Defending Defense:

Setting the Record Straight on US Military Spending Requirements

(To see references, download PDF)

Myth

Additional defense spending is unnecessary as the United States already spends more on defense than half the world combined.

Fact

No other country in the world has the enduring vital national interests of the United States, and therefore the U.S. military has global reach and responsibilities. Comparing the unique needs of U.S. security and the resources required against those of other countries is misleading. Further, it is not surprising that the richest nation on earth and history’s “sole superpower” should have a first-rate military; the overall dollar cost is mostly a measure of the size of our economy. What is surprising is that we get so much from such a small proportion of our wealth. As Mackenzie Eaglen of the Heritage Foundation writes,

Defense spending is near historic lows… Between 2010 and 2015, total defense spending is set to fall from 4.9 percent to 3.6 percent of gross domestic product (GDP), even though the nation has assigned more missions to the military over the past two decades.[1]

A narrow focus on strictly dollar figures is also misleading. Consider China’s military budget, which Beijing claims is $78 billion for this year. The Pentagon estimates that the relative “purchasing power” of the Chinese military is actually closer to $150 billion, in good part because China does not have to pay their soldiers, sailors, and airmen anything comparable to what the United States pays its servicemen and women.[2] By this yardstick, China moves from fifth place in overall military spending among the nations of the world to second.[3] And more to the point, China’s defense expenditures are focused primarily on gaining military leverage in a distinct region of the world—Asia—while the U.S. military has responsibilities everywhere. The resources the U.S. military can actually deploy “in theater” are not vastly superior to those of the Chinese. Simple comparisons of defense expenditures are deceptive measures of the unique needs of America’s armed forces.

Myth

Pentagon budgets were a “gusher” of new money in the Bush Administration.

Fact

In his recent drive to cut overhead, Defense Secretary Robert Gates indeed described the emergency supplemental appropriations for the costs of Iraq and Afghanistan as a “gusher.”[4] But as AEI’s Gary Schmitt and Tom Donnelly have written,

The budget increases that have occurred…are largely tied to fighting the wars. When Bill Clinton left the White House and Dick Cheney told the military that “help [was] on the way,” the defense burden stood at 3 percent of GDP—a post-World War II low. When George W. Bush headed out the door, the figure for the core defense budget was about 3.5 percent. This is an increase, to be sure, but not one to make the military flush after a decade of declining budgets and deferred procurement.[5]

One of the consistent and correct purposes of the wartime supplementals was to “reset” the force—to return the military to at least pre-war readiness levels. This goal is still a long way off. The backlogs at service repair depots will take years to work through.

More profoundly, very little wartime funding went to increase the number of U.S. ground forces. The strains on soldiers and Marines—reflected in rising suicide rates, for example—have yet to be fully calculated. And despite the withdrawal of combat forces from Iraq and President Obama’s deadline for drawdown in Afghanistan, the Army and Marine Corps will continue to deploy overseas for years, an effort that can only be sustained by a reduced pace of operations, sharing the constant burden across a larger force.

There is a moral obligation not only to bind the wounds and tend to the families of those who have fought so well and so long, but also to give them what they need to continue to answer the call to service. Further, the government’s Constitutional obligation is to “provide for the common defense,” and to “secure the blessings of liberty” now and for future generations. This is the government’s fundamental obligation to its citizens and its cardinal contribution to our liberties.

[….]

Myth

Current levels of defense spending are unaffordable.

Fact

The defense budget is a relatively small slice of the $14-plus-trillion American pie. And it’s a shrinking slice: as a percentage of our economy and as a percentage of the federal budget, the burden of defense is declining. President Obama’s long-term budget projections also reduce Pentagon spending in real dollars.

Moreover, the idea that defense cuts will restore fiscal health simply does not add up: suppose Pentagon spending for 2011—$720 billion—were eliminated entirely.[7] This would only halve this year’s federal deficit of $1.5 trillion. And defense spending is a drop in the ocean of today’s $13.3 trillion of government debt. From the Korean War to the collapse of the Soviet Union, total U.S. defense spending was about $4.7 trillion.[8] So had there been no military spending at all during the Cold War, the savings would not equal even half our current national debt.

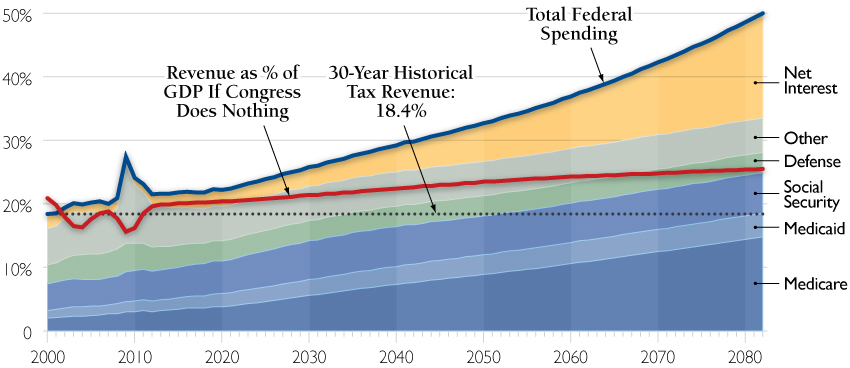

Talking about defense spending in isolation while discussing the overall federal budget is also misleading. Defense is not the source of the federal government’s fiscal woes. As Mackenzie Eaglen notes,

The substantial decline in the defense share of the budget largely reflects the dramatic growth of entitlement spending. Entitlements now account for around 65 percent of all federal spending and a record 18 percent of GDP. The three largest entitlements— Social Security, Medicare, and Medicaid—eclipsed defense spending in 1976 and have been growing ever since. If future taxes are held at the historical average, these three entitlements will consume all tax revenues by 2052, leaving no money for the government’s primary constitutional obligation: providing for the common defense.[9]

Over the past decade, necessary defense spending increases are responsible for less than 20 percent of all new spending from 2001 to 2009. This does not even include 2009 stimulus spending totaling $787 billion, with almost no money for defense.

Myth

The United States should not be “the world’s policeman.”

Fact

At a cost of less than one nickel of the American taxpayers’ dollar—and only 4.9 percent of U.S. GDP—the United States has fought two wars and provided the essential backbone for a system of global security; by any measurement, it’s an amazing bargain.[10]

The investments made during the Cold War—including the Reagan build-up— continue to pay global dividends. Europe, for the first time in centuries, enjoys a durable peace. East Asia, for millennia a theater of violent competition, is emerging as an economic dynamo, lifting hundreds of millions out of poverty.

Yet this peace and the prosperity it helps to create are not self-generating or selfsustaining. No other nation, or group of nations, is ready, willing or able to take on America’s role. As the Quadrennial Defense Review Independent Panel observed, the future is

…likely to place an increased demand on American “hard power” to preserve regional balances. While diplomacy and development have important roles to play, the world’s first-order problems will continue to be our security concerns….As the last 20 years have shown, America does not have the option of abandoning a leadership role in support of its national interests….Failure to anticipate and manage the conflicts that threaten those interests…will not make those conflicts go away….It will simply lead to an increasingly unstable and unfriendly global climate and, eventually, to conflicts America cannot ignore.[11]

In short, the cost of preserving America’s role in the world is far less than would be the cost of having to fight to recover it or, still greater, the cost of losing it altogether. While many Americans would prefer to see our allies and partners play a larger part in securing the blessings of our common liberty, no president of either political party has backed away from America’s global leadership role —a bipartisan consensus that remains strong evidence that American leadership is still necessary to protect the nation’s vital interests.