Nancy Pelosi’s husband is attacked in an alleged home invasion; the media and Democrats blame Republicans; and Elon Musk’s Twitter takeover continues.

Biased Media

Tom Cotton Schools CBS for Blaming Conservatives for Pelosi Attack

Tom Cotton schools CBS:

- Senator Tom Cotton (R-AR) finally put a stop on Tuesday to CBS Mornings’s attempts to blame conservatives and Republicans for the brutal attack on Paul Pelosi by a drug-addicted, mentally ill, and former Green Party-supporting nudist. During the six-plus-minute interview meant to promote his new book, Cotton calmly beat down the repeated aspersions from co-host Tony Dokoupil by citing the left’s double standard on crime and political violence…….. (great read over at NEWSBUSTERS)

Trump Lost By 42,918 Votes (Larry Elder & MSNBC’s Steve Kornacki)

Originally Posted Feb 2, 2021

UPDATED WITH TONY BOBULINSKI’S POINT

Tony’s point is that if you take that number (42,918) and essentially half it, the election would have gone to Trump. There was easily that many votes that should have been rejected due to fraudulent ballots.

I combine a couple segments of Larry Elder showing that to say this election was close and maybe it was so close that small court cases would have changed the outcome. Which is why I include Rand Paul mentioning the crazy amount of mail-in-ballots with only a name and no address. Wow! That alone would have almost turn Wisconsin red….

Arizona: 10,457 votes

+

Georgia: 11,779 votes

+

Wisconsin: 20,682 votes

=

Total margin: 42,918 votes

….Kornacki noted that last month’s election of Joe Biden over President Trump could have easily gone the other way, despite a 7 million vote margin for the Democratic ticket.

“If you flipped about 20,000 votes in Wisconsin, about 13,000 in Georgia and 10,000 in Arizona, that’s just over 40,000 votes collectively,” said Kornacki. “In those three states, the electoral vote count would have been 269 to 269 and it would have gone to the House of Representatives. Republicans would have been able to elect Trump.

“The way that I look at this election is, Donald Trump came within about 43,000 votes of getting re-elected. We came very close to one of the biggest disconnects we’ve ever seen in terms of the popular vote and the Electoral College,” he said….

UPDATE: Conversation

I mentioned the following in a conversation with a friend, and he asked a question which I will respond to here. Enjoy. I said:

- Sean Giordano — Biden won Wisconsin by just over 20,000 votes. There were 10s of thousands of ballots that only had a signature and no address, in all previous elections these were not accepted.

He asked simply,

- B.A.M. — where did you get your info? I looked this up and couldn’t verify.

So, here are a few articles that build a related case that Senator Paul mentioned in the video above. First up is the earlier April election. Wisconsin Public Radio notes an issue that would have had consequences if the [illegal] change in laws hadn’t of happened before the November 4th election.

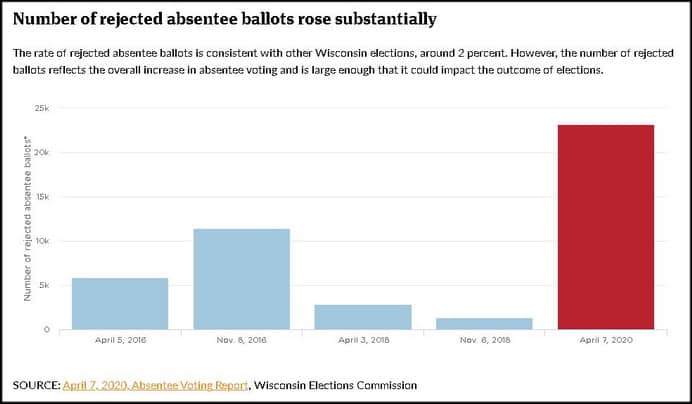

- But an APM Reports analysis of voter data from Wisconsin’s April primary shows a far more measurable and consequential effect of mail-in voting — rejected ballots. Slightly more than 23,000 ballots were thrown out, mostly because those voters or their witnesses missed at least one line on a form.

To wit, some counties changed ballots in 2020 to try and make them legal, but as retired Wisconsin Supreme Court Justice Michael Gableman (who worked as a poll watcher in Milwaukee on Election Day), “The statute is very, very clear. If an absentee ballot does not have a witness address on it, it’s not valid. That ballot is not valid” (RED STATE).

Before going on to my next point — I want to drive home the issue made by the Public Radio in another article via REVEAL.

…But an analysis of voter data from the April primary in the swing state of Wisconsin shows that mail-in voting may pose the opposite risk – rejected ballots. Slightly more than 23,000 ballots were thrown out in the primary, according to an analysis by APM Reports, mostly because those voters or their witnesses missed at least one line on a form.

That figure is nearly equivalent to Trump’s 2016 margin of victory in Wisconsin of 22,748 votes. And with Wisconsin voter turnout expected to double from April to more than 3 million in November, a proportionate volume of ballot rejections could be the difference in who wins the swing state and possibly the presidency…..

[….]

Taken together, the analysis serves as a case study of what may lie ahead for a presidential battleground state overwhelmed by applications and without the experience or systems to cope. Other battleground states such as Georgia and Pennsylvania saw increased by-mail voting in their primaries, as well as problems managing an increase in absentee ballots.

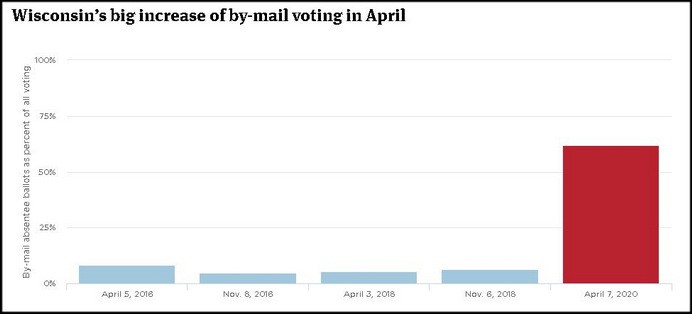

In the 2016 and 2018 Wisconsin general elections, by-mail absentee ballots made up no more than 6% of all ballots counted. In April, the portion jumped to more than 60%, the result of Gov. Tony Evers’ stay-at-home order because of the pandemic.

And while state officials stress the percentage of rejected ballots in the April primary is consistent with rejection rates in past elections, it’s little comfort to voters who learned that their ballots were rejected months after they thought their votes were counted.

More importantly, while the rate may be similar, raw numbers will make the difference when it comes to winning or losing an election.

One of the main issue I see is the equal protection of voters. There were not clerks fixing all the ballots evenly. It seems that this happened in more inner-city areas and not in the more conservative suburbs. RED STATE notes the last minute change to laws that also allowed more opportunity for fraud and ballots that have not been counted in the past.

…In Wisconsin, a federal judge extended the deadline for receiving absentee ballots during the primary election cycle by a period of six days. No one objected to that extension in the early days of state “lockdown” orders to address the outbreak of the COVID 19 virus. But, five days before the scheduled election, the same judge clarified the order to state that ballots postmarked on or before the extended day for receipt of ballots could be counted even though that violated Wisconsin election law which required that they be postmarked no later than Election Day, and no party in the case had asked for the Court to grant the additional relief. The Supreme Court reversed that provision of the district court’s order, writing as follows:

Nonetheless, five days before the scheduled election, the District Court unilaterally ordered that absentee ballots mailed and postmarked after election day, April 7, still be counted so long as they are received by April 13. Extending the date by which ballots may be cast by voters—not just received by the municipal clerks but cast by voters— for an additional six days after the scheduled election day fundamentally alters the nature of the election… This Court has repeatedly emphasized that lower federal courts should ordinarily not alter the election rules on the eve of an election…. The District Court on its own ordered yet an additional extension, which would allow voters to mail their ballots after election day, which is extraordinary relief and would fundamentally alter the nature of the election by allowing voting for six additional days after the election.

The four liberals on the Court, including the late Justice Ginsburg, dissented from this order and would have allowed votes to be cast and counted after the deadline imposed by state law in Wisconsin, basing their judgment on the complications of the COVID 19 pandemic. So, you can see where the lower court judges are finding their “justification for rewriting election rules more to the liking of plaintiffs who — in every case I’ve looked at — are Democrat party interest groups….

The WASHINGTON POST agrees with the above by pointing out that [in the April election in Wisconsin] “more than 30,000 votes arrived after voting day in 11 cities where that information was available, more than 10 percent of all votes cast in those cities. In Brookfield, a western suburb of Milwaukee in conservative Waukesha County, the figure was closer to 15 percent.”

So Wisconsin changed laws on the fly (against their state’s normal [legal] constitutional process), or improperly applied others.

MAIN POINT

As JUST THE NEWS noted, an order from the election commission (passed in 2016) that went out in this election “permits local county election clerks to cure spoiled ballots by filling in missing addresses for witnesses even though state law invalidates any ballot without a witness address.”

This is part of the reason that 3-of-the-4 justices in Wisconsin’s Supreme Court wanted to see the evidence, the three dissenting conservative justices, led by Chief Justice Patience Roggensack, said the court should have decided whether votes should have counted in each of the four categories, and clarified the law for future elections.

- “A significant portion of the public does not believe that the November 3, 2020, presidential election was fairly conducted,” Roggensack wrote. “Once again, four justices on this court cannot be bothered with addressing what the statutes require to assure that absentee ballots are lawfully cast.”

Because of the ruling, procedural wrongs:

- absentee ballots filled in in one county to fix missing information by local county election clerks, and not in other counties (votes treated different) — probably 10’s of thousands via past numbers of ballots rejected and the increase of voting this time;

- and the more than 28,000 votes counted from people who failed to provide identification by abusing the state’s ‘indefinitely confined status’

The liberal justices went on to say there was no evidence of fraud.

Dumb.

This is a red herring.

The above are not about fraud at all, but the invalidation of ballots because voters ballots were treated differently across the state, and, failure to follow the new regulation for voting from home by Wisconsin officials.

“Fraud,” it just sounds good and the press runs with the same narrative.

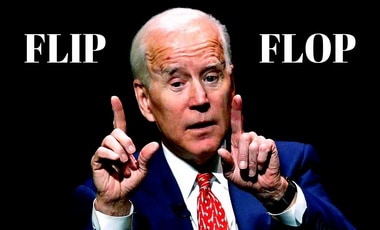

Biden Admits Democrats and the Media Are Anti-Democratic

Fox News host Steve Hilton weighs in on MSNBC’s reaction to the election of Italian Prime Minister Giorgia Meloni and gives viewers a flashback into Democrats’ own election denial accusations on ‘The Next Revolution.’

(THE BELOW WAS POSTED SEPT 7TH, 2022)

Yes, years of denial that Trump won the 2016 election has made this video possible.

~ UPDATED ~

Joe Biden’s own press secretary is a threat to democracy!

Here are some pics via the POSTMILLENNIAL:

PJ-MEDIA has a decent post on the exchange:

…It’s been pointed out several times now that Joe Biden declared that anyone who questioned the results of an election was a “threat to democracy” even though Biden and pretty much everyone around him has also questioned the results of an election.

“Democracy cannot survive when one side believes that there are only two outcomes to an election: either they win or they were cheated,” Biden claimed during his infamous Hitler-esque speech. “And that’s where MAGA Republicans are today.”

However, in 2020 Biden agreed with a supporter of his who told him she thought Trump was an illegitimate president. In 2013, he also said he believed that Al Gore won the 2000 presidential election. Biden’s vice president, Kamala Harris, also said that Trump was an illegitimate president.

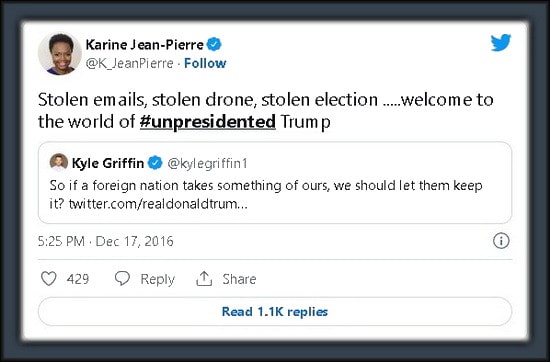

Another person in Biden’s inner circle who is an election denier is his press secretary, Karine Jean-Pierre. She believes the 2016 election was stolen from Hillary, and she also said that Brian Kemp stole the 2018 Georgia gubernatorial election from Stacey Abrams. And on Tuesday, she was finally called out over it, by, you guessed it, Fox News White House Correspondent Peter Doocy.

Doocy, recalling how Biden has focused on attacking “MAGA Republicans” as dangerous for questioning the results of the 2020 election, pointed out how she denied the results of the 2016 presidential election and the 2018 Georga gubernatorial election. Jean-Pierre tried to laugh it off, “I knew this was coming! I was waiting, Peter, [wondering] when you were gonna ask me this question.”

“Well, here we go. You tweeted Trump stole an election. You tweeted Brian Kemp stole an election. If denying election results is extreme now, why wasn’t it then?”

[….]

- DOOCY: “You tweeted in 2016 that Trump stole an election.”

- KJP: “I knew this was coming.”

- DOOCY: “If denying election results is extreme now, why wasn’t it then?”

- KJP: “That comparison that you made is just ridiculous.”

Umm. What? Jean-Pierre claims she knew that question was coming, and that’s the best response she could come up with. That doesn’t even make sense. Jean-Pierre quickly deflected, insisting she now believes that Trump won in 2016 and that Kemp won in 2018 (perhaps she should tell Stacey Abrams, who never conceded) and then tried to shift the issue back to January 6, before not allowing Doocy a chance to follow up.

FLASHBACK:

Here are some “threats to democracy”

I use an excerpt of Matt Gaetz floor speech from the 6th (January 2021), and combine it with Dinesh D’Souza’s RUMBLE upload as well as MRCTV’s YouTube upload. There is a good post regarding this via PJ-MEDIA that is a must read:

LIKEWISE, I post on the topic via my website:

NEWER RPT EDIT

The “Very Fine People” Record Set Straight

(Originally Oct 2020, Updated with “Biden vs. Biden” at bottom)

NBC NEWS mocked the following with this headline: “Former NFL player claims Trump never called white nationalist rallygoers ‘very fine people’.” Jack Brewer (below) is right-chya-know:

I made the following short clips not because I haven’t heard versions of this before, but these two versions clearly show that Trump didn’t say it the way the media or politicians mean he said it. He didn’t call on the one hand Nazi/KKK affiliated persons “fine people” — JUST LIKE HE DIDN’T call anyone from Antifa “fine people.” He was speaking about the normal Democrat and Republican (libertarian, independent, non-voter, etc) who came to express their support of tearing down a Confederate monument or for not supporting the destruction of our past (good or bad). Very rarely would a person find an article or video by Steve Cortes to see what the other side of the issue is.

However, these nets support the rhetoric because in the end they wish to defeat Trump, truth be damned. Here — for instance — is People magazine printing the issue:

…To borrow from The Washington Post, this is becoming a “Bottomless Pinocchio” for Biden. He never stops lying and smearing:

Biden: The easy part of this is like my relationship with Barack — we trusted each other. Think about what happened when those folks came out in Charlottesville, carrying those torches. Close your eyes and remember what you saw, chanting the same anti-Semitic bile that was chanted in the streets of Germany in the ’30s, accompanied by the Ku Klux Klan. And a young woman gets killed protesting against them and the president of the United States says, “There are very fine people on both sides.” That phrase was heard ’round the world. This is going to change.

Harris: That’s right.

Biden: This is who we are [gestures to Harris next to him]. This is America.

When people say the above (friends, family, MSM, politicians) they are “meaning” this often times:

However, Trump never said that…

Michael Rapaport EDITION

(LANGUAGE WARNING!)

Michael Rapaport admits being misled by media in 2017 about Trump’s ‘Very fine people on both sides’, firmly rules out voting for Joe Biden, Kamala Harris or Gavin Newsom

‘I was wrong…when you see the full quote that wasn’t what he said’

‘…I’m going to tell you right now, i… pic.twitter.com/m4ZDYrgx0W

— Unlimited L’s (@unlimited_ls) February 9, 2024

…or meant what many attribute to him saying (in context… remember “context is king”).

TAPPER EDITION:

- In an often misused comment (ripped from its context) Trump actually denounced Nazi’s in this press conference. I add some prophetic statues predictions coming true as well as Dennis Prager commenting on an evidence this was misconstrued. (See more at my post HERE)

BIDEN EDITION:

- I just wanted to add another person to the mix. The GOP WAR ROOM has a Biden “Confederate Flag” video worth your time: “Joe Biden called the United Daughters Of The Confederacy ‘an organization made up of many fine people who continue to display the Confederate flag‘”

Smerconish EDITION:

Michael Smerconish doing what real reporters and media persons should do… that is… track down the real story [the truth of the matter] (“The Michael Smerconish Program” — March 27th, 2019: https://tinyurl.com/y6g4dnhy). The article mentioned by Michael Smerconish’s guest, Steve Cortes, can be found here:

Steve also did Prager University video, “The Charlottesville Lie”:

Did President Trump call neo-Nazis “very fine people” during a famous press conference following the Charlottesville riots of August 2017? The major media reported that he did. But what if their reporting is wrong? Worse, what if their reporting is wrong and they know it’s wrong? A straight exploration of the facts should reveal the truth. That’s what CNN political analyst Steve Cortes does in this critically important video.

BREITBART comments on this Prager-U video.

Wheeler Edition

The Left is obsessed with this Lie?! Ted was hitting home-runs with the bumper sticker mantras. From making fun of a handicapped guy, to many others Lefty Lies. (A quick answer to two of his mishaps can be found in the first two sections here: Some Trump Sized Mantras). Ted Wheeler is a putz.

LARRY ELDER’S EDITION

Larry Elder recaps one of the biggest lies by the media and Democratic Presidential nominee… Joseph Robinette Biden Jr. (e.g., Good Ol’ Joe). I include video “The Sage” had audio for, as well as extending some other audio – like Michael Smerconish doing what real reporters and media persons should do… that is… track down the real story [the truth of the matter] (March 27th, 2019). This is Larry at his best, I only tried to embolden his points [hopefully I did]. I will be making a smaller truncated version to accent my just uploaded video, HERE: https://youtu.be/aXvxgjumk2s

BIDEN CONDEMNS BIDEN

First of all, this is a remaking of my original video titled: “Fine People On Both Sides (Biden Edition)” (My YouTube Channel). I remove Trump and add “Confederate Biden” into the mix (original file at Trump War Room). The GRUNGE makes a simple notation to start out their wonderful article on “The United Daughters of the Confederacy,” or, UDC:

- Honestly, with a name like “The United Daughters of the Confederacy,” it’s really not all that hard to imagine why in the world this group would be at the center of some pretty controversial stuff.

My post that gives one of the best synopsis, “media-wise”, is here: “The ‘Big Lie’ Biden Continues To Spread“

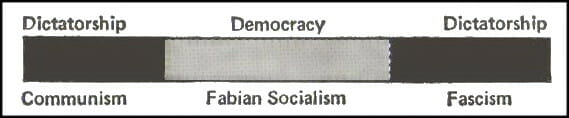

Stu Burguiere Discusses Italy, Giorgia Meloni, and Fascism

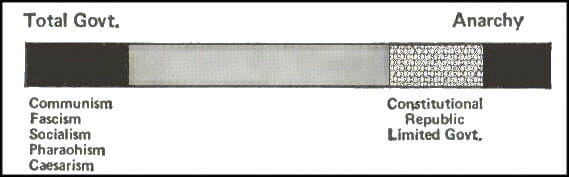

Stu Burguiere discusses Italy’s new Prime Minister, Giorgia Meloni, and the American Left’s misunderstanding of “What Fascism Is” — “Italians have voted for a new prime minister, and the American Left can’t stop calling her a ‘fascist’.” THIS WAS EXCELLENT! I had to clip “Stu Does America’s” episode #579 titled: “The Left Is Obsessed with Fascism, But Has NO IDEA What It Is” — see my POST TITLED SIMILARLY.

BONUS

Two graphs from my post: “What ‘Is’ Fascism ~ Two Old Posts Combined (Updated 4-2015)”

FALSE

ACCURATE

CLASSIC VIDEO

Environmentalist Doomsday Predictions

All fails BTW (SLAY NEWS):

- “‘The trouble with almost all environmental problems,’ says Paul R. Ehrlich, the population biologist, ‘is that by the time we have enough evidence to convince people, you’re dead. … We must realize that unless we are extremely lucky, everybody will disappear in a cloud of blue steam in 20 years.’” —The New York Times, 1969.

- “No real action has been taken to save the environment, [Ehrlich] maintains. And it does need saving. Ehrlich predicts that the oceans will be as dead as Lake Erie in less than a decade.” —Redlands Daily Facts, 1970.

- “Scientist Predicts a New Ice Age by 21st Century: Air pollution may obliterate the sun and cause a new ice age in the first third of the next century. … If the current rate of increase in electric power generation continues, the demands for cooling water will boil dry the entire flow of the rivers and streams of continental United States. … By the next century ‘the consumption of oxygen in combustion processes, world-wide, will surpass all of the processes which return oxygen to the atmosphere.’” —The Boston Globe, 1970.

- “The world could be as little as 50 or 60 years away from a disastrous new ice age, a leading atmospheric scientist predicts. … ‘In the next 50 years,’ the fine dust man constantly puts into the atmosphere by fossil fuel-burning could screen out so much sunlight that the average temperature could drop by six degrees. If sustained ‘over several years’—‘five to 10,’ he estimated—‘such a temperature decrease could be sufficient to trigger an ice age!’” —Washington Post, Times Herald, 1971.

- “Dear Mr. President: … We feel obliged to inform you on the results of the scientific conference held here recently. … The main conclusion of the meeting was that a global deterioration of climate, by order of magnitude larger than any hitherto experienced by civilized mankind, is a very real possibility and indeed may be due very soon. The cooling has natural cause and falls within the rank of processes which produced the last ice age. … The present rate of the cooling seems fast enough to bring glacial temperatures in about a century.” —Brown University, Department of Geological Sciences, 1972.

- “However widely the weather varies from place to place and time to time, when meteorologists take an average of temperatures around the globe they find that the atmosphere has been growing gradually cooler for the past three decades. The trend shows no indication of reversing.” – Time Magazine, 1974.

- “Climatological Cassandras are becoming increasingly apprehensive, for the weather aberrations they are studying may be the harbinger of another ice age. Telltale signs are everywhere—from the unexpected persistence and thickness of pack ice in the waters around Iceland to the southward migration of a warmth-loving creature like the armadillo from the Midwest. Since the 1940s the mean global temperature has dropped about 2.7 [degrees] F. Although that figure is at best an estimate, it is supported by other convincing data. When Climatologist George J. Kukla of Columbia University’s Lamont-Doherty Geological Observatory and his wife Helena analyzed satellite weather data for the Northern Hemisphere, they found that the area of the ice and snow cover had suddenly increased by 12% in 1971 and the increase has persisted ever since. Areas of Baffin Island in the Canadian Arctic, for example, were once totally free of any snow in summer; now they are covered year round.” —Time magazine, 1974.

- “A senior U.N. environmental official says entire nations could be wiped off the face of the Earth by rising sea levels if the global warming trend is not reversed by the year 2000.” —Associated Press, 1989.

- “Unless drastic measures to reduce greenhouse gases are taken within the next 10 years, the world will reach a point of no return.” —former Vice President Al Gore, 2006.

- “The world is going to end in 12 years if we don’t address climate change.” —Rep. Alexandria Ocasio-Cortez (D-NY), 2019.

Kari Lake Wrecks The Media Narrative (RPT Edit)

I edit in some evidence to Kari Lake’s excellent response to a reporter, which BREITBART writes out for us:

- “You say you feel like Joe Biden is dividing the country, but do you feel like Donald Trump is doing the same by falsely telling people he won that election when he lost it?”

Lake, a former Fox 10 phoenix anchor, asked the reporter. She continued:

As a journalist for many years, I was a journalist after 2016 and I distinctly remember many people just like you asking a lot questions about the 2016 election results. And nobody tried to shut you up. Nobody tried to tell Hillary Clinton to shut up. Nobody tried to Kamala Harris when she was questioning the legitimacy of these electronic voting machines to stop.

We have freedom of speech in this country and you of all people should appreciate that. You’re supposedly a journalist, you should appreciate that. So, I don’t see how asking question about an election where there are many problems is dividing a country. What I do see as dividing a country is shutting people down, censoring people, canceling people, trying to destroy people’s lives when they do have questions.

Lake added that “we’re going to save” the “constitution, and we’re going to bring back freedom of speech, and maybe someday you will thank us for that.”……..

SOME RESOURCES USED (AND OTHERWISE)

- Here’s 10 Minutes of Democrats Questioning Election Results

- Mainstream Media Propaganda Montage

- Dan Bongino Shows Gore/Bush vs. Trump/Biden MSM Hypocrisy

- Joe Rogan: Tweaking The 1st Amendment & the Censorship Train “Are You Out of Your F*ucking Mind!”

- Kamala Harris – Voting Machine Hacking – Election Security – C-Span3

Anderson Cooper pOANed After He Disses Christina Bobb

OAN destroys Anderson Cooper after he disses Christina Bobb

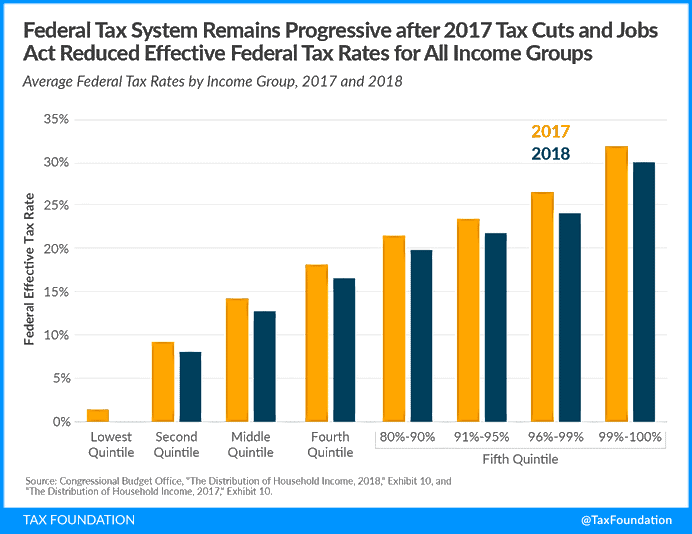

TCJA | Trump Tax Cuts vs Rhetoric (FLASHBACK)

This is to bring into one place a few of my past posts regarding the tax reforms Trump passed via the TCJA (Tax Cuts and Jobs Act). They are not reforms in the way conservatives think of them. But neither did they overwhelmingly benefit “the rich” and large corporations and did little or nothing to help middle class families — as Democrats state it.

In March, Speaker of the House Nancy Pelosi, D-Calif., called the 2017 Trump tax cuts a $2 trillion “GOP tax scam.”

Sen. Bernie Sanders, I-Vt., accused Republicans of hypocrisy for supporting the tax cuts but opposing Congress’ massive spending spree.

The Biden White House issued a press release claiming “the Trump tax cuts had added $2 trillion to deficits over a decade.”

But the numbers tell a different story. Despite the political rhetoric, tax revenues are up.

(DAILY SIGNAL – June 1, 2022)

I will date my posts as I add them in a mixed order. But first… let us start this grand flashback with YAHOO NEWS (February 13, 2019):

…data reflects a single week of tax filing season and it is likely that the size of refunds will increase as tax season continues – Morgan Stanley analysts have predicted that refunds will increase by 26 percent.

In addition, the size of a tax refund means nothing without also comparing the change in paychecks. In net, the overwhelming number of filers will be better off as an estimated 90 percent of Americans are seeing a tax cut.

[….]

the success of the TCJA is clear. In the months following passage of the tax cuts, unemployment fell to a 49-year low and key demographics including women, African-Americans and Hispanics have seen record low unemployment rates.

Job openings have now hit a record high of 7.3 million and over 300,000 jobs were created last month, as most private-sector businesses continued hiring despite the government shutdown. Year-over-year, wages have grown 3.2 percent and the economy is projected to grow at 3.1 percent over 2018.

This positive news is not anecdotal.

According to Guy Berkebile, the owner of Pennsylvania-based small business Guy Chemical and one of the witnesses at the Ways and Means hearing, the bill has been a net positive for businesses.

“On the business expansion front, Guy Chemical was able to build a new laboratory that was five-times larger than our previous one, invest in new chemical compounding equipment and purchase new packaging line,” Berkebile told lawmakers on Wednesday.

Not only was this good for the businesses, it also benefited employees as noted in the testimony of Mr. Berkebile: “We were also able to pass down much of the financial savings to employees. More specifically, we were able to raise wages, expand bonuses by up to 50 percent, start a 401(k) retirement program and create 29 new jobs. These changes also instilled a sense of optimism among our staff, which has produced a less stressful and more enjoyable work environment.”

This is not an isolated story. Workers across the country have seen increased take-home pay, new or expanded education and adoption programs, and increased retirement benefits, while consumers are seeing lower utility bills.

More Good News

To use a few examples, Firebird Bronze, an Oregon-based manufacturer was able to afford to give its nine employees health insurance for the first time while McDonald’s has used tax reform to allocate $1,500 in annual tuition assistance to every employee working more than 15 hours a week.

Visa has doubled its 401(k) employee contribution match to 10 percent of employee pay, while Anfinson Farm Store, a family-owned business in Cushing, Iowa (population 223) has given its employees a $1,000 bonus and raised wages by 5 percent.

In addition to these employee benefits, America’s middle class is seeing direct tax relief.

A family of four with annual income of $73,000 is seeing a 60 percent reduction in federal taxes — totaling to more than $2,058. According to the Heritage Foundation, the typical American family will be almost $45,000 better off over the next decade because of higher take-home pay and a stronger economy.

Tax reform doubled the child tax credit from $1,000 to $2,000, giving over 22 million American families important tax relief. The standard deduction was doubled from $6,000 to $12,000 ($12,000 to $24,000 for a family) giving tax relief for over 105 million taxpayers that took the deduction prior to tax reform and simplifying the code for tens of millions Americans that will not take the standard deduction instead of itemizing.

While the rhetoric of the left has sought to portray the Republican tax cuts as a negative for the middle class, nothing could be further from the truth. The reality is, the middle class has seen strong tax reduction, higher take home pay, more jobs and more economic opportunity……

NOTE:

- The TCJA reduced the average federal tax rate from 20.8 percent to 19.3 percent for all filers. The bottom 20 percent of earners saw their average federal tax rate fall from 1.2 percent to nearly 0 percent. (TAX FOUNDATION | August 5, 2021)

RPT: December 28, 2017

(As an aside, I sent the “calculator” linked below to my wife’s uncle as he expressed concern in a private discussion to him paying more.)

Larry Elder plays CBS’ tax special with three families (watch the CBS video here at TOWNHALL) from different incomes: (a) little under $40,000 a year; (b) more than $150,000 a year; (c) couple’s combined income was $300,000. Turns out ALL THREE will get a tax return. The Democrats know they are in trouble!

Here Are The Winners And Losers Of The New Tax Law — In that article is a link to THIS TAX CALCULATOR

END

There are critics however, as noted by Robb Sinn at THE FEDERALIST (November 02, 2020):

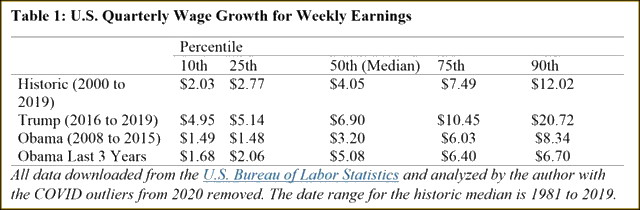

Many on the left refuse to admit President Trump’s populist policies have provided massive benefits to working-class Americans. Matthew Yglesias argued at Vox that Trump’s refusal to endorse a federal $15 per hour minimum wage proves Trump has abandoned populist ideals. Progressives claim the Trump economy helps billionaires, not workers, and snidely dismiss his outreach to minorities.

Yet, during the first three years of the Trump presidency, wage growth was off the charts, especially for low-income workers and African Americans. The third-quarter economic data released Thursday confirm once again that Trump is on the job for U.S. workers.

The Biden campaign has tried to tie COVID-linked economic devastation to Trump’s leadership. The new third-quarter economic data once again shows that’s wrong. The total number of U.S. wage earners increased more than 5 percent in that period, and the third-quarter rebound for African Americans occurred at a 17 percent faster rate than for wage earners as a whole.

Trump campaigned on exiting the China-centric Trans-Pacific Partnership and renegotiating North American Free Trade Agreement (NAFTA). Trump claimed his tax and trade policies would benefit American workers.

Even though evidence shows they are highly effective, Trump’s economic ideas have consistently underwhelmed pundits. Democrats hated his tax cuts. Liberals predicted a worldwide economic crisis if he was elected in 2016 and scoffed at Trump’s “middle class miracle.” Leading up to the 2016 election, economists including eight Nobel laureates derided his economic ignorance and called his proposals “magical thinking.”

[….]

The story grows quite interesting when we focus on wage earners in lower brackets. According to data from the U.S. Bureau of Labor Statistics, the 20-year growth trend for the 10th percentile weekly wage was $2.03 per quarter. For Trump’s first three years, wage growth was $4.95.

What about in the Obama era? Even cherry picking Obama’s last three years and ignoring the 2009 recession leaves us with growth of $1.68 per quarter, well below both the historic trend and Trump’s. Table 1 shows striking wage growth under Trump, a reversal of prior patterns, not a continuation, especially in the lowest wage brackets.

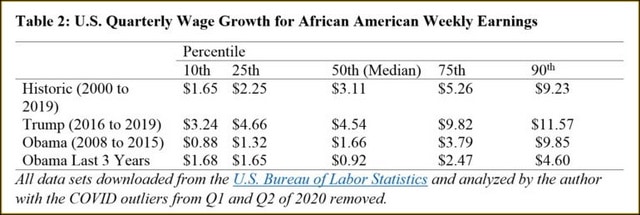

Trump Benefited Black Americans More Than Obama Did

During the final presidential debate, President Trump boldly stated he has done more for black Americans than any president since Abraham Lincoln. And he is not so sure Abe did better. While liberals fact-checked his hyperbole, we may employ the quaintly anachronistic approach of using data and logic. The Obama era proved dispiriting for many African American wage earners. The first three years of the Trump administration were a comparative godsend.

Obama oversaw the addition of 2.1 million African American wage earners during eight years in office, about 250,000 per year. Table 2 reveals the tepid results in terms of wage growth. Trump oversaw the addition of 1.3 million African American wage earners in his first three years, more than 400,000 per year. Excellent wage growth occurred across the spectrum. The results for the 10th and 25th percentiles were remarkable.

The 10th percentile U.S. weekly wage grew by $3.25 per quarter for African Americans during Trump’s first three years, nearly double the historic rate of $1.65. The best Obama growth rate was only $1.68. Perhaps having a businessman at the helm of the world’s largest economy is not such a bad idea. Will any deniers admit they were wrong?

……

Here are the links one should enjoy spending time in via my membership retirement org, AMAC:

- TCJA lowered the average federal tax rate for all filers: TCJA reduced the average federal tax rate from 20.8percent to 19.3 percent for all filers.

- The lowest income earners paid less in taxes: The bottom 20 percent of earners saw their average federal tax rate fall from 1.2 percent to 0 percent – a lower rate than the previous 40-year average.

- The highest earners paid the highest share of taxes: The top 1 percent of households saw their share of federal taxes paid increase from 25.5 percent in 2017 to 25.9 percent in 2018.

And please note this as well:

- …Wages for all workers and measures of real wages show similar upticks. Census Bureau data also show that real household income reached an all-time high in 2019, growing by $4,400 (a 6.8% one-year increase). … (HERITAGE FOUNDATION | March 24, 2021)

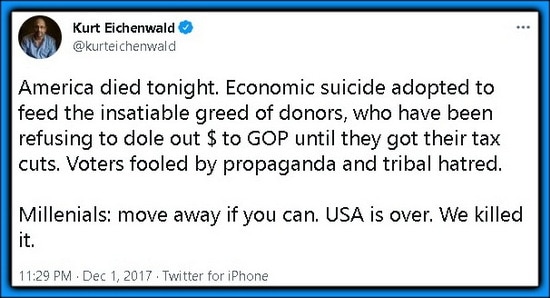

RPT: December 4, 2017

GAY PATRIOT [now, sadly, defunct] comments on the main idea that the Left are a bunch of babies with almost zero understanding of anything economic:

The tax “reform” bill the US Senate passed last night is pretty lame, actually. It keeps the current ridiculous progressive structure of seven separate tax rates. (The House reduced it to four, and the correct number ought to be one.) Susan Collins was bought off by retaining the mortgage interest deduction on vacation homes for millionaires. Freeloaders at the lower income brackets still pay nada. Some high income progressives from blue states are whining because some of their state and local taxes are no longer deductible. Sucks that you progressives in high tax blue states forgot to elect any Republican senators.

There has also been a lot of howling from the “suddenly we’re concerned about the debt” progressive left that the bill will add $1.5 Trillion to the National Debt over ten years. That figure represents less than 3% of Government expenditures in that time period. Cut Government spending 3% (I’m sure we can get by on 97% of the Government). Problem solved.

It’s a lame bill. Really, the best part of the Senate Bill passing has been watching the histrionic meltdown on the Progressive Left. (But even that gets a little boring considering the progressive left has a histrionic meltdown at literally everything Donald Trump does.)

Oh, Patti, don’t feel so bad. There are lots of other countries you can move to. Have you considered Mexico? No Republicans there. Strict gun control, too. The Government is very progressive, taxes are very progressive, and economic activated is highly regulated. It’s a lot like California, come to think of it. But with fewer Mexicans……..

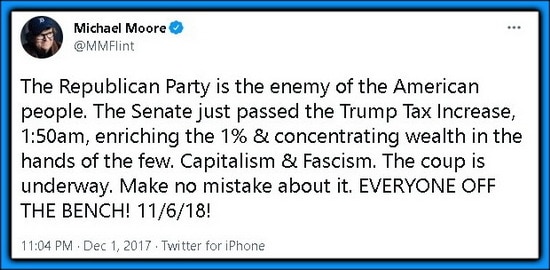

POWERLINE opines well with two RAMIREZ TOONS:

- It is comical to see Democrats feigning outrage over the claim (likely false) that the GOP tax reform plan will add to the national debt. Talk about a head-snapping about face! Where was the Dems’ concern about debt when the Obama administration ran up $10 trillion of it?

….A remarkable thing happened over the weekend; Democrats rediscovered their concern about the national debt, state’s rights, and voter fraud.

The same Democrats who had no problem helping Barack Obama double the national debt to a mind-blowing $20 Trillion have attacked the Republican Senate’s limpwrist “tax reform” bill claiming it will add $1.5 Trillion to the national debt over ten years.

$1.5 Trillion represents less than 3% of Government spending over the next ten years. If that’s a problem, then, by all means, cut spending by 3%.

Democrats are also suddenly hollering about “state’s rights” because Congress is looking to make concealed carry licenses valid across state lines; like driver’s licenses. (And, yes, most states require training and a background check before a concealed carry license is issued.) The Democrats have suddenly taken a position analogous to claiming Rosa Parks only had the right to sit in the front of the bus while she was in Alabama…..

END

RPT: May 25, 2022

(OG Post was March of 2016)

The bottom small section was posted March of 2016… the updated information comes to us as a way of emboldening the comparisons between Hillary’s tax plan and Trump’s compared. With the predictions made about Trumps’ plan coming to fruition.

UPDATE

The WASHINGTON EXAMINER (Dec 2021) has a tracking of how these tax plans worked out (note the highlighted portion readers):

President Joe Biden and congressional Democrats’ Build Back Better Act would increase taxes on higher-income earners and expand business levies to help cover its $2.4 trillion price tag.

Biden and many Democrats in Congress have argued that their plan to raise taxes in the midst of an economic recovery is justified because it would help offset or reverse important elements of the Republican tax reform passed in 2017. Democrats have long claimed that the Tax Cuts and Jobs Act needs to be repealed or heavily altered because it unjustly benefits the wealthy at the expense of working and middle-class families.

However, the most recent personal income tax data from the IRS prove that this claim is completely false. The 2017 tax law has disproportionately benefited lower- and middle-income working families. The data show the law has also led to substantial improvements in economic mobility for middle-income and upper-middle-income households.

A careful analysis of detailed tax data from 2017 and 2018, the first year the TCJA went into effect and the most recent year for which detailed IRS income data are available, reveals that over just one year, households with an adjusted gross income of $15,000 to $50,000 saw their total tax bills cut by an average of 16% to 26%, with most filers enjoying at least an 18% tax cut. Similarly, filers earning between $50,000 and $100,000, one of the largest groups of taxpayers, experienced a 15% to 17% tax cut, on average, from 2017 to 2018.

Higher-income households also experienced sizable tax cuts, but not nearly as large as the tax reductions provided by the law to working and middle-class families. Those with AGIs of $500,000 to $1 million, for example, had their taxes cut by less than 9%, and filers earning $5 million to $10 million received a 3.4% cut, the lowest of any bracket provided by the IRS.

The data also show that wealthier filers ended up providing a slightly higher proportion of total personal income tax revenue in 2018 than they did in 2017. In 2017, filers earning $500,000 or more provided 38.9% of all personal income tax revenues. In 2018, the same group provided 41.5% of revenues.

That means the Trump-GOP tax cuts made the income tax code more progressive than it had previously been. That’s a remarkable finding. After all, Democrats have spent the past few years insisting the TCJA provided a huge windfall to the richest income brackets while leaving everyone else behind!

Perhaps most importantly, the tax cuts caused substantial upward economic mobility. Despite an increase in the total number of tax returns filed in 2018 compared to 2017, the number of people filing who claimed an AGI of $1 to $25,000 fell by more than 2 million. But every other income bracket above $25,000 increased, with many seeing huge gains.

The number of filers claiming an AGI of $100,000 to $200,000, for example, increased by more than 1 million in a single year……

And in April of 2022 AMERICAN’S FOR TAX REFORM noted that this delve into the IRS data shows strongly that the “Trump Tax Breaks for the Rich” helped the middle class the most:

The Internal Revenue Service’s released 2019 Statistics of Income (SOI) data, the agency’s most recent available data, shows that middle income American families saw a significant tax cut – measured as the percentage decrease in “total tax liability” between 2017 and 2019 – from the Trump-Republican Tax Cuts and Jobs Act (TCJA). Similarly, Americans saw significant decreases in tax liability from 2017 to 2018.

Total tax liability includes federal income taxes as well as taxes listed on IRS form 1040 such as payroll taxes including social security and Medicare taxes. The TCJA significantly reduced federal income taxes but did not modify payroll taxes.

As the data notes, Americans with incomes between $50,000 and $100,000 saw a substantial decline in their tax liability:

- Americans with adjusted gross income (AGI) between $50,000 and $74,999 saw a 15.2 percent reduction in average tax liabilities between 2017 and 2019.

- Americans with AGI of between $75,000 and $99,999 saw a 15.6 percent reduction in average federal tax liability between 2017 and 2019.

Middle-class Americans in key states were delivered significant tax cuts:

- Floridians with AGI between $50,000 and $74,999 saw a 19.6% reduction. Floridians with AGI between $75,000 and $99,999 saw a 17.2% reduction.

- New Yorkers with AGI between $50,000 and $74,999 saw a 18.9% reduction. New Yorkers with AGI between $75,000 and $99,999 saw a 12.4% reduction.

- Californians with AGI between $50,000 and $74,999 saw a 18.4% reduction. Californians with AGI between $75,000 and $99,999 saw a 14% reduction.

The TCJA also caused millions of Americans to see an increased child tax credit, and millions more qualified for this tax cut for the first time. The TCJA expanded the child tax credit from $1,000 to $2,000 and raised the income thresholds so millions of families could take the credit.

The TCJA also repealed the Obamacare individual mandate tax by zeroing out the penalty. Prior to the passage of the bill, the mandate imposed a tax of up to $2,085 on households that failed to purchase government-approved healthcare. Five million people paid this in 2017, and 75 percent of these households earned less than $75,000.

[….]

Additionally, the TCJA enacted a high alternative minimum tax (AMT) exemption and raised the income level at which the exemption begins to phase out. Congress enacted the Alternative Minimum Tax (AMT) in 1969 following the discovery that 155 people with adjusted gross income above $200,000 had paid zero federal income tax. Over time, the AMT grew so large that millions of Americans paid the tax and millions more saw increased tax complexity. The TCJA caused the number of AMT taxpayers to fall from more than 5 million in 2017 to just 263,720 in 2018.

For years, President Joe Biden has falsely claimed that the 2017 Tax Cuts and Jobs Act (TCJA) passed by the Congressional Republicans and President Trump overwhelmingly benefited “the rich” and large corporations and did little or nothing to help middle class families.

Even left-leaning media outlets have (eventually) acknowledged the tax cuts benefited middle class families. The Washington Post fact-checker gave Biden’s claim that the middle class did not see a tax cut its rating of four Pinocchios. The New York Times characterized the false perception that the middle class saw no benefit from the tax cuts as a “sustained and misleading effort by liberal opponents.” ……

Yep, another Democrat myth about Trump bites the dust. Here is the small original post:

ORIGINAL 2016 POST

This is with thanks to the US Tax Center:

(to enlarge right click on image and “open in another tab”)

END

When the Kremlin Speaks, The MSM Listens

Taking Cue From Dems, Media Abandon ‘Raid’ To Describe Trump FBI Raid

Liz Cheney Is Caught Lying About Trump’s Request for National Guard

If it weren’t for FOX, no other news organization (media or print) would have asked that question.

- Liz Cheney Is Caught Openly Lying About Trump’s Request for 20,000 National Guard on January 6 (RIGHT SCOOP hat-tip)

Bret Baier fed Liz Cheney the questions she needed and wanted to grandstand on Sunday. Each easy leading question led to dramatic, self-important answers on her part. But the libs are acting like she was owning Baier and he was unaware.

So that theater is the backdrop for this crap, where she lies about the National Guard troops. Rumble’s super-cut of this with the proof of her lie is excellent.

FLASHBACK A MONTH

MEMO CONFIRMS TRUMP’S NATIONAL GUARD AUTHORIZATION

Kash Patel destroys the J6 narrative by going into detail about how President Trump, through Sec Def Miller, authorized (days before J6) the Secretary of the Army to act immediately when Mayor Bowser called upon the National Guard.

When [they] called for the National Guard on J6, they knew it would take time to pull the actual NG soldiers together from their daily life to get to the Capitol.

The swamp chose chaos to further their narrative.