State Deficits Budget Shortfall on Pensions from Papa Giorgio on Vimeo.

Pensions in Peril: The funding status of state-sponsored pension plans:

As the races for governor heat up in thirty-six states, the question of how to fix troubled state-sponsored pension plans may be one of the most challenging that candidates will have to face. State pension plans are underfunded by $3.2 trillion when misguided accounting practices are corrected according to research by Joshua D. Rauh, an associate professor of finance at the Kellogg School of Management, and Robert Novy-Marx at the University of Chicago, published in the Journal of Economic Perspectives. Furthermore, because pension funds are highly exposed to market risks, there is only a 5 percent chance that they will perform well enough to meet the needs of retirees in fifteen years.

State governments in the United States had approximately $2 trillion set aside in pension funds and $3 trillion of “stated” pension liabilities in December 2008. By this measure, the funds seemed to be short nearly $1 trillion. But according to Rauh and Novy-Marx, the shortfall is more than three times larger, at $3.2 trillion. The lower estimate, they say, is the result of government accounting standards that require states to apply accounting procedures that severely understate their defined-benefit pension plan liabilities….

New York Times: State debt woes grow too big to camouflage:

…Pensions are debts, too, after all, paid over time just like bonds. But states do not disclose how much they owe retirees when they disclose their bonded debt, and state officials steadfastly oppose valuing their pensions at market rates.

Joshua Rauh, an economist at Northwestern University, and Robert Novy-Marx of the University of Chicago, recently recalculated the value of the 50 states’ pension obligations the way the bond markets value debt. They put the number at $5.17 trillion.

After the $1.94 trillion set aside in state pension funds was subtracted, there was a gap of $3.23 trillion — more than three times the amount the states owe their bondholders.

“When you see that, you recognize that states are in trouble even more than we recognize,” Mr. Rauh said.

With bond payments and pension contributions consuming big chunks of state budgets, Mr. Rauh said, some states were already falling behind on unsecured debts, like bills from vendors. “Those are debts, too,” he said.

In Illinois, the state comptroller recently said the state was nearly $9 billion behind on its bills to vendors, which he called an “ongoing fiscal disaster.” On Monday, Fitch Ratings downgraded several categories of Illinois’s debt, citing the state’s accounts payable backlog. California had to pay its vendors with i.o.u.’s last year.

“These are the things that can precipitate a crisis,” Mr. Rauh said.

Verum Serum points to the recent Stanford study that shows California owing 500-billion (that’s a “B”) dollars in unsecured pensions (and growing):

Yesterday, Stanford released an analysis of California’s pension liability which showed it may be as high as $500 billion, i.e. six times the state’s annual budget. Much of this liability has been hidden behind rosy assumptions of 7.5-8.0% returns on investment.

How did we get here? The Governor’s economic adviser David Crane put it this way:

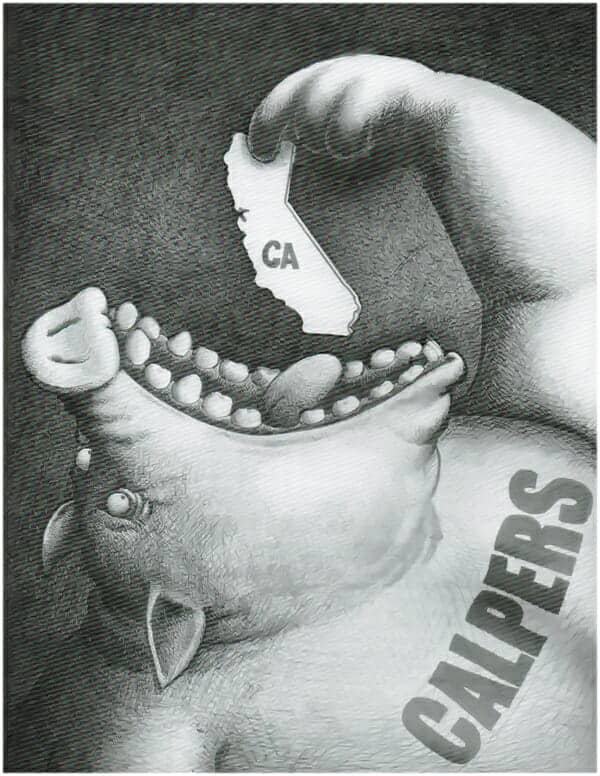

State legislators are afraid even to utter the words “pension reform” for fear of alienating what has become — since passage of the Dills Act in 1978, which endowed state public employees with collective bargaining rights on top of their civil service protections — the single most politically influential constituency in our state: government employees.

Because legislators are unwilling to raise issues that might offend that constituency, they have effectively turned the peroration of Abraham Lincoln’s Gettysburg Address on its head: Instead of a government of the people, by the people and for the people, we have become a government of its employees, by its employees and for its employees.

In short, we got here because unions demanded levels of benefits which the state could not afford. That happened because liberal Governors (Jerry Brown) gave unions the power to put us all in this position….

California’s governor Schwarzenegger commissioned a study by Stanford University, which has found that California’s three public employee pension funds (The California Public Employees’ Retirement System [CalPERS], California State Teachers’ Retirement System [CalSTRS], and University of California Retirement System [UCRS]) lost $109.7 billion in portfolio value in one year (June ’08 to June ’09) and are currently in shortfall of “more than half a trillion dollars.”

American Thinker has a great article on this as well, naming names even:

California’s governor Schwarzenegger commissioned a study by Stanford University, which has found that California’s three public employee pension funds The California Public Employees’ Retirement System [CalPERS], California State Teachers’ Retirement System [CalSTRS], and University of California Retirement System [UCRS]) lost $109.7 billion in portfolio value in one year (June ’08 to June ’09) and are currently in shortfall of “more than half a trillion dollars.”

By law, California taxpayers are required to pay the public employees’ pensions shortfalls that may occur. Local governments cannot “print money” as the federal government does to cover budget deficits.

What should have been considered a huge scandal in the state pension fund system in the past year got little attention but is more pertinent now: The two largest plans, CalPERS and CalSTRS, were reportedly near bankruptcy in 2009 after it was learned the funds had lost from 25%-41% of their value due to risky investments in real estate and the stock market. Former employees of the state plans were accused in January of getting huge fees to direct pension investments to certain banks or ventures.

There are outrageous examples of abuse in the California public pension system.

PensionTsunami.com, which has been tracking the pension fund liability issue for five years, has found that 9, 233 retired members of CalPERS or CalSTRS receive more than $100,000 per year in retirement benefits, amounting to more than a billion dollars a year.

The retired city administrator of Vernon, California, Bruce Malkenhorst, receives an annual pension of $449,675 from CalPERS. Vernon, a Los Angeles suburb, has 92 residents….

The Author of “Pluder” Interviewed from Papa Giorgio on Vimeo.