- “A fundamental principle of information theory is that you can’t guarantee outcomes… in order for an experiment to yield knowledge, it has to be able to fail. If you have guaranteed experiments, you have zero knowledge” ~ George Gilder

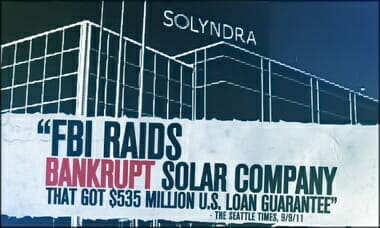

Interview by Dennis Prager {Editors note: this is how the USSR ended up with warehouses FULL of “widgets” (things made that it could not use or people did not want) no one needed in the real world. This economic law enforcers George Gilder’s contention that when government supports a venture from failing, no information is gained in knowing if the program actually works. Only the free-market can do this.}

From transportation to energy, and everything in between, should the government invest money in as many promising projects as possible? Or would that actually doom many of those ventures to failure? Burt Folsom, historian and professor at Hillsdale College, answers those questions by drawing on the fascinating history of the race to build America’s railroads and airplanes.