Freedom Toons noted:

- This was inspired by an actual democrat ad I saw a while back where a republican man in a truck is chasing minority children around lmao google “American Nightmare” from the Latino Victory Fund

Freedom Toons noted:

This is what happens when one party controls government in the state:

John and Ken discuss SB-350 Clean Energy and Pollution Reduction Act of 2015 of California. You think gas prices are high now? Just wait!

See an article on this at Townhall.

In total, Exxon makes about 8 cents on the dollar for everything it does, soup to nuts: Its profit margin for the past 20 quarters averages 8.26 percent. That is, it is worth noting, a good deal lower profit margin than Wired parent company Conde Nast generally achieves, according to the company’s CEO, Charles Townsend. Apple’s profit margin runs about three times Exxon’s. Chip-maker Linear Technology’s profit margins routinely run four times those of Exxon. Energy is a high-volume business, not a high-profit-margin business. (National Review)

This comes by way of Breitbart:

Effective January 1st, drivers in California will be in for a shock as gas prices jump. This overnight price increase has nothing to do with the fluctuations of the market, nor will drivers be getting a better grade of gasoline. It’s simply the price of supporting a government that wants to control your every move.

Under complete Democrat domination, Gov. Jerry Brown’s appointee to the California Air Resources Board (CARB), Mary Nichols, has decreed that every driver must pay for another level of government control. As California singlehandedly attempts to combat the ever-elusive “global warming”—now conveniently renamed “climate change”—CARB is putting gasoline and diesel fuel under the Cap-and-Trade scheme authorized by AB32 (known as the Global Warming Solutions Act).

It doesn’t matter that theres no evidence that raising the cost of fuel will do anything to alleviate a problem that is rooted in llaklitics instead of science. By requiring refiners to buy a permit, this unelected board is doing nothing more than confiscating capital from ordinary Californians. Even though the cost is passed on at the pump, it will be paid by more than just drivers: the cost of every product that must be transported on California roads will cost more.

And for what? The only clear beneficiary of this hidden tax on fuel are the bureaucrats whose ranks will increase, and the Democrat politicians whose socialist programs will be funded, further solidifying their control over every Californian. This is how government continues to grow faster than the economy at large—and the never-ending growth of government is the greatest threat to our future, and our freedom. Tomorrow, 900 new laws take effect, many of which limit our freedom or raise the cost of living in the most oppressed state in the union….

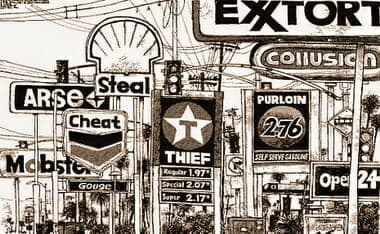

So let us recap some of the taxes imposed on California drivers per gallon of gasoline (a sorta update to an older post):

That adds up to roughly 55-cents per gallon, not including state and local sales tax. This new tax will add a minimum of about 10-cents to this… meanwhile “Evil Big Oil” makes out like a bandit! with their 8-cents a gallon profit margin. Here’s an old 2007 Neil Cavuto discussion about essentially the above… lackluster profit margins for evil oil companies (my 2nd ever uploaded video onto my YouTube channel):

And as Fox already pointed out, these taxes like others will go to pet projects. Now, Jerry Brown’s pet projects versus covering the 500-billion dollars in un-subsidized retirement promises to California workers.

Via HotAir:

Via Big Journalism

Via The Blaze

Many believe that the gas companies are gauging us… this is just not the case. For EVERY gallon of gasoline sold to Americans from Exxon, Exxon makes $.09 profit (yes, you read that right, nine-cents!)! I recently had a discussion with a democratic co-worker whom had the same idea about Exxon gauging us. For every gallon of gas we buy the government puts a total of $.50 of tax on it. We argued some about the total amount of tax, but I decided that I wouldn’t push the point… so I agreed that we will use the tax rate as posted on California pumps.

Which is $.18. So I said that if Exxon is making nine-cents ($.09) profit on a gallon of gas and there is a eighteen-cents ($.18). Let’s assume that the 8.4 billion dollar profit for Exxon last quarter was only from Americans, then the government “profit” is 16.8 billion. I asked my Democrat co-worker if we were to compare “SOCIAL CAUSES” between Democrat policies and Republican policies… which party has more “social programs” (welfare, universal health care, Medicare, school lunches, and the like), he agreed with me that the Democrats would support more of these types of programs.

I then asked how these programs are paid for. He realized his mistake now, but answered anyways… taxes. So I said he should be happy that the government has made “windfall profits,” maybe California can be in the black for once. I then made another point. I asked him what is the best way to make something increase in value? He answered that one would make it scarce – like diamonds, or the Federal reserve controlling inflation by letting more or less dollars into the market. He asked what that had to do with gas. I then answered by asking a question:Who is more beholden to environmental groups and causes, the Democrats or Republicans?

My co-worker said the Democrats. I then said that in the past almost FORTY YEARS we haven’t built a refinery to make crude oil into gas… I then asked him if he knew why? He didn’t. Mostly because environmental groups like the Sierra Club and others have successfully stopped us from building them. I asked if he could answer that with the growth of China’s infrastructure and shift towards industry, as well as India’s shift towards the same, if just those two countries alone (comprising half the worlds population) have increased exponentially their demand for “fossil” fuels and the companies that supply that need cannot increase production – that “that” will naturally – at some point – bring up the price of not only fuel, but any good to be sold, who’s fault is that????? (I put fossil fuel in ” ” because I do not believe that oil is a fossil fuel, research is showing that it is “a-biotic,” and that the earth is producing it always as part of the natural inner-working of the planet. The real red-hearing is making us believe that it will run out, which is another belief that has kept the prices high. So environmental “Doomsday” predictions about a limited supply of “fossil” fuel are “fueling” the hype and price as well… no pun intended.)

Exxon’s fault? Or the same people – liberal democrats – who stopped us from drilling in ANWAR a decade ago which could have produced enough barrels each day to match what we get from Venezuela? It seems funny to me that the people bitching about the problem now are the same ones that caused it to begin with. I then zinged my co-worker about his belief (which mirrors Al Gores) that fossil fuels are hurting our Earth via “Global Warming.” I asked him what the best way to get people to conserve or look for alternative fuels would be. By now he was catching up to me, he said somewhat sheepishly “to make the prices higher so people are forced to look elsewhere.”

So Stop Bitching!!! I would be more pissed at our inept politicians about drilling and building refineries in “The 48” rather than demand Exxon stop making a profit and socialize them like many other now defunct nations (U.S.S.R. and NAZI Germany) have tried, and like they are once again trying in South America.

Who’s to blame for high gasoline prices?

San Francisco Chronicle

Brian P. Simpson

Thursday, April 14, 2005

Gasoline prices are at record highs again. Many think oil companies are to blame. A Field Poll from May 2004 showed that 77 percent of Californians believed this to be true. But this just shows that people are misinformed about who’s causing high gas prices. Investigating a few clues can help find out who’s responsible.

One thing is certain: Oil companies are not the culprits. In California, where gas prices are among the nation’s highest, the oil industry has been repeatedly investigated yet no evidence of “price manipulation” has ever been found.

Though other factors cause high gas prices, such as high taxes and increasing world demand, environmental regulation is among the primary reasons. For example, environmental regulation has significantly restricted drilling for oil in Alaska and on the continental shelf. More drilling will increase the supply and thus lower prices.

Furthermore, 18 different gasoline formulations are in use across the United States, making it much more costly to produce and distribute gasoline. These blends aren’t needed due to requirements of automobile engines, nor are they required by oil companies. The blends, including different ones used at different times of the year and in different geographic areas, are imposed by environmental regulations. Among other things, the regulations force refiners to incur greater costs in switching from the production of one blend to another. They also force refiners to produce a more costly “summer blend,” which is partially responsible for the rise in price.

The situation is worse in California, where environmental regulations are strictest. For example, California was one of three states to require the removal of the octane booster MTBE in January 2004. This reduced the gasoline supply by almost 10 percent, because MTBE accounted for about 10 percent of the volume in the old gasoline formula. Using corn-based ethanol as a replacement doesn’t help much, because California’s strict emissions regulations require the removal of almost the equivalent in other gasoline components to accommodate ethanol. Ethanol must also be shipped from the Midwest in trucks, because it cannot be produced in refineries and doesn’t travel well through pipelines.

As a result, gas prices were predicted to increase by 35 to 40 cents per gallon. Given that the average price in 2004 was almost 30 cents higher than in 2003, these predictions weren’t too far off.

Additionally, California required gasoline stations to install double- walled underground tanks, which forced many stations to rip perfectly good single-walled tanks out of the ground. California also imposes the harshest emissions requirements in the country, necessitating the use of a more costly, special blend of gasoline not produced anywhere else. It’s no accident that gas in California is generally 30 to 40 cents above the national average.

From drilling to refining to distribution, environmentalists have done everything they can to raise gas prices.

The above raises a question: Why do environmental regulations exist?

One might think they exist to protect consumers, but the evidence doesn’t show this. For instance, MTBE was banned based on claims that it causes cancer. However, it has never been shown to be a danger to humans in the amounts to which they are typically exposed, according to a study by the federal Environmental Protection Agency. Claims that it “causes cancer” are based on experiments in which mice were fed doses almost 70,000 times larger than to what humans are typically exposed. No scientist worthy of the title would make claims based on that extrapolation.

Environmentalists are not actually concerned with the well-being of man. Their real motive is to sacrifice man to nature by stopping industrial activity. For instance, Adam Kolton of the Alaska Wilderness League states, “Drilling the wildest place in America is objectionable no matter how it’s packaged.” David M. Graber, a research biologist with the National Park Service, states, “We are not interested in the utility of a particular species, or free-flowing river, or ecosystem, to mankind. They have … more value — to me — than another human body, or a billion of them.”

Oil companies deserve praise for producing an abundance of gasoline despite the massive burden of environmental regulations foisted upon them. To increase the gasoline supply, we need to start by eliminating needless environmental regulations, including drilling bans and prohibiting certain octane boosters. If the government makes the choice to protect people’s freedom, gasoline prices below a dollar-per-gallon won’t be just a relic of the past.

Brian P. Simpson is an assistant professor of economics at National University in San Diego and author of the upcoming “Markets Don’t Fail!” (Lexington Books).

February 19, 2006 2006 WorldNetDaily.com

As of Friday, Hawaii drivers were paying the highest per-gallon costs in the nation, with record-setting prices of as much as $3.39. A year ago, consumers in Hawaii were paying nearly $1 a gallon less. The national average today is $2.24 a gallon.

The price controls were set by the state Public Utilities Commission Sept. 1. The idea was that the limits would bring Hawaii’s gas prices in line with the mainland, which has traditionally had lower prices on many goods because of the transportation costs involved in delivering product to the islands.

Now there are moves afoot in the Hawaii legislature to scrap the price controls.

Hawaii’s current controls base limits on per-gallon charges by averaging wholesale gas prices in New York, Los Angeles and the Gulf Coast. The PUC then adds a 4-cent “location adjustment” fee and another 18 cents as a market margin factor. Then a few cents more are added for transportation costs to various islands. Wholesale prices are set by the bureaucrats every Wednesday and go into effect the following Sunday.

In a recent check Hawaii’s average cost per gallon was $2.84, followed by New York at $2.57, California at $2.53 and Connecticut at $2.47. The least expensive gas in the country is in Utah at $2.13.

Before the gas cap law, Hawaii paid an average of 44 cents more per gallon than the rest of the mainland. Since the law went into effect in September, however, the differential has increased to more than 50 cents per gallon.

Still, the proponents of the gas cap insist that prices would be even higher without the limits. Rep. Marcus Oshiro, an advocate of the gas cap, claims the new law has actually saved islanders $33 million. But even he is having second thoughts.

He said this week Hawaii has “achieved price parity with the mainland and in that sense, the law has been working.” But he also notes that “oil companies have posted record profits during this period and without greater transparency, we are unable to determine whether the cap has allowed unreasonable profits.

“Basically the implementation of the gas cap was not as we expected,” said Oshiro, the House majority leader. “The enforcement was not as vigorous as we thought it could be.”

Three House committees in Hawaii this week approved a proposal to suspend the gas cap as of July 1, while mandating the PUC to closely monitor data on the petroleum business in Hawaii, including new standards for the kinds of confidential business information the industry needs to provide to the PUC.

One of the gas cap’s key supporters is Senate Consumer Protection Chairman Ron Menor, who said he will do everything he can to make sure the cap stays in place.

“I cannot support a repeal because I think that would really be caving in to the oil industry that doesn’t want to be regulated,” Menor said.

Menor is proposing changes to the cap which he says could save drivers an extra 16-cents per gallon.

“Instead of talking about a repeal or suspension, legislators ought to be seriously considering strengthening and improving the law so we can provide even greater savings to consumers,” Menor said.

Meanwhile, free-market advocates say retailers charged the maximum allowable under the limits to compensate for the threat of not being able to profit in the future.