Dennis Prager interviews California Senator John Moorlach (37th District) about California Assembly Bill 2943, HOWEVER, the conversation started out with budgets and economics. Sen. Moorlach is a CPA after all. This is the section I clipped for use with friends and family that state California is money rich when you speak about our states debt.

Other related audio is here:

- The Author of “Plunder” Interviewed (Dennis Prager)

- A Quick 101 Tour on Taxes & Liabilities (Larry Elder)

Here are half of Senator John Moorlach’s six points in his article entitled, “Budget Primer: 6 Key Measures Of California’s Fiscal Health” (January, 2017):

1. California’s Net Financial Position

California’s “net” unrestricted financial position is a $169 billion deficit ($4,375 per person) according to the most recent Comprehensive Annual Financial Report (CAFR).

This figure should be positive for healthy organizations. It is derived by tallying the state government’s assets (monetary funds, investments, buildings, roadways, bridges, parks, etc.) and subtracting its obligations. The last positive position California had was during Governor Pete Wilson’s final term where the state had $1.5 billion in unrestricted net assets.

California is now ranked the worst state, below Illinois, whose net position is a negative $143 billion, or $11,174 per person. Illinois’ finances are so bad, they’re telling lottery winners that they may have to delay their payments.

Deferred maintenance for the state’s roads and highways is some $59 billion.

2. Estimates of California Unfunded Pension Liabilities

- CalPERS: $114.5 billion

- CalSTRS: $76.2 billion

- UC Pensions (UCR) : $12.1 billion

*NOTE: For the 2015/16 fiscal year, CalPERS planned for a 7.5% rate of return, but only managed to achieve a 0.6% rate of return. Seven percent of a $400 billion liability means a shortfall of $28 billion (some 20% of Governor Brown’s general fund budget.)

3. Current Unfunded Retiree Medical Liability

California has the nation’s highest unfunded retiree medical liability at $74.1 to $80 billion.

A John and Ken reality check (posted January 2017):

John and Ken speak to Marc Joffe of the California Policy Center (http://californiapolicycenter.org/) in regard to these recent articles on the subject of California’s fiscal emergency:

- California’s Total State and Local Debt Totals $1.3 Trillion (Article)

- Can California’s Economy Withstand $1.3 Trillion of Government Debt? (Article)

One aspect Marc Joffe mentioned would be a way to overcome this “debt” is to increase California’s population… however, we see through some recent stories…

- California Won’t Fall Into The Sea — It’s Moving To Texas Instead (Article)

- The Exodus of People Moving Away From California Is Becoming an Avalanche (Article)

…this is not a viable option… nor will it be as long as Democrats are in charge:

In other words, Californians are doomed if remaining on this course.

See also:

- 500-Billion Unsecured California Pensions and growing; 3.2 Trillion Nationally (My Post)

- California’s Half-Trillion-Dollar Pension Fund Mess: Blame Jerry Brown (Article)

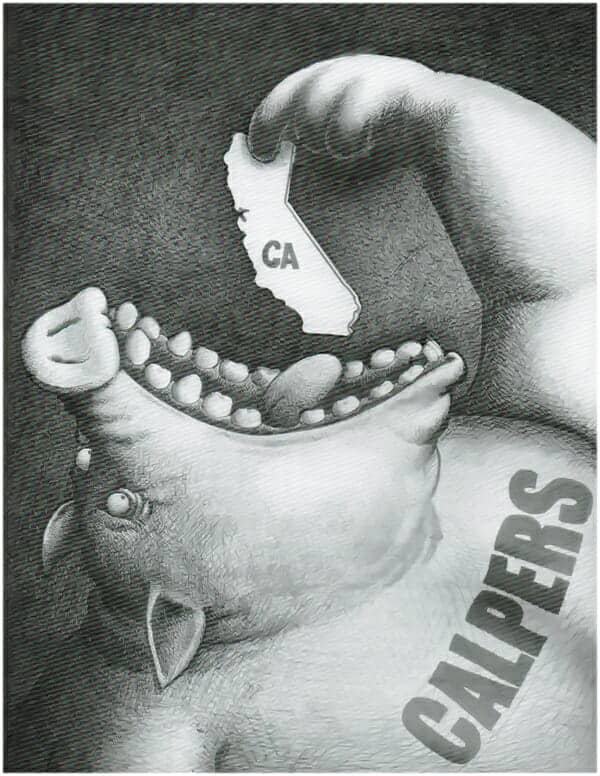

- The Pension Fund That Ate California (Article, click pic below) <<< MUST READ