This is really a story about a GOVERNMENT INDUCED SHIT SHOW. The artificial inflation of a segment of the market that will “trickle-down” (so-to-speak) to many aspects of our lives. And so, with billions given to EV production from the Inflation Reduction Act will accomplish the exact opposite of what the Democrats promised it would do. Of course we all knew this, I am just pointing out the EV connection. As one article notes below,

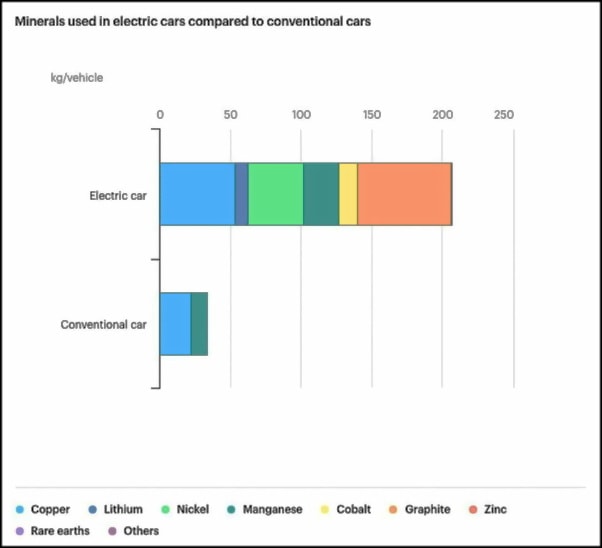

- The automakers are still healing from the chip shortage, which we talked about in one of our previous articles: Chip Shortage Puts a Brake on Automotive Production. They are now faced with lithium supply constraints which are not expected to ease down for a couple of years. And then there is also a looming threat of a shortage of other minerals such as graphite, nickel, cobalt, etc., which are also critical for the production of EV components.

It will take years for economists to sift through the wreckage of Big-Government edicts and messianic proclamations to “save the planet.” For now, all I can do is sound the alarm bells, in my own corner of the WWW.

QUOTE w/MEDIA

This is a FLASHBACK that originally aired on the radio Jul 2, 2013. Dennis Prager interviews George Gilder about his new book, “Knowledge and Power: The Information Theory of Capitalism and How it is Revolutionizing our World.” I found this small bit on Dodd-Frank interesting as it leads to government interference creating a business atmosphere that nets zero information — or — creativity, entrepreneurial investment, or new growth and business.

- “A fundamental principle of information theory is that you can’t guarantee outcomes… in order for an experiment to yield knowledge, it has to be able to fail. If you have guaranteed experiments, you have zero knowledge” | George Gilder (The Fuller Interview Is Here)

EDITOR’S NOTE: this is how the USSR ended up with warehouses FULL of “widgets” (things made that it could not use or people did not want) no one needed in the real world. This economic law enforcers George Gilder’s contention that when government supports a venture from failing, no information is gained in knowing if the program actually works. Only the free-market can do this.

Why the posting of this key idea, or, rightly called an economic law. There are two stories I wish to share that brought me to think about this old audio I uploaded to my YouTube, and just fixed and reuploaded to my RUMBLE.

STORY 1

US to Give Automakers, Suppliers $12B to Produce EVs

The United States is making $12 billion available in grants and loans for automakers and suppliers to retrofit their plants to produce electric and other advanced vehicles, Energy Secretary Jennifer Granholm told reporters Thursday.

The Biden administration will also offer $3.5 billion in funding to domestic battery manufacturers, Granholm said.

For the advanced vehicles, $2 billion of the funding will come from the Inflation Reduction Act which Democrats passed last year, and $10 billion will come from the Energy Department’s Loans Program Office, Granholm said…….

STORY 2

U.S. EV Share Goes Flat At 7.1% Through June As Gas Autos Return

EV share of the new-vehicle market flattened out at 7.1 percent across the first half of the year after growing steadily in 2021 and 2022, according to U.S. new-vehicle registration data from Experian.

Is the party over? Hardly.

But in the fast-growing U.S. market of the moment, as microchip supplies improve and the production of popular gasoline-engine autos returns in force this summer, EVs are no longer outpacing the rest of the car business — at least for now…..

ALSO:

- EVs sat at dealerships for an average of 92 days in the second quarter of 2023 versus 36 days for the same period in 2022. (U.S. NEWS and WORLD REPORT)

However, the push by governments to replace fossil fuels will increase production of these EV vehicles, reducing inflation will be impossible as prices of all sorts of items will greatly increase. 2-billion wasted and doing just the opposite of what Democrats say it would do.

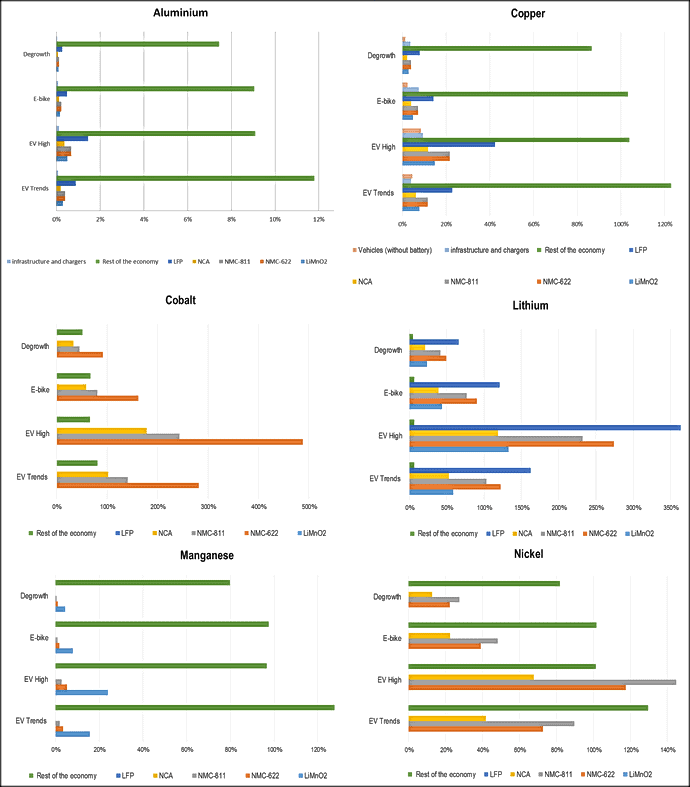

The below articles will deal primarily with Nickel, but the overuse of this material as well as others in battery production due to this artificial inflation by governments will create interference in knowledge to be produced allowing the market [people] to make choices based on supply and demand.

What this means is that a shit show will trickle-down the supply chain. To the cost of stainless steel, to other ingredients key to electronics and all batteries. In other words,

A GOVERNMENT INDUCED SHIT SHOW HAS BEGUN

NATIONAL SECURITY (Sino-Russian)

Global Nickel Mining Industry – Statistics & Facts

Nickel is a chemical element and a transition metal. It is mostly used for high-grade steel manufacturing, and increasingly so, in batteries. Global production of nickel from mines was estimated to amount to a total of 3.3 million metric tons in 2022. The major countries in nickel mining include Indonesia, Philippines, Russia, and New Caledonia. Home to the world’s two largest nickel mines based on production in 2022 was Russia, with the Kola MMC Mine’s production amounting to 151,030 metric tons and the Sorowako Mine producing 77,270 metric tons of nickel. Indonesia has the largest reserves of nickel, tied with Australia, and followed by and Brazil in third place. Interestingly, nickel reserves are among the metals and minerals with the least remaining life years, however, because nickel is a highly recyclable material, this poses less of a problem.

Nickel Mining Companies

The leading companies based on nickel production worldwide as of 2022 were Tsingshan Group and Delong from China, Nornickel from Russia, and Jinchuan Group from Hong Kong [China]. Tsingshan Group alone accounted for a 20 percent share of global nickel production that year. The world’s leading nickel producing companies based on market capitalization as of July 2023, however, were a different cohort: BHP from Australia had the leading market cap, at 155.2 billion U.S. dollars. The Brazilian company Vale came in second, with a market cap of nearly 62 billion U.S. dollars…..

Russia and China Unveil a Pact Against America and the West

In a sweeping long-term agreement, Vladimir Putin and Xi Jinping, the two most powerful autocrats, challenge the current political and military order.

n their matching mauve ties, Russia’s Vladimir Putin and China’s Xi Jinping last week declared a “new era” in the global order and, at least in the short term, endorsed their respective territorial ambitions in Ukraine and Taiwan. The world’s two most powerful autocrats unveiled a sweeping long-term agreement that also challenges the United States as a global power, nato as a cornerstone of international security, and liberal democracy as a model for the world. “Friendship between the two States has no limits,” they vowed in the communiqué, released after the two leaders met on the eve of the Beijing Winter Olympics. “There are no ‘forbidden’ areas of cooperation.”

Agreements between Moscow and Beijing, including the Treaty of Friendship of 2001, have traditionally been laden with lofty, if vague, rhetoric that faded into forgotten history. But the new and detailed five-thousand-word agreement is more than a collection of the usual tropes, Robert Daly, the director of the Kissinger Institute on China and the United States, at the Wilson Center, in Washington, told me. Although it falls short of a formal alliance, like nato, the agreement reflects a more elaborate show of solidarity than anytime in the past. “This is a pledge to stand shoulder to shoulder against America and the West, ideologically as well as militarily,” Daly said. “This statement might be looked back on as the beginning of Cold War Two.” The timing and clarity of the communiqué—amid tensions on Russia’s border with Europe and China’s aggression around Taiwan—will “give historians the kind of specific event that they often focus on.”….

NICKEL SHORTAGE AND BATTERIES

Electric Vehicles And The Nickel Supply Conundrum: Opportunities And Challenges Ahead

…One of the key commodities to realizing this ambition is nickel. Unlike other battery materials such as cobalt and lithium, nickel is unique in not being primarily driven by global battery demand. About 70% of the world’s nickel production is consumed by the stainless steel sector, while batteries take up a modest 5%.

S&P Global Market Intelligence forecasts global primary nickel consumption to rebound year-on-year due to stainless steel capacity expansions in China and Indonesia. Demand outside China is expected to be the main driver of global growth in volume terms in 2022 and global consumption is forecasted to rise at a compound annual growth rate of about 7% between 2020 and 2025.

The battery sector’s nickel demand is also expected to accelerate substantially, with many predicting it to near 35% of total demand by the end of the decade….

Why An Electric Vehicle Battery Shortage Could Be a Big Problem

With more electric vehicle orders than ever, can our international supply chain keep up with the demand? Or can the U.S. constrict its own battery plants in time?

Consumers have never been more interested in electric cars and climate change goals. But with automakers scrambling to produce more EVs than ever, we could be facing a problematic shortage in the near future.

Jerry, your favorite super car app, breaks down why the predicted lack of inventory could be much worse than the current computer chip shortage.

A Storm Is Brewing

With a looming battery shortage, carmakers are doubling down on mining raw battery materials like lithium, nickel, and cobalt. The shortage would affect not only sourcing materials but processing and building the actual batteries as well.

Some companies are taking battery manufacturing into their own hands and constructing exclusive battery plants.

Rivian Automotive Inc. Chief Executive RJ Scaringe said, “Put very simply, all the world’s cell production combined represents well under 10% of what we will need in 10 years,” according to Market Watch. Essentially, at least 90% of the necessary supply chain to keep up with demand does not exist.

…CNN notes that “the United States sources about 90% of the lithium it uses from Argentina and Chile, and contributes less than 1% of global production of nickel and cobalt, according to the Department of Energy. China refines 60% of the world’s lithium and 80% of the cobalt.”

No Ev Battery Plan For The Long-Term

We all know about Biden’s goal to ensure that at least half of all vehicles will be electric by 2030. We’re talking a $7.5 billion electric vehicle charging infrastructure. California even pledged that by 2035, all cars must be zero-emission vehicles.

Though the Biden administration has pushed for more EV production in the short term, there aren’t long-term plans pertaining to electric batteries. Did you know it can take at least seven to 10 years to set up a mine?

Unfortunately, the U.S. is very dependent on foreign countries that have the manufacturing capacity and raw materials that we don’t.

If for political reasons China shut down the world’s electric vehicle transition, what happens then? It’s also possible that China could restrict “exports of lithium hydroxide to give its domestic electric battery and vehicle manufacturers an advantage,” according to CNN.

As you can imagine, the price for critical battery metals has shot through the roof. According to CNN, “Some automakers like Tesla have made deals with suppliers of raw materials recently, which may help insulate them from shortages.”

If you’ve looked into buying an electric car recently, you’re very familiar with the federal tax credit awarded to EV car owners.

According to CNN, “The government has offered subsidies for electric vehicle purchases and charging infrastructure, but the mining sector hasn’t seen similar support, the battery metals experts say.”

[….]

Will Super-Sized EV Batteries Strain the Supply Chain?

Electric vehicle battery costs soared in 2022. But that doesn’t seem to have slowed the pace of automakers planning to adopt ever larger battery packs to satisfy ever-higher EV driving range claims.

As Bloomberg recently calculated, using EV models from the U.S., Europe, and China, the average pack size is now around 80 kwh, from in the vicinity of 40 kwh in 2018, and the growth trend is expected to continue for some years.

Meanwhile, average global EV range is now at 210 miles—up dramatically versus the average range of 143 miles in 2018.

That also means average EVs are less efficient, the byproduct of a shift to larger EVs.

EV driving range has been increasing at a rate of about 10% each year. Bloomberg sees the market finally reaching a ceiling in its demand for more range at 250-310 miles depending on the size of the EV, with the smallest city cars well below that range.

[….]

According to Bloomberg New Energy Finance, the Silverado EV’s pack, topping 200 kwh, represents $25,000 to $27,000 of direct cost to GM. That happens to be as much as a well-equipped 2024 Chevrolet Trax crossover, or a base 2024 Chevrolet Trailblazer SUV.

The Chevy Silverado EV won’t even have the biggest battery among full-size electric trucks. Ram plans a gigantic 229-kwh pack for its upcoming Ram 1500 REV.

The Silverado EV’s battery pack has more than twice the capacity versus that of the top Lucid Air that can go more than 500 miles on a charge. It’s also enough to power an average American house for almost three weeks, based on the U.S. Energy Information Administration’s 2021 household daily average of 10.632 kwh.

Ford isn’t going to go to 600 miles of range and thinks the sweet spot is around 350 miles. Mazda has said that long-range EVs aren’t the future…..

Behind the 2023 Surge in Battery Demand for EVs

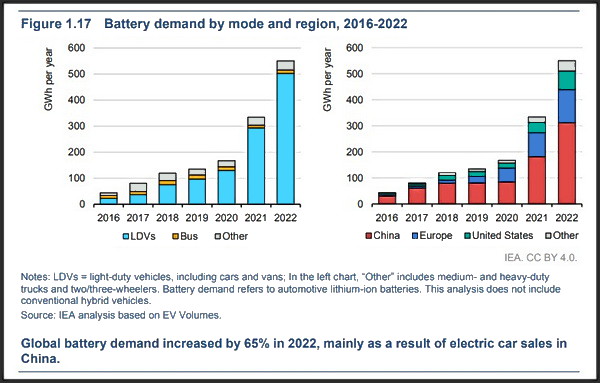

Global sales of electric cars are set to surge to yet another record this year, expanding their share of the overall car market to close to one-fifth and leading a major transformation of the auto industry that has implications for the energy sector, especially oil. That’s according to the International Energy Agency’s (IEA) recent report, “Global EV Outlook, 2023”, accessible here [as a PDF], which, in its 142 pages, shines a bright light on the remarkable dynamics that have unfolded in the field of battery demand for Electric Vehicles (EVs). This gallery summarizes the IEA report to navigate six compelling sides of the industry’s transformative journey. It begins with a surge in battery demand for EVs, outlining how, in 2022, it soared by approximately 65%, reaching a colossal 550 GWh from 330 GWh in 2021. This growth, fueled by a 55% increase in electric passenger car registrations, is a global phenomenon, yet it finds its epicenter in China and the United States.

[….]

1. Battery demand by mode and region, 2016–2022:

IEA’s report states that the demand for lithium-ion (Li-ion) batteries in the automotive sector surged significantly in 2022, rising by approximately 65% to reach 550 GWh, up from about 330 GWh in 2021. This remarkable growth was primarily attributed to the increasing sales of electric passenger cars, which saw new registrations rise by 55% in 2022 compared to the previous year.

In China, the demand for batteries in the automotive industry experienced an even more substantial increase, exceeding 70%. This coincided with an 80% increase in electric car sales in 2022 compared to 2021. However, this upward trajectory in battery demand was somewhat tempered by the rising prevalence of Plug-in Hybrid Electric Vehicles (PHEVs).

Meanwhile, in the United States, the demand for vehicle batteries also witnessed robust growth, expanding by approximately 80%, even though electric car sales only saw a comparatively modest increase of around 55% in 2022 relative to the preceding year.

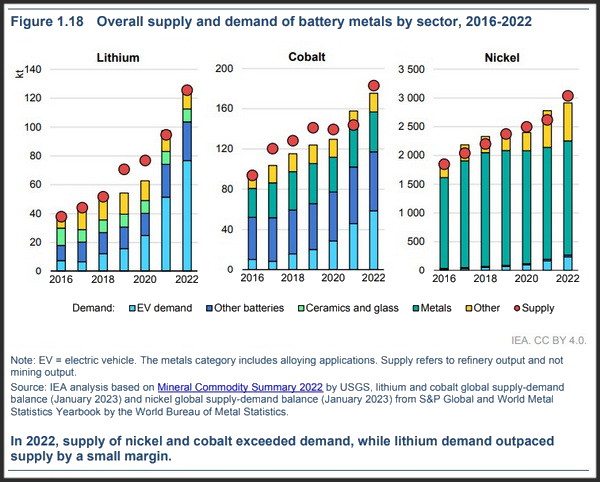

2. Overall supply and demand of battery metals by sector, 2016–2022

The surge in battery demand is spurring the need for essential materials. In 2022, there was still an imbalance between the demand for lithium and its supply, a situation that persisted from 2021. This discrepancy occurred despite a significant 180% rise in production since 2017.

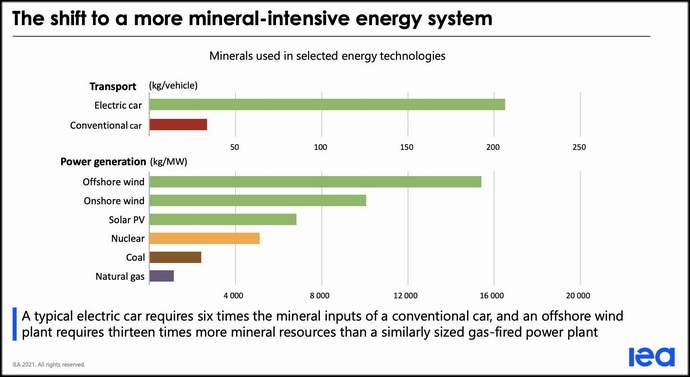

This chart shows that in 2022, EV batteries accounted for approximately 60% of the demand for lithium, 30% for cobalt, and 10% for nickel. In contrast, just five years prior, in 2017, these proportions were roughly 15%, 10%, and 2%, respectively.

(READ THE REST! – Great Summary of larger report! Maria Guerra’s articles are now my first stop on this topic)

Electric Vehicle Industry Jittery over Looming Lithium Supply Shortage

The transition to Electric Vehicles (EVs) is picking pace with concentrated efforts to achieve the net-zero carbon scenario by 2050. The International Energy Agency (IEA) estimated that global EV sales reached 6.6 million units in 2021, nearly doubling from the previous year. IEA projects that the number of EVs in use (across all road transport modes excluding two/three-wheelers) is expected to increase from 18 million vehicles in 2021 to 200 million vehicles by 2030, recording an average annual growth of over 30%. The estimation is based on policies announced by governments around the world as of mid-2021. This scenario will result in a sixfold increase in the demand for lithium, a key material used in the manufacturing of EV batteries, by 2030. With increasing EV demand, the industry looks to navigate through the lithium supply disruptions.

Lithium Supply Shortages Are Not Going Away Soon

The global EV market is already struggling with lithium supply constraints. Both lithium carbonate (Li2CO3) and lithium hydroxide (LiOH) are used for the production of EV batteries, but traditionally lithium hydroxide is obtained from processing of lithium carbonate, so the industry is more watchful of lithium carbonate production. BloombergNEF, a commodity market research provider, indicated that the production of lithium carbonate equivalent (LCE) was estimated to reach around 673,000 tons in 2022, while the demand was projected to exceed 676,000 tons LCE. In January 2023, a leading lithium producer, Albemarle, indicated that the global demand for LCE would expand to 1.8 million metric tons (MMt) (~1.98 million tons) by 2025 and 3.7 MMt (~4 million tons) by 2030. Meanwhile, the supply of LCE is expected to reach 2.9 MMt (~3.2 million tons) by 2030, creating a huge deficit.

There is a need to scale up lithium mining and processing. IEA indicates that about 50 new average-sized mines need to be built to fulfill the rising lithium demand. Lithium as a resource is not scarce; as per the US Geological Survey estimates, the global lithium reserves stand at about 22 million tons, enough to sustain the demand for EVs far in the future.

However, the process of mining and refining the metal is time-consuming and not keeping up pace with the surging demand. As per IEA analysis, between 2010 and 2019, the lithium mines that started production took an average of 16.5 years to develop. Thus, lithium production is not likely to shoot up drastically in a short period of time.

Considering the challenges in increasing the lithium production output, industry stakeholders across the EV value chain are racing to prepare for the anticipated supply chain disruptions.

[….]

The automakers are still healing from the chip shortage, which we talked about in one of our previous articles: Chip Shortage Puts a Brake on Automotive Production. They are now faced with lithium supply constraints which are not expected to ease down for a couple of years. And then there is also a looming threat of a shortage of other minerals such as graphite, nickel, cobalt, etc., which are also critical for the production of EV components. While the world is determined and excited about the EV revolution, the transition is going to be challenging.

So challenging in fact that GOOGLE years ago admitted the problem:

We came to the conclusion that even if Google and others had led the way toward a wholesale adoption of renewable energy, that switch would not have resulted in significant reductions of carbon dioxide emissions. Trying to combat climate change exclusively with today’s renewable energy technologies simply won’t work; we need a fundamentally different approach.

[…..]

“Even if one were to electrify all of transport, industry, heating and so on, so much renewable generation and balancing/storage equipment would be needed to power it that astronomical new requirements for steel, concrete, copper, glass, carbon fibre, neodymium, shipping and haulage etc etc would appear. All these things are made using mammoth amounts of energy: far from achieving massive energy savings, which most plans for a renewables future rely on implicitly, we would wind up needing far more energy, which would mean even more vast renewables farms – and even more materials and energy to make and maintain them and so on. The scale of the building would be like nothing ever attempted by the human race.”

Google Joins the Common Sense Crew On Renewable Energies ~ Finally! (RPT)

Global Lithium Shortage Could Severely Impact EV Makers In 2025

Here’s what could happen if demand outstrips supply.

The automotive industry could be in for a shock, with a new report predicting that a lithium shortage is on the horizon. Citing BMI, a research unit of Fitch Solutions, CNBC reports that by 2025, demand will outstrip supply. The BMI report puts this down to China’s soaring appetite for the alkali metal.

“We expect an average of 20.4% year-on-year annual growth for China’s lithium demand for EVs alone over 2023-2032,” reads the report. Lithium is an essential component in electric vehicle batteries. It is used in most battery packs, including those found in popular vehicles such as the Tesla Model S. According to Euronews, the electric sedan uses approximately 26 pounds of lithium in its battery pack.

While China’s lithium demand will increase by 20.4% year-on-year, the country’s supply will only grow by 6% over the same time. It’s worth noting that China is the world’s third-largest lithium producer after Australia and Chile…..