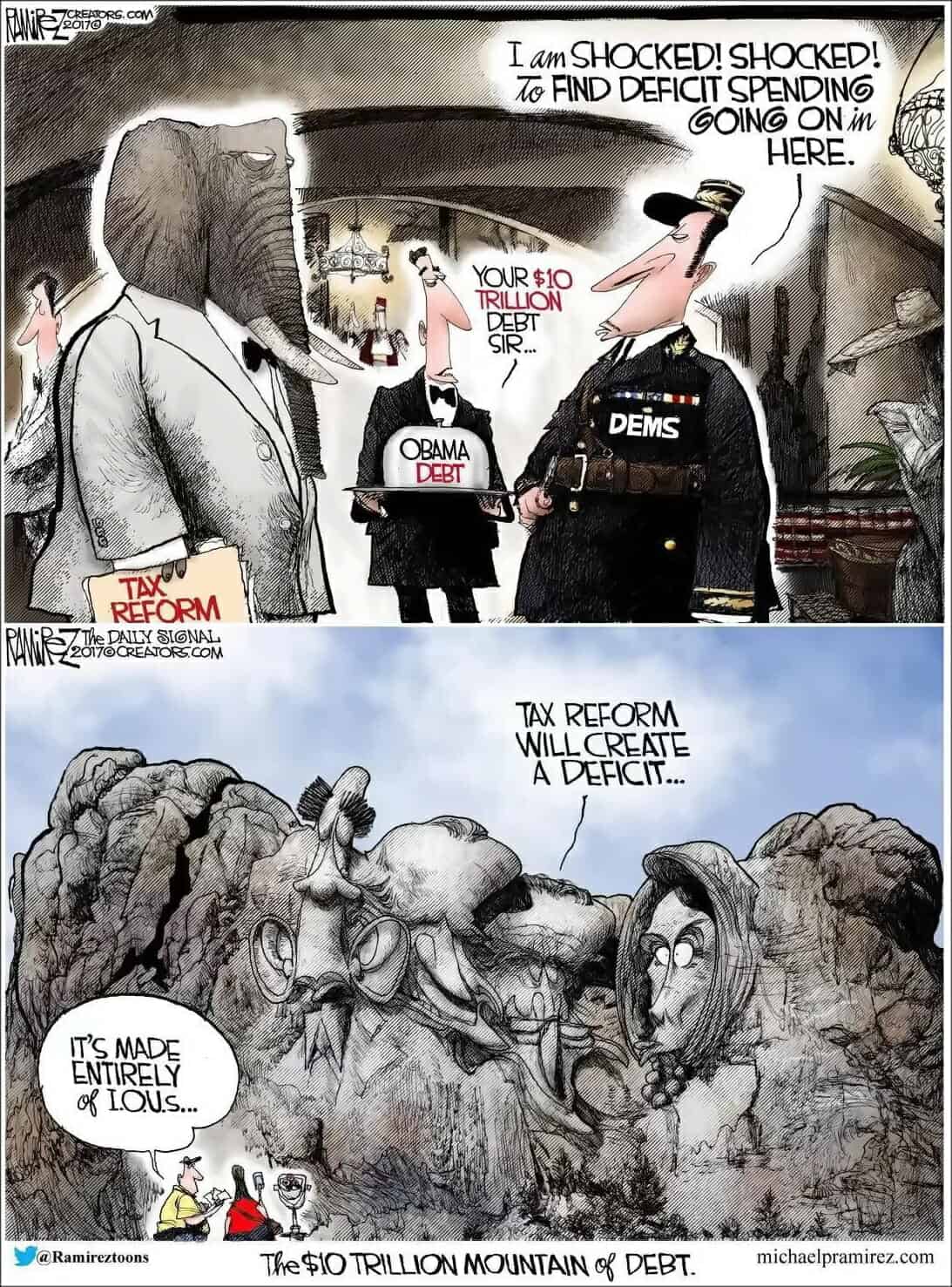

POWERLINE opines well with two RAMIREZ TOONS:

- It is comical to see Democrats feigning outrage over the claim (likely false) that the GOP tax reform plan will add to the national debt. Talk about a head-snapping about face! Where was the Dems’ concern about debt when the Obama administration ran up $10 trillion of it?

….A remarkable thing happened over the weekend; Democrats rediscovered their concern about the national debt, state’s rights, and voter fraud.

The same Democrats who had no problem helping Barack Obama double the national debt to a mind-blowing $20 Trillion have attacked the Republican Senate’s limpwrist “tax reform” bill claiming it will add $1.5 Trillion to the national debt over ten years.

$1.5 Trillion represents less than 3% of Government spending over the next ten years. If that’s a problem, then, by all means, cut spending by 3%.

Democrats are also suddenly hollering about “state’s rights” because Congress is looking to make concealed carry licenses valid across state lines; like driver’s licenses. (And, yes, most states require training and a background check before a concealed carry license is issued.) The Democrats have suddenly taken a position analogous to claiming Rosa Parks only had the right to sit in the front of the bus while she was in Alabama…..

END

RPT: May 25, 2022

(OG Post was March of 2016)

The bottom small section was posted March of 2016… the updated information comes to us as a way of emboldening the comparisons between Hillary’s tax plan and Trump’s compared. With the predictions made about Trumps’ plan coming to fruition.

UPDATE

The WASHINGTON EXAMINER (Dec 2021) has a tracking of how these tax plans worked out (note the highlighted portion readers):

President Joe Biden and congressional Democrats’ Build Back Better Act would increase taxes on higher-income earners and expand business levies to help cover its $2.4 trillion price tag.

Biden and many Democrats in Congress have argued that their plan to raise taxes in the midst of an economic recovery is justified because it would help offset or reverse important elements of the Republican tax reform passed in 2017. Democrats have long claimed that the Tax Cuts and Jobs Act needs to be repealed or heavily altered because it unjustly benefits the wealthy at the expense of working and middle-class families.

However, the most recent personal income tax data from the IRS prove that this claim is completely false. The 2017 tax law has disproportionately benefited lower- and middle-income working families. The data show the law has also led to substantial improvements in economic mobility for middle-income and upper-middle-income households.

A careful analysis of detailed tax data from 2017 and 2018, the first year the TCJA went into effect and the most recent year for which detailed IRS income data are available, reveals that over just one year, households with an adjusted gross income of $15,000 to $50,000 saw their total tax bills cut by an average of 16% to 26%, with most filers enjoying at least an 18% tax cut. Similarly, filers earning between $50,000 and $100,000, one of the largest groups of taxpayers, experienced a 15% to 17% tax cut, on average, from 2017 to 2018.

Higher-income households also experienced sizable tax cuts, but not nearly as large as the tax reductions provided by the law to working and middle-class families. Those with AGIs of $500,000 to $1 million, for example, had their taxes cut by less than 9%, and filers earning $5 million to $10 million received a 3.4% cut, the lowest of any bracket provided by the IRS.

The data also show that wealthier filers ended up providing a slightly higher proportion of total personal income tax revenue in 2018 than they did in 2017. In 2017, filers earning $500,000 or more provided 38.9% of all personal income tax revenues. In 2018, the same group provided 41.5% of revenues.

That means the Trump-GOP tax cuts made the income tax code more progressive than it had previously been. That’s a remarkable finding. After all, Democrats have spent the past few years insisting the TCJA provided a huge windfall to the richest income brackets while leaving everyone else behind!

Perhaps most importantly, the tax cuts caused substantial upward economic mobility. Despite an increase in the total number of tax returns filed in 2018 compared to 2017, the number of people filing who claimed an AGI of $1 to $25,000 fell by more than 2 million. But every other income bracket above $25,000 increased, with many seeing huge gains.

The number of filers claiming an AGI of $100,000 to $200,000, for example, increased by more than 1 million in a single year……

And in April of 2022 AMERICAN’S FOR TAX REFORM noted that this delve into the IRS data shows strongly that the “Trump Tax Breaks for the Rich” helped the middle class the most:

The Internal Revenue Service’s released 2019 Statistics of Income (SOI) data, the agency’s most recent available data, shows that middle income American families saw a significant tax cut – measured as the percentage decrease in “total tax liability” between 2017 and 2019 – from the Trump-Republican Tax Cuts and Jobs Act (TCJA). Similarly, Americans saw significant decreases in tax liability from 2017 to 2018.

Total tax liability includes federal income taxes as well as taxes listed on IRS form 1040 such as payroll taxes including social security and Medicare taxes. The TCJA significantly reduced federal income taxes but did not modify payroll taxes.

As the data notes, Americans with incomes between $50,000 and $100,000 saw a substantial decline in their tax liability:

- Americans with adjusted gross income (AGI) between $50,000 and $74,999 saw a 15.2 percent reduction in average tax liabilities between 2017 and 2019.

- Americans with AGI of between $75,000 and $99,999 saw a 15.6 percent reduction in average federal tax liability between 2017 and 2019.

Middle-class Americans in key states were delivered significant tax cuts:

- Floridians with AGI between $50,000 and $74,999 saw a 19.6% reduction. Floridians with AGI between $75,000 and $99,999 saw a 17.2% reduction.

- New Yorkers with AGI between $50,000 and $74,999 saw a 18.9% reduction. New Yorkers with AGI between $75,000 and $99,999 saw a 12.4% reduction.

- Californians with AGI between $50,000 and $74,999 saw a 18.4% reduction. Californians with AGI between $75,000 and $99,999 saw a 14% reduction.

The TCJA also caused millions of Americans to see an increased child tax credit, and millions more qualified for this tax cut for the first time. The TCJA expanded the child tax credit from $1,000 to $2,000 and raised the income thresholds so millions of families could take the credit.

The TCJA also repealed the Obamacare individual mandate tax by zeroing out the penalty. Prior to the passage of the bill, the mandate imposed a tax of up to $2,085 on households that failed to purchase government-approved healthcare. Five million people paid this in 2017, and 75 percent of these households earned less than $75,000.

[….]

Additionally, the TCJA enacted a high alternative minimum tax (AMT) exemption and raised the income level at which the exemption begins to phase out. Congress enacted the Alternative Minimum Tax (AMT) in 1969 following the discovery that 155 people with adjusted gross income above $200,000 had paid zero federal income tax. Over time, the AMT grew so large that millions of Americans paid the tax and millions more saw increased tax complexity. The TCJA caused the number of AMT taxpayers to fall from more than 5 million in 2017 to just 263,720 in 2018.

For years, President Joe Biden has falsely claimed that the 2017 Tax Cuts and Jobs Act (TCJA) passed by the Congressional Republicans and President Trump overwhelmingly benefited “the rich” and large corporations and did little or nothing to help middle class families.

Even left-leaning media outlets have (eventually) acknowledged the tax cuts benefited middle class families. The Washington Post fact-checker gave Biden’s claim that the middle class did not see a tax cut its rating of four Pinocchios. The New York Times characterized the false perception that the middle class saw no benefit from the tax cuts as a “sustained and misleading effort by liberal opponents.” ……

Yep, another Democrat myth about Trump bites the dust. Here is the small original post:

ORIGINAL 2016 POST

This is with thanks to the US Tax Center:

(to enlarge right click on image and “open in another tab”)

END